Ryan Defends Cutting Corporate Taxes

YOUNGSTOWN, Ohio – U.S. Rep. Tim Ryan defended his call for lowering the corporate tax rate Wednesday, which he said needs to be part of a broader tax reform.

Ryan, who earlier in the day joined U.S. Rep. Ro Khanna, D-17 Ohio to introduce legislation in the House of Representatives to expand the Earned Income Tax Credit, is the target of a TV ad paid for by progressive groups that accuse him of fighting for tax cuts for corporations.

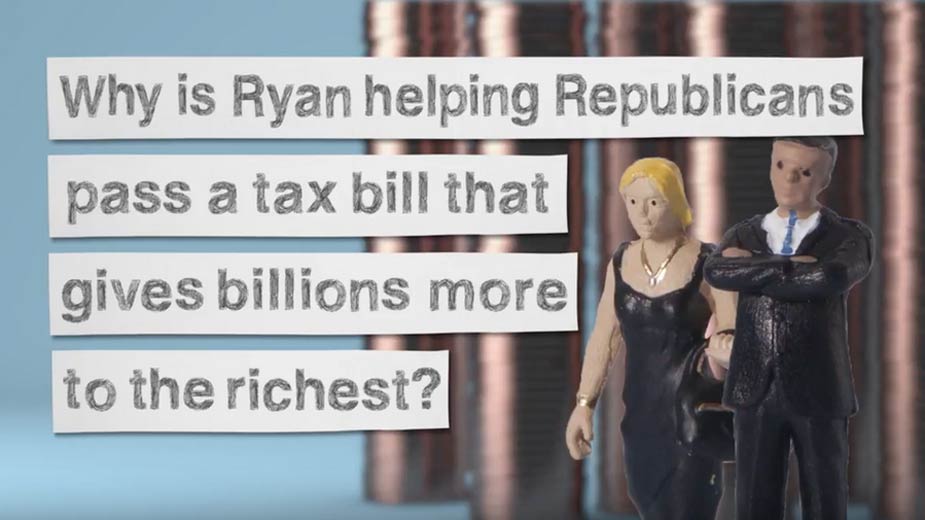

The 30-second spot, “Not One Penny,” paints Ryan as being influenced by rich donors to help Republicans pass a tax bill that gives more money to the wealthiest Americans.

The commercial misrepresents his position, he said.

Ryan, D-13 Ohio, said he backs cutting the corporate tax to 15% and eliminating loopholes so that corporations like General Electric can no longer get away with paying no corporate taxes, while smaller corporations pay up to 30%.

“I’m not going to apologize for trying to figure out how to create a good environment for small and medium-sized businesses, even bigger companies, to make investments here in the United States,” he said during a conference call with reporters to discuss his tax proposal.

“If Democrats are for growth and for helping the workers, we’ve also got to be for a simplified tax code that allows these businesses to grow and hire our workers,” Ryan said. “It doesn’t mean being anti-business. It means being progressive and smart when it comes to economic development.”

Ryan’s comments in support of lowering the corporate tax rate also landed him in an ad by a Republican group, American Action Network.

The Democratic Party talks about supporting workers, but there need to be companies that hire those workers, the congressman said. The United States is competing in a global economy that is witnessing developments in automation, artificial intelligence and driverless technology, and the country needs to have a tax code that makes it competitive globally and incentivizes companies to invest here, he said.

“We can’t be an anti-business party. We’ve got to be a party that acts with fairness,” he said. “You can have a progressive tax code and ask the wealthiest to pay more, but you don’t have to be anti-business, and you can also help those businesses, especially the newer ones, innovate, nurture and grow.”

Ryan said he supports lowering the corporate tax rate as part of a comprehensive tax bill that includes expansion of the Earned Income Tax Credit. The legislation that he and Khanna introduced in the House, the Working Families Tax Relief Act, would expand the tax credit from $510 for families with no qualifying children and $6.318 to those with three or more qualifying children to $3,000 for families with no qualifying children and $12,131 for families with three or more qualifying children. The tax credit would phase out at higher income levels.

“We need tax reform in the United States that can actually lift up families that are working hard, playing by the rules and just need a little boost,” Ryan said. The issue is “especially sensitive” to him, he noted, because his mother accessed the EITC when he was growing up. “For single moms trying to make ends meet, this is an opportunity to get more money in their pockets,” he said.

More than 23 million working families and individuals received the tax credit in 2015, according to a news release from Ryan’s office.

“The EITC is already proven at lifting people out of poverty. By Strengthening it to reach more families and individuals, it can have a lasting impact on our economy,” Khanna said in the release.

U.S. Sen. Sherrod Brown, D-Ohio, introduced companion legislation in the Senate.

“Americans are working longer hours, but too many aren’t seeing that hard work reflected in their pay. And worse – our tax system can actually tax workers into poverty. That’s not how we grow our middle class or our economy,” Brown said in a statement. “Updating the EITC will make sure all workers can keep more of the money they earned for their work.”

Ryan said they are working “very hard” to secure Republican support. The late Ronald Reagan called the EITC “the greatest poverty reduction program in American history,” he pointed out.

“This traditionally has had a lot of Republican support.”

During Wednesday’s call, Ryan also discussed his support for expanding Medicare. An email sent by his congressional campaign urges constituents to sign an online petition to support “Medicare for All” and stand with Ryan “to make universal health care a reality.”

Pictured at top: Screen shot from ad attacking Ryan.

Copyright 2024 The Business Journal, Youngstown, Ohio.