Economists: Consumers Confident, Business Set to Spend

YOUNGSTOWN, Ohio — It took more than five years of economic recovery – the Great Recession officially ended in June 2009 – before small businesses and consumers here at last felt they were in one.

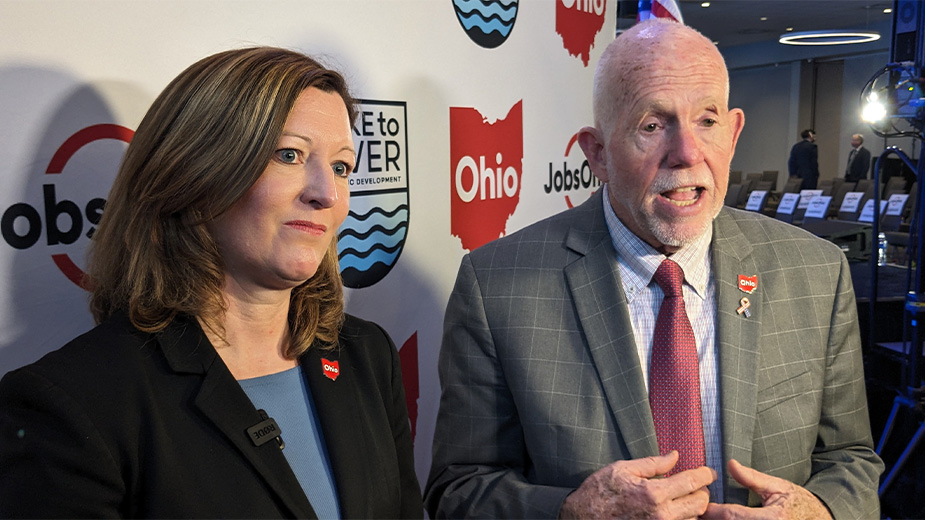

The reasons why are many and varied. A.J. Sumell, professor of economics at Youngstown State University, notes that the economy is in its sixth year of expansion. “The difference this year,” he says, “is people are starting to feel it.”

The director of economics at Huntington Bank, George Mokrzan, points to its third annual Midwest Economic Index Survey that found most consumers and small businesses “have moved on from the troubling economic downturn” and expect this year to be better than 2014 and 2013. “Fifty-six percent said they are better off financially now than they were five years ago [and] 16% of consumers said they definitely will purchase a new car in 2015 compared to 6% last year.”

The falling rate of unemployment has given consumers more confidence to spend as they save less and are not paying down household debt as rapidly.

The feeling of being left out, says Kenneth T. Mayland, president of ClearView Economics LLC in Pepper Pike, can be explained. “This recovery has been a muted and disappointing recovery. This recovery is the weakest on record [since World War II even though] December was the 66th month of expansion,” he says.

The increase and pace of economic growth last year has allowed small-business owners to at last decide whether to spend on growth and expansion or wait until next year, a survey conducted by Citizens Bank finds.

The unemployment rates in the Midwest, the Mahoning and Shenango valleys, are lower than the national average, Sumell and Mikael Teshome, an economist for PNC Bank, agree, because the manufacturing sector is performing better than the economy as a whole. Even so, it took until last fall for manufacturing output to overtake its pre-Great Recession peak in December 2007, the Federal Reserve reports.

Mokrzan expects the unemployment rate to reach 5.4% by yearend, Mayland 5% and PNC 5.1%. “I’m bullish on jobs,” Mokrzan, Huntington’s director of economics, says. The economy has added more than 200,000 jobs each month of the last three quarters of 2014, a trend he sees continuing this year.

The economics profession has defined full employment as somewhere between 5% and 5½%, Teshome says. “So we’re getting there. 2015 will be a year of broad-based job growth.”

Those who dropped out of the official unemployment rate, those who gave up looking for work and were no longer part of the official statistics, are returning to the workforce, Mayland says, slowing the drop in the official rate of unemployment. “For 2015, the participation rate will stabilize,” he says. “I would hope it would increase.”

Job growth of more than 200,000 per month “may sound like a big number,” Mayland observes. The Labor Department reported growth of 256,000 jobs in December, the highest in 15 years. However, the rate of post-recession job growth “has been 4% historically, but we’ve been at just under 2%. I do see a chance of better economic performance, 250,000 to 275,000 per month,” he says.

The labor market is starting to get back to normal,” Mokrzan says. Those who have the talent and skills should have little problem getting a job.

After a disappointing first quarter last year when gross domestic product, or GDP, shrank 1.8% because of an extremely harsh winter, second- and third-quarter growth came roaring back. “Third-quarter GDP growth of 5% was a surprise. It followed second-quarter growth of 4.6%, Huntington’s Mokrzan says. “So we had a year of some really good growth.”

Huntington projects 2.7% GDP growth for 2015, 2.9% this quarter, 2.8% in the second and third quarters and 2.3% in the last quarter.

Mayland sees 3.5% this year, “with a caveat.” Year-over-year growth will be 3.2% because of the 1.8% contraction in the first quarter of last year. The economy will grow 3.1% this quarter, 3% the second, 3.2% the third and 3.4% the last, he says.

The PNC Economics Department sees 3.2% growth this quarter, 3.1% in the second and again in the third and the last quarter achieving 3.3% for an overall rate of 3½%. “What got us into the recession is back in balance,” Teshome says.

The steep drop in the price of oil, to as low as $47 a barrel and hovers around $50, and gasoline at the pump, the economists agree, has boosted the economy outside Louisiana, Texas, Oklahoma and possibly Alaska, and made consumers more confident.

“It’s almost equivalent to a tax cut,” Mokrzan says.

Mayland calls it “a reverse oil shock” that has had as much impact of late as the Arab oil embargo in 1973. “It’s akin to a $160 billion tax cut,” he observes.

The economists agree low oil prices will restrain the rate of inflation to well below the Fed’s target rate of 2%.

Closer to home, producers of oil-country tubular goods, such as pipe, have felt the effects. U.S. Steel Corp. announced it would lay off steelworkers in March at its plants in Lorain, Ohio, and Houston. The Vallourec mill in Youngstown says it’s monitoring demand.

Less expensive gasoline has resulted in drivers returning to less-fuel efficient SUVs, pickup trucks and full-sized cars – and turning away from electric cars and hybrids. Fifty-two percent of auto sales in October were trucks and SUVs, Kelly Blue Book reports, up from 49% a year earlier and 44% in October 2008, just into the Great Recession.

Regardless, all four economists project a sales pace of 17 million this year, ahead of the 16.4 million pace last year, and that sales of the fuel-efficient Cruze made in Lordstown should be little affected. Those inclined to buy Cruzes, Mayland suggests, will likely order “more expensive [models] with more extras.”

PNC projects energy prices will remain low, Teshome says. Its economics department sees oil returning to $65 a barrel at year-end and gasoline remaining well below $3 a gallon.

“We are pretty close to the bottom [of gasoline prices],” Mayland says. “We could stay there a couple of months.” It will be March before pump prices drivers see prices rise.

Not one of the economists sees Congress raising the tax on a gallon of gasoline to replenish the Highway Trust Fund.

Speaking as economists, all agreed, now is the time to raise the tax from 18.5 cents a gallon (it’s been that rate since 1993) if Congress were inclined to replace and repair roads and bridges long neglected.

“It would be reasonable to raise the gas tax now,” Mayland ventures. The more fuel-efficient cars, trucks and SUVs means gasoline consumption won’t increase as much. “They’re using the highways and bridges more and not burning as much gas,” he points out. “We need good highways and bridges to get to work.”

None was prepared to suggest how much the gasoline tax should be raised

Other signs of sustained and increased recovery are in the housing, health-care and professional services sectors. While real wages remain flat, and nominal wages keeping pace with inflation, “Housing remains affordable,” Teshome says. Mortgage rates remain low.

The segment of strongest growth in housing are residences priced at “$750,000, $1 million and higher,” Mayland says. “The weakest segment is existing houses for $150,000 and less.

All note that mortgages taken out to buy houses have waxed as mortgage refinancing has waned.

“Rates have been so low for so long,” Mayland points out, would-be buyers begin to assume they’ll remain low even as the price of existing houses rises incrementally.

Refinancings have dropped, the economists suggest, because most who could benefit have done so. With the paperwork lenders require, “If you have 4%, does it make sense to go to 3¼?” Mayland asks.

Copyright 2015 The Business Journal, Youngstown, Ohio.

Copyright 2024 The Business Journal, Youngstown, Ohio.