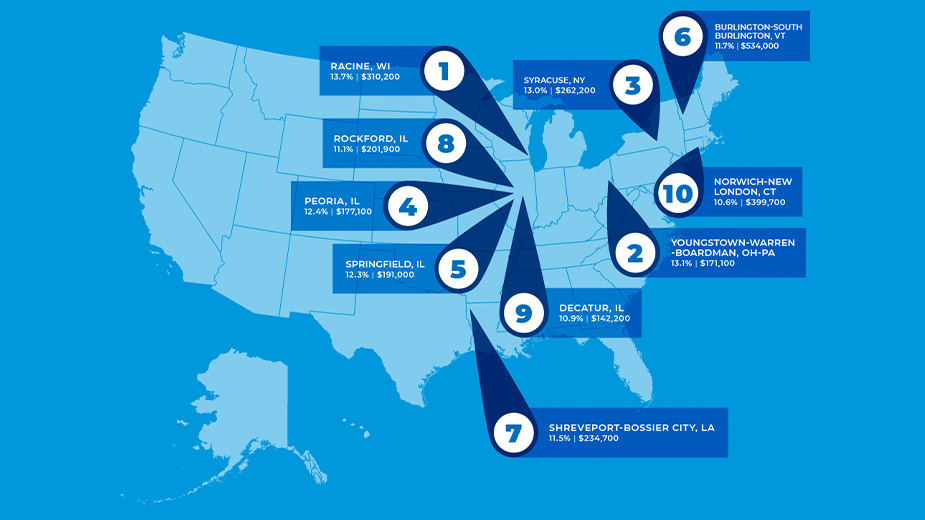

Valley Ranks 2nd in Largest Home Price Increases in Q3

WASHINGTON – The Youngstown-Warren-Boardman area was among the top 10 metro areas with the largest year-over-year median home price increases in the third quarter of 2024.

Home prices increased in 196 of 226, or 87%, of metro markets as the 30-year fixed mortgage rate ranged from 6.08% to 6.95%, the National Association of Realtors reported Thursday.

“Home prices remain on solid ground as reflected by the vast number of markets experiencing gains,” said Lawrence Yun, chief economist for the National Association of Realtors. “A typical homeowner accumulated $147,000 in housing wealth in the last five years. Even with the rapid price appreciation over the last few years, the likelihood of a market crash is minimal. Distressed property sales and the number of people defaulting on mortgage payments are both at historic lows.”

Compared with a year ago, the national median single-family existing-home price rose 3.1% to $418,700. In the prior quarter, the year-over-year national median price increased 4.9%.

Among the major U.S. regions, the South registered the largest share of single-family existing-home sales (45.1%) in the third quarter, with year-over-year price appreciation of 0.8%. Prices also increased 7.8% in the Northeast, 4.3% in the Midwest and 1.8% in the West.

The top 10 metro areas with the largest year-over-year median price increases, which can be influenced by the types of homes sold during the quarter, all experienced gains of at least 10.6%. Four of the markets were in Illinois. Overall, those markets were Racine, Wis. (13.7%); Youngstown-Warren-Boardman, Ohio. (13.1%); Syracuse, N.Y. (13.0%); Peoria, Ill. (12.4%); Springfield, Ill. (12.3%); Burlington-South Burlington, Vt. (11.7%); Shreveport-Bossier City, La. (11.5%); Rockford, Ill. (11.1%); Decatur, Ill. (10.9%); and Norwich-New London, Conn. (10.6%).

Nearly 13% of markets (29 of 226) experienced home price declines in the third quarter, up from almost 10% in the second quarter.

Housing affordability improved slightly in the third quarter as mortgage rates trended lower. The monthly mortgage payment on a typical existing single-family home with a 20% down payment was $2,137, down 5.5% from the second quarter and 2.4% from a year ago. Families typically spent 25.2% of their income on mortgage payments, down from 26.9% in the prior quarter and 27.1% from a year ago.

“Housing affordability has been a challenge, but the worst appears to be over,” Yun said. “Rising wages are outpacing home price increases. Despite some short-term swings, mortgage rates are set to stabilize below last year’s levels. More inventory is reaching the market and providing additional options for consumers.”

Published by The Business Journal, Youngstown, Ohio.