New Ohio Unemployment Claims Hold Steady at 17K

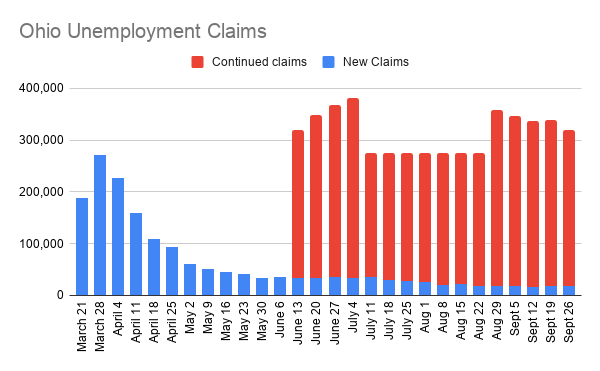

COLUMBUS, Ohio – The Ohio Department of Job and Family Services reports 17,944 initial jobless claims filed last week, as well as 301,274 continued claims.

The number of new claims was up a tick – 509 – from the 17,435 filed the week ended Sept. 19. Continuing claims dropped from 321,057 filed that same week.

Over the past 28 weeks, since the pandemic began affecting Ohio, Job and Family Services has disbursed $6.8 billion to more than 813,000 claimants. In addition, $6.3 billion in pandemic unemployment assistance payments to 585,000 people.

The agency also has initiatives underway to spur economic recovery, including the Ohio To Work program to help displaced workers learn new skills and restart their careers, a $8.5 million National Dislocated Workers Grant that will help workers and employers affected by the coronavirus and a $9.4 million grant to expand apprenticeship program.

In Pennsylvania, the state’s Department of Labor reports 22,762 new unemployment claims filed the week ended Sept. 19, the most recent available. Since March 15, the state has received 2,145,248 unemployment claims.

It has paid out $4.7 billion in unemployment compensation and $4.5 billion in pandemic unemployment assistance.

Nationwide, 837,000 people filed jobless claims last week.

The Labor Department’s report, released Thursday, suggests that companies are still cutting a historically high number of jobs, though the weekly numbers have become less reliable as states have increased their efforts to root out fraudulent claims and process earlier applications that have piled up.

For example, California, which accounts for more than one-quarter of aid applications, simply provided the same figure it submitted the previous week. The state had said it would stop accepting jobless claims online so it could tackle a backlog of 600,000 claims.

Measures of the U.S. economy have been sending mixed signals. Consumer confidence jumped in September, fueled by optimism among higher-income households, though it remains below pre-pandemic levels. And a measure of pending home sales rose in August to a record high, lifted by ultra-low mortgage rates.

Yet some real-time measures indicate that growth has lost momentum with the viral pandemic still squeezing many employers, especially small retailers, hotels, restaurants and airlines, nearly seven months after it paralyzed the economy. An economic index compiled by the Federal Reserve Bank of New York grew in September at a weaker pace than during the summer months.

In its report on jobless claims Thursday, the Labor Department said the number of people who are continuing to receive benefits fell to 11.8 million, extending a steady decline since spring. That suggests that many of the unemployed are being recalled to their old jobs.

But it also reflects the fact that tens of thousands of jobless Americans have exhausted their regular state unemployment benefits. Some of them are likely transitioning to an extended jobless aid program that provides benefits for an additional three months.

The Associated Press contributed to this story.

Copyright 2024 The Business Journal, Youngstown, Ohio.