Brown Promotes Food Donation, New Tax Credits

YOUNGSTOWN, Ohio – A record amount of food was distributed through the Second Harvest Food Bank last year and executive director Mike Iberis expects to surpass last year’s mark once 2015’s numbers have all been tallied and again in 2016.

With growing numbers of hungry in the Mahoning Valley – one in six people and 25% of children are unsure of the source of their next meal, Iberis said – Second Harvest is always looking for ways to meet demand.

“There are 15,000 people showing up at food pantries every week to get a meal or emergency bag of food,” he said. “If we and the 150 pantries and kitchens weren’t doing what we’re doing, then you’d have a lot of hungry people. That’s the only way to put it.”

Last week, with the passing of the federal government spending bill, the food donation tax deduction was extended, incentivizing both companies and individuals to donate to organizations like Second Harvest, which serves Columbiana, Trumbull and Mahoning counties.

“Second Harvest has more opportunities to serve people. Christmas is a hard time of year for a lot of families because they can’t buy the presents and feed their family the way they want to,” said U.S. Sen. Sherrod Brown, D-Ohio. “The least we can do is make sure people get the food they need at Christmas and Second Harvest does an excellent job of it.”

Brown, a member of the Senate Finance Committee, was at the food bank’s warehouse on Salt Springs Road to meet with Iberis and volunteers, as well as to discuss various tax deductions he supported in the spending bill. Under the new credit, 15% of taxable income can be deducted for food donations.

“Grocery stores and other retailers who donate food do it because they want to help,” Iberis said. “But it doesn’t hurt if you get some tax deductions along with it. It’s a win-win for everyone – the food bank, the vendors and for those who are hungry.”

Brown noted that a hungry population is often indicative of economic development. There are aspects of the Mahoning Valley that are improving but that success hasn’t necessarily spread to all areas in the Valley.

“The [Youngstown Business Incubator] is good news, Lordstown since the auto rescue is good news and we’ve seen a better steel industry,” Brown said. “But hunger results from not enough jobs and means that fewer people have the discretionary income to buy things at their local store or pay taxes to hire teachers, police, fire and others.”

With groups like Second Harvest and the Mahoning Valley Organizing Collaborative, though, the Valley is positioned to feed those who need assistance with food, Brown said.

The line between providing help and needing it is often thin, Iberis said.

“Some of us could be on the other side of that line very easily. One little slip or missed paycheck can move someone over to an area where they need help,” he said. “The emergency food that people get is sometimes the difference between making it and not making it.”

Brown also discussed some of the other tax credits he supported in the spending bill. Perhaps the most important, he said, were the earned income tax credit and child tax credit, which awards a credit to families with children earning below about $39,000 in most cases. Those who are eligible for the credit are often either working poor or struggling to make ends meet, Brown said.

“People that serve our food and provide security and wait tables and do the hard work are paid so little. They’re simply not treated by companies and society the way that they should ” Brown said. “That’s part of what’s wrong with this country.”

For Ohio, Brown said the impact of the renewable energy tax credits could spur both a shift away from the oil industry and an industry focused on building the machines and products needed for energies such as wind and solar power.

“[Wind and solar energy] will help the steel industry and help Ohio, which is a good state for manufacturing and production of solar and wind,” he said. “I want to see us export wind turbines and the whole mechanisms for wind and solar power.”

Investment in low-income areas throughout the Mahoning Valley will be bolstered by the new markets tax credit, which provides incentives of up to 39% of investments over seven years – 5% in the first three years of the credit and 6% over the final four. The development from that, Brown suggested, would start in downtown Youngstown and reverberate into the city’s neighborhoods.

With the success of YBI and other technology-based companies in the area, the research and development credit pushed by Brown could further innovation in the Valley. The credit allows businesses to deduct expenditures from research and development projects, as well for hiring new staff to complete the projects.

“I want companies in Youngstown to invest and if they invest in research and development, then they’re putting money back into the company. That means hiring, innovation and economic growth down the road,” Brown said. “We made that credit permanent so companies can better plan and predict what it’ll mean to their bottom line when they invest.”

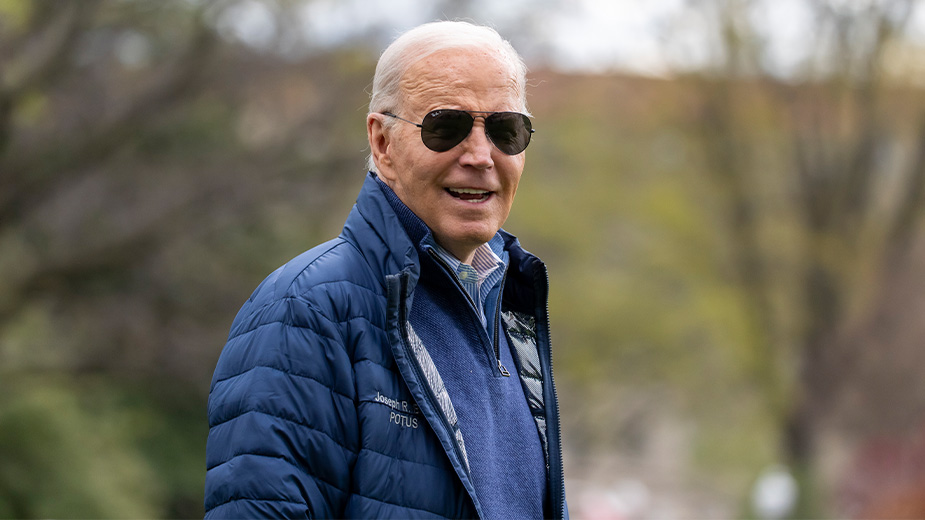

Pictured: U.S. Sen. Sherrod Brown and Mike Iberis, executive director of Second Harvest Food Bank, with volunteers at the Salt Springs Road warehouse.

Copyright 2024 The Business Journal, Youngstown, Ohio.