Efficiency, Big Jobs Spark Electrical Contractors

With cracker plant on the horizon, worker shortages loom.

Shell Chemical is working on a petrochemical plant in Monaca, Pa., that’s expected to employ 6,000 workers during construction, the same figure estimated for another cracker plant that could be built by PTT Global Chemical in Belmont County. In Lordstown, a second power plant could employ as many as 500 (See related story on Page 48 in our May Edition. Order yours here).

Projects of that size are good news for the region’s electrical contractors, but the lineup also comes with its own set of challenges.

“It can’t be here fast enough. But at the same time, we need those trained tradesmen who can handle the work when it comes,” says Jeff Barber, vice president of projects for VEC Inc., Girard. “We still have the normal work, then the spinoff [from the cracker] work plus [the cracker] work. A lot of guys are needed.”

The labor shortage remains the top concern for electrical contractors, others agree.

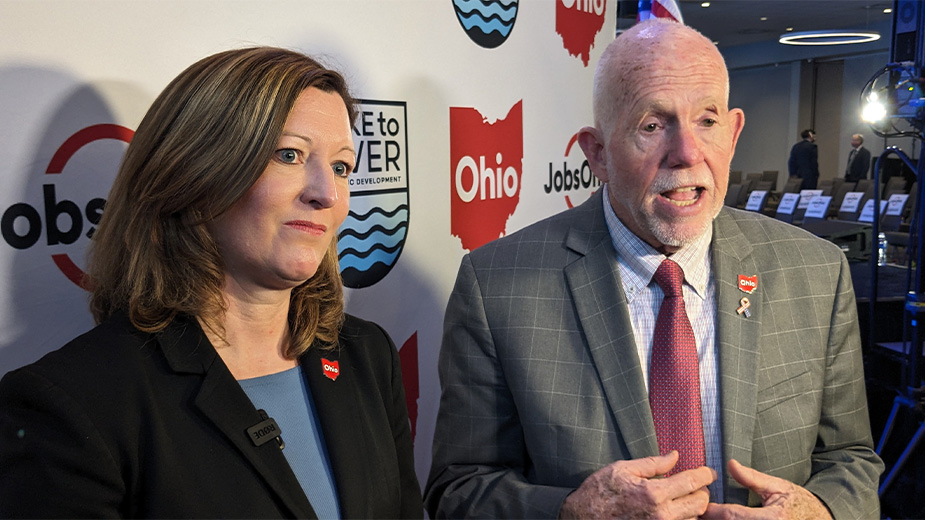

“Looking down the road, the cracker plant in Monaca is going to bring in loads of electricians and other trades,” says Jack Savage, executive director of the Mahoning Valley chapter of the National Electrical Contractor Association. “It’ll be across all trades that we’re looking for workers.”

Adds Eric Carlson, president of Joe Dickey Electric in North Lima, “I expect to see more power-plant work. It may not be Joe Dickey Electric but just because of the size of it, there may be out-of-town companies coming in. But they’ll be looking for local workers.”

Jim DeRosa, general manager of Yesco Electrical Supply Inc., notes that with the Monaca cracker, there’s a vast market that will emerge after the plant is up and running as ancillary companies and new residents arrive.

“You immediately know as a distributor that there’s going to be an influx of residential upgrades, light commercial upgrades and new construction with restaurants and hospitals,” DeRosa says. “People will start moving in. So if homes aren’t up to code, updates have to be made.”

While contractors are concerned about having the workforce to handle such projects – Barber notes that he’s heard about it from contractors across the country through his travels as part of the local NECA chapter – there are bright spots.

New technologies are coming into play for contractors and end-users alike. On the contractor side, these advancements can improve efficiency on jobs. Both VEC and Bruce & Merrilees Electric Co. in New Castle, Pa., use modeling technologies to create renderings of sites.

“We’re doing more things with laser-scanning substations and giving customers a 3-D model or using ground-penetrating radar to determine exactly what’s underground to provide a complete as-is condition [report],” says Bruce & Merrilees Vice President Justin Bruce.

There are plenty of customers willing to spend money on projects, he adds. “The challenge is they don’t know what they have. They’ve lost so much seniority that they don’t have the records. Or maybe they did upgrades but didn’t keep everything in the same document.”

VEC, meanwhile, started to use technologies such as PlanGrid, AutoCAD and BIMBox with the construction of Hollywood Gaming at Mahoning Valley Race Course. One of the builders on-site was using iPads equipped with PlanGrid, software that provides real-time blueprints, punch lists and daily reports, Barber says.

“We had to implement it and that project was 18 months to two years, start to finish. So the guys took it to the next job to spread the word and then those guys took it to their next jobs,” he says, noting VEC has around 40 tablets in the field. “It’s all real-time. They can make their changes on the fly. It pushes it out to everyone else, so everyone sees the same information at the exact same time.”

For consumers, there’s still much focus on energy management, says Dickey’s Carlson.

Among the more common upgrades on that front are the installation of LED bulbs, occupancy sensors and dimmers. On the safety front, housing codes dictate the use of arc fault breakers, which trip when they detect arcs caused by loose connections, helping to prevent fires.

“Another big push is for electrical maintenance. People just aren’t doing basic maintenance and when the economy was bad, that was definitely something they didn’t do,” Carlson says.

Throughout the electrical industry, everything is moving faster than ever, the contractors agree.

“Customers want to see a return on investment faster,” VEC’s Barber says. “We never used to work through the winters and the last three, four winters we’ve worked full speed. The whole industry is moving 10 times faster.”

Joe Dickey Electric was steady through the end of December before slowing down for the first two months of the year. The contractor has about 100 on staff and Carlson expects that number to reach around 150 this summer.

While not a contractor, Yesco sees its customers looking for products that can improve efficiency.

“Labor savings are what’s attractive to them. Now, instead of taking an hour to install five boxes, they may be able to install 20 in the same amount of time. They can do their jobs quicker and safer,” says DeRosa. “Just like we educate end-users about energy saving, we educate contractors on labor savings.”

VEC is already planning projects for 2019 and 2020, Barber says, and working on prefabricated products to help steady its workforce. Bruce & Merrilees is as well and expanding its engineering, surveying and prefab staff, says its vice president.

“It maximizes efficiency in the field so that when the labor shortage does hit, we’re not stuck. There’s a lot of work out there. People are investing money,” Bruce says. “I don’t know of any sectors that aren’t spending money or planning on spending money. That creates a lot of opportunities but it also creates some challenges because you have to pick the right projects.”

Copyright 2024 The Business Journal, Youngstown, Ohio.