City to Move Forward with Developer on 20 Federal Place

YOUNGSTOWN, Ohio – The city plans to pursue a memorandum of understanding with a Dallas-based developer that would spearhead a $57 million redevelopment of 20 Federal Place, officials said Tuesday.

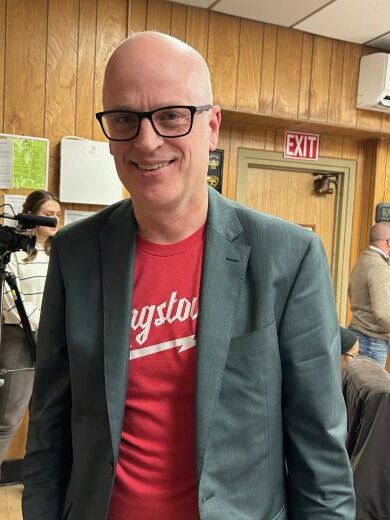

Bluelofts Inc., the singular firm that responded to the city’s request for proposals earlier this year, has submitted a plan that includes converting the former downtown office building into 100 student, multifamily and penthouse apartments, said Doug Rasmussen, CEO and managing partner of Steadfast City Economic & Community Partners, the city’s consultant on the project.

Members of the City Council’s Community Development and Economic Development committee on Tuesday heard more details from Rasmussen regarding the project, including partners, financing structure and a timeline for completion.

“If this development team is selected, it starts about a 10-month process of additional due diligence and pre-development,” Rasmussen said. An MOU is nonbinding, and it doesn’t legally obligate the city to go through with the project should plans change, he added.

Timeline Proposed

Rasmussen said that should the city’s Board of Control approve moving forward with Bluelofts at its next meeting, the project would enter a pre-development phase beginning in January 2025 through October 2025. During this period, the project would build the development team, develop market studies, identify contractors, secure preliminary design and architectural agreements, establish a financing process and draft bond documents, he said.

“If everything continues to track well, the goal would be to finance these bonds and close these bonds in October 2025, at which time construction could start,” Rasmussen said. Construction on the project would take another 18 months, he added, with the new development completed by June 2027.

Under the proposal, Bluelofts would partner with Madrone Community Development Foundation, a Berkeley, Calif.-based 501(c)3 that specializes in public-private partnerships, or P3, developments, Rasmussen said.

According to its website, Madrone “was formed to lessen the burdens of government by assisting local governments, public agencies, schools, community colleges, colleges, and universities in acquiring, developing, and constructing facilities, including educational, community, infrastructure, and housing facilities. Madrone was also formed to assist governments in meeting the restoration and planting goals for parks, forests, and streets.”

The project calls for transforming 20 Federal Place into 100 units that number a total of 184 bedrooms, Rasmussen said. Forty-three of these units would be considered workforce/affordable housing, he added.

Parking would be made available through a 62-space lot in the building’s basement, Rasmussen noted. Another 66 spaces would be leased in a lot along Commerce Street.

Other plans for the building include ground floor retail, e-commerce and mini-warehouse space, medical suites and a wellness hub, Rasmussen added.

Project Financing

A portion of the $57 million – $18 million in all – would be covered by historic tax credits available through the federal government and the state of Ohio. These tax credits, however, expire at the end of 2025.

Under a complex financing arrangement, Madrone would own the building, Rasmussen said. Madrone would act as the owner/borrower; Stifel would serve as underwriter; and the Western Reserve Port Authority would issue the government bonds.

“We are expecting this to be somewhere between a 30- to 40-year bond issue,” Rasmussen said.

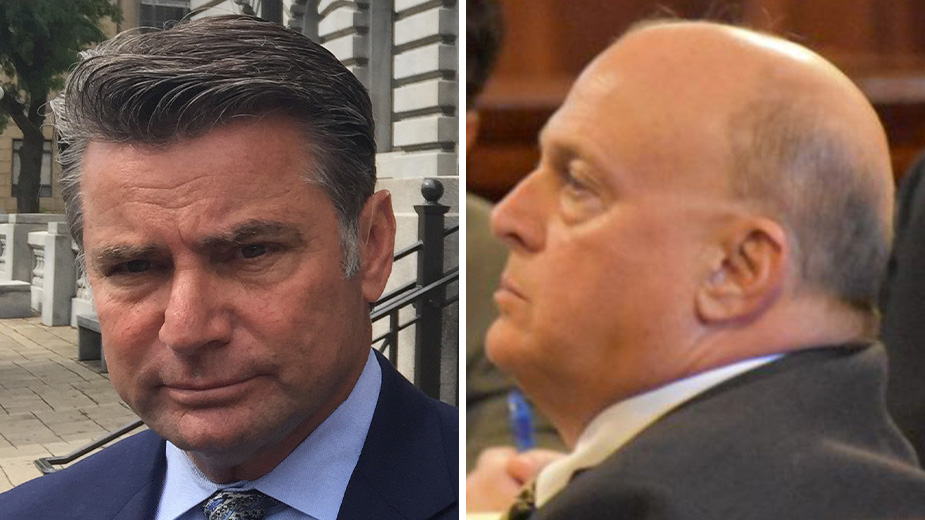

Mayor Jamael Tito Brown said he approached the plan with caution but believes the effort outweighs the risk of not pursuing the project.

“It’s well worth our attempt to swing at this and knock it out of the park than not swing at all,” Brown said.

Brown said that questions related to the finance structure and other issues could be addressed as more due diligence is performed, emphasizing the city could walk away from the project during the pre-development phase. “There’s always an out for us,” he said.

However, the mayor encouraged council members to prepare any questions they have related to the project, ideally before the next Board of Control meeting Dec. 19. “We want to hear those questions and those thoughts,” he said. “We’d like to have some sense in this month of December.”

Council had earlier passed enabling legislation that authorizes the BOC to move forward with an intent to enter into a development agreement.

“There’s always going to be risk,” said Councilman Mike Ray, 3rd Ward. “We have to see what our appetite for that risk is and limit the city’s exposure the best we can.”

Rasmussen said Bluelofts, established in 2018, helped develop The Bell project in Cleveland and is engaged in three other apartment complexes in Dallas, Fort Worth and Atlanta.

Kyle Miasek, finance director, said 20 Federal Place costs the city approximately $100,000 a year to cover property taxes and utilities. “We have a party that has a financial structure that has been proven across certain large cities,” he said. “We believe this is our best opportunity to sell it. It’s my recommendation that you support this tonight.”

The historic tax credits, he added, are an important incentive to move forward with the project. However, he cautioned that these tax credits will expire, so it is important to act.

“We’ve got to be critical when we think about timing,” he said. “If we let this slip through the cracks, those dollars are no longer going to be available towards the project.”

Councilman Julius Oliver, 1st Ward, also warmed to the project’s benefits. “At this point, we’ve got to do something. The structure is a little different from other projects. It pays to be able to have a brand-new development in downtown Youngstown,” said Oliver, committee chairman. “I do think this is phenomenal at this point.”

Copyright 2024 The Business Journal, Youngstown, Ohio.