Miller to Become Third MVEDC Executive Director

LIBERTY TOWNSHIP, Ohio – A new revolving loan fund announced Tuesday is just one step in Mahoning Valley Economic Development Corp.’s plans to increase its ability to bring capital to the region and to grow businesses and jobs, MVEDC’s incoming executive director said.

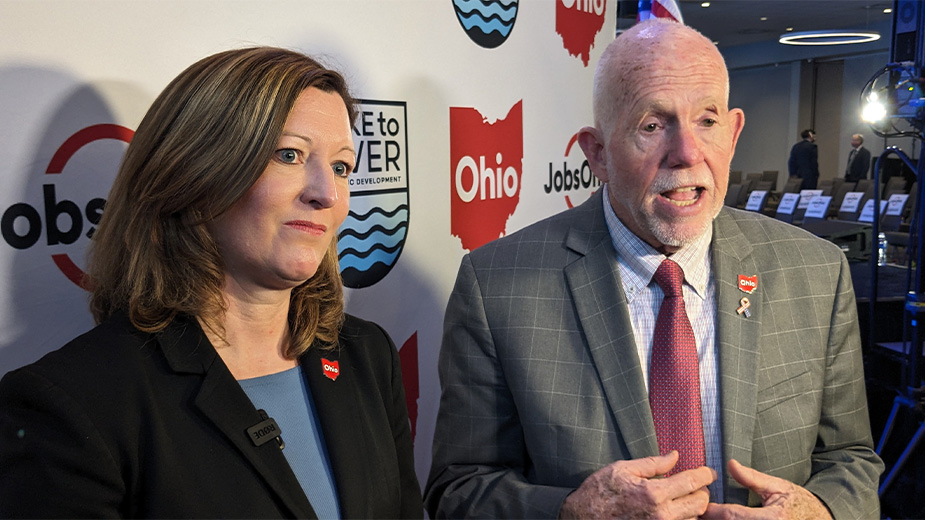

Teresa Miller, a longtime MVEDC employee who last year was named associate executive director, will succeed Michael Conway in the post, effective Jan. 1. She will be the third executive director since the economic development agency was formed in 1979 following the steel mill closings that left thousands of workers jobless and devastated the local economy.

Conway, who followed Don French as MVEDC executive director in 2011, said Wednesday he was “of age to retire.” More importantly, the organization has developed and matured and its staff has reached “a level where it can continue forward and perform its mission” effectively.

“I feel very comfortable that my time should come to an end here and a new team should transition into leadership,” he said. He recommended to MVEDC’s board of directors that Miller succeed him, and its members voted to follow his recommendation.

The MVEDC board “didn’t consider any other candidates” and based their decision on the Conway’s recommendation, said Michael Keys, Warren community development director and outgoing president of the MVEDC board. The board’s decision also was based on Miller’s performance under a strategic plan put in place when she became assistant executive director last year.

“Since I’ve been on the board, I’ve noticed Teresa has plenty of leadership qualities,” Keys said. “She just has a great deal of experience and familiarity with the programs MVEDC offers.”

Keys praised Conway for never letting the board forget MVEDC’s mission to create jobs and support small business and entrepreneurship by filling a role that bankers and commercial lenders don’t necessary fill, and not to focus exclusively on the bottom line.

“She has all the talents and skills to perform more than adequately as executive director,” Conway said. “She has a long tenure here, she’s multiversed in the inner workings. She has networked out into the community to deal with our banking partners.”

He also credited her with securing the participation of banking partners to raise the $400,000 local match for a grant to establish the recently announced Economically Disadvantaged Growing Entrepreneurs, or Edge, Revolving Loan Fund.

Miller worked at a local accounting firm before coming to MVEDC in 2006. She was interested in finding a position with an organization where she had an opportunity to advance, and MVEDC also filled a personal desire.

“I’ve always had a heart for helping people, and this place definitely does that for those small businesses that are trying to get their start,” Miller said.

Miller started at MVEDC as account servicing specialist, then moved up to loan closing officer and later trust manager before accepting her current post. During her time with the agency, she also built relationships with members of the economic development community, financial institutions and other local partners.

“I worked my way from the bottom to the top and all the ins and outs and all the different nooks and crannies. I’m ready to take over and take us to new levels,” she said. “I’m ready to bring some new and exciting things here to the Valley to make sure MVEDC becomes more visible and active in the community and in the participation of economic growth.”

One piece of that strategy is the creation of the Edge Fund. The fund, for which MVEDC received a $1.6 million federal grant, will target women-owned and minority-owned enterprises as well as businesses and startups operated by other disadvantaged populations.

MVEDC’s “main niche” is lending to small businesses in a nine-county region in northeastern Ohio and western Pennsylvania through a variety of loan programs it administers, including one through the U.S. Small Business Administration. Its loan portfolio is just over $40 million, Miller said.

Additionally, the organization owns two railroads and two industrial parks, and houses the Mahoning Valley Procurement Technical Assistance Center, which assists companies with identifying and securing contracting and subcontracting opportunities with federal, state and local governments.

As part of its decision to focus mainly on small business lending, MVEDC is looking at potentially getting rid of the two industrial parks it operates, Youngstown Commerce Park in North Jackson and Warren Commerce Park, Miller said. The majority of the developable land in each has been developed and some of the remaining parcels are classified as wetlands.

“We have depleted our efforts in growing the economy with those parks, so at this point it’s just us maintaining them,” she said. “It’s not an opportunity to create more jobs.”

The parks “are liabilities to us as they exist,” carrying tax, maintenance and insurance burdens among others, Conway affirmed.

“For all of those factors, it may make more sense to divorce ourselves of those assets and free up operations for small-business lending,” he continued. About 95% of MVEDC’s annual revenue is derived from small-business lending, he pointed out.

Reflecting on his tenure, one of the major changes Conway said he has seen locally is the emergence of small, technology-oriented businesses locally, including those developing out of the Youngstown Business Incubator and Brite Energy Innovators in Warren, as well as other such firms.

“It’s a bottom-up economy that I’m seeing blossom and a lot of it is technology-oriented,” he said.

He also is encouraged by the partnerships he sees among the various Valley entities working on economic development. “That’s the way that economic development should play out in a community,” he remarked. One of the highlights of his time at MVEDC was its role in helping establishing the Valley Growth Ventures venture capital fund.

MVEDC’s biggest upcoming priority will be to become more visible and increase participation in economic growth in the counties it serves, Miller said.

“We want to make sure that we’re active in the community, that we’re actively building those relationships that we have with business owners and with our financial institution partners, and to get ourselves more visible so that those business owners know who we are and what we do,” she said. “If we’re more visible and active, then people will understand more what we do. … that will help increase the small business lending.”

Pictured: Teresa Miller succeeds Michael Conway as executive director of MVEDC.

Copyright 2024 The Business Journal, Youngstown, Ohio.