Ohio Sees New Unemployment Claims Fall Again

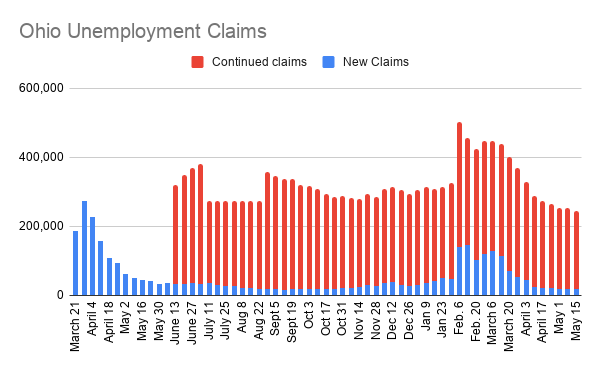

YOUNGSTOWN, Ohio – There were 17,472 new unemployment claims filed last week, according to the Ohio Department of Job and Family Services, the lowest level since late October.

The number of new claims filed the week ended May 15 is down about 2,500 from the previous week.

Continued claims, meanwhile, were at 228,061, a decrease of nearly 4,000.

During the pandemic, the state has disbursed $11.6 billion in unemployment compensation to more than 1 million Ohioans, as well as $10.2 billion in pandemic unemployment assistance to those who don’t qualify for traditional unemployment, such as part-time workers and the self-employed.

In Pennsylvania, the state’s Department of Labor reports 22,906 initial unemployment claims filed the week ended May 15, down about 1,200 from the previous week.

In total, the state has paid $7.7 billion in traditional unemployment and $9.2 billion in pandemic unemployment assistance.

Across the country, the number of people seeking unemployment aid dropped to a new pandemic low of 444,000.

Thursday’s report from the Labor Department coincides with moves by nearly all the nation’s Republican governors to cut off a $300-a-week federal unemployment benefit that they and many business executives blame for discouraging the unemployed from seeking jobs. Those cutoffs of federal jobless aid will begin in June. Jobless people have been able to receive the $300 weekly benefit on top of their regular state unemployment aid.

In addition to ending the federal benefit, most of the same states are also withdrawing from programs that provided jobless aid to self-employed or gig workers and to people who have been unemployed for more than six months.

Twenty-two states, including Ohio, will end the $300 federal payment, starting in June, according to an Associated Press analysis. Two more states, Florida and Kansas, are considering doing so. Those 24 states all have Republican governors and state legislatures. About 3.5 million people will see their benefits reduced in the coming months, according to Oxford Economics.

In Oklahoma, Republican Gov. Kevin Stitt said this week that the state will end the federal benefit on June 26. That was unhappy news for Gilbert Cruz and his wife, Marrissa Enloe-Cruz, whose graphic design company in Tulsa has suffered a collapse in business since the pandemic struck.

Both received jobless aid under the program for self-employed. But even with the $600 a week in federal aid between the two of them, they had earned more from their business before the pandemic. Now, they’re unsure what they’ll do, especially because they’re uneasy about sending their 7-year-old son back to school before being vaccinated.

“It’s going to mean picking and choosing what bills to pay, or getting behind on things,” Enloe-Cruz said. “It will mean whether or not we’re able to put food on the table.”

Thursday’s data release showed that applications for unemployment benefits declined 34,000 from a revised 478,000 a week earlier. The number of weekly jobless claims — a rough measure of the pace of layoffs — has declined steadily since the year began.

About 16 million people were receiving unemployment benefits during the week ending May 1, the latest period for which data is available, the government said Thursday. That is down from 16.9 million in the previous week, and it suggests that some Americans who had been receiving aid have found jobs.

Eliminating the $300-a-week federal unemployment benefit is one of several measures that states have taken to restrict or eliminate jobless aid and press more recipients to seek work. That trend gained momentum after the April jobs report, released earlier this month, showed that employers added far fewer jobs than expected, in part because many couldn’t find enough workers.

Twenty-one states say they will also cut off all benefits for the self-employed and gig workers, who became newly eligible for jobless aid under a relief package that was enacted in March last year. They will also drop out of a federal program for those who have been out of work for more than six months.

Those moves will end all benefits for approximately 3.6 million of the nearly 16 million people receiving aid, or about one in four of current recipients, according to The Century Foundation.

In addition, 35 states have reinstated a requirement that jobless aid recipients search for work in order to keep receiving benefits. That requirement had been suspended at the start of the pandemic, when many businesses were closed and Americans were encouraged to stay at home.

As the economy quickly recovers from the pandemic recession, consumers are showing more confidence and spending at a healthy rate. Most economists think the economy could expand 7% this year, which would amount to the fastest annual growth in more than 35 years.

Yet the rapid reopening from the pandemic has created a wide range of supply shortages that have disrupted what economists had hoped would be a smooth rebound. Home building fell sharply in April, for example, as builders struggled with shortages of lumber and labor.

The shortages have caused a spike in inflation, which led stock markets to tumble this week because investors worry that higher prices will force the Federal Reserve to prematurely cut back on its efforts to stimulate growth.

Fed officials have stressed their belief that the accelerating price increases are temporary. But the minutes of their April policy meeting, released Wednesday, showed that some Fed officials support a discussion at future meetings about dialing back their efforts.

The Associated Press contributed to this story.

Copyright 2024 The Business Journal, Youngstown, Ohio.