Tax Abatements Create, Retain Jobs of More than 1,600 Trumbull Residents

WARREN, Ohio — Businesses in Trumbull County last year created or retained more than 2,800 jobs on the strength of tax abatements from the county – and more than half of those jobs went to Trumbull residents.

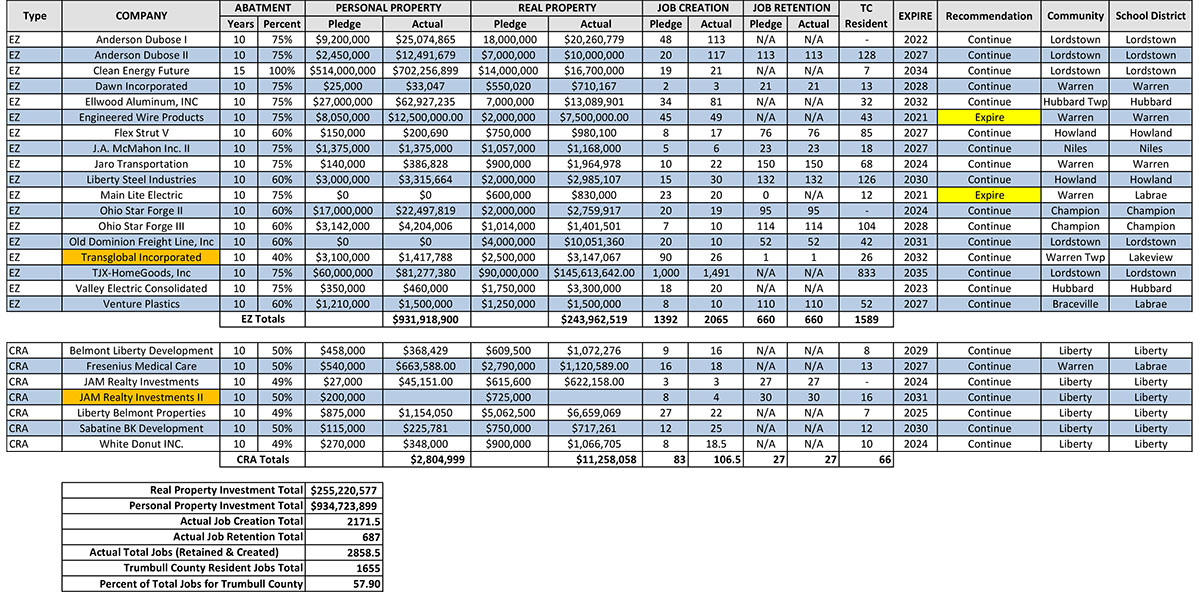

The 25 businesses that received tax abatements in 2021 created 2,171.5 jobs and retained another 687, Nicholas Coggins, assistant director of the Trumbull County Planning Commission, reported during the annual meeting of the county’s Tax Incentive Review Council. County residents secured 1,655 of those jobs, or 57.9% of the combined new and retained jobs.

The state requires 30% of jobs created or retained go to county residents, Coggins said. “So we almost doubled what the state requirement is,” he said. The statistic is “exceptional for our companies” considering how close areas like Lordstown are to borders of Mahoning County and Pennsylvania.

“There’s a large chance for us to lose a lot of these jobs to somebody traveling only 15 or 20 minutes, but not be a Trumbull County resident,” he said.

Among the companies well ahead of its job creation pledges, according to the 2021 report, is Transglobal Inc., which wasn’t expected to begin hiring until this year. In June 2021, the Trumbull County Board of Commissioners approved a 10-year, 40% property tax abatement for Transglobal, which will supply doors for General Motors and Rivian electric vehicles from a new plant in Warren Township.

The company has already hired 26 of the 90 workers it has pledged to hire over the next three years, according to the report.

“We weren’t even expecting them to have a single job yet,” Coggins said in a phone call with The Business Journal after the meeting. “They’re actually way ahead of what was expected of them.”

Other businesses are ahead of where they pledged to be in terms of job creation and retention, as well as investments in real and personal property, according to the annual report. Real property reflects property acquisition and construction, while personal property is more furniture and fixtures.

According to the report, businesses that received tax abatements invested a total $255,220,577 in real property in 2021, and $934,723,899 in personal property.

Coggins said he was “pleasantly surprised” by the number, after the global pandemic kept numbers low in 2020. “This year, it seems like everybody has bounced back,” he said.

Here are the numbers:

Per the report, the planning commission finds all businesses to be in compliance, Coggins said.

All tax abatements are recommended to continue, except the abatements that were set to expire in 2021 for Engineered Wire Products and Main Lite Electric.

Copyright 2024 The Business Journal, Youngstown, Ohio.