Bankers Address Economic Issues at Chamber Event

BOARDMAN, Ohio — Consumers clearly are benefiting from low energy prices but those same low prices can have a negative effect on regional economies and communities tied to oil and gas production as is being experienced in the Mahoning Valley, a financial adviser with First National Bank of Pennsylvania says.

Renee D. Laychur, senior vice president and managing portfolio adviser with F.N.B. Wealth Management Advisory Group, was among nine banking industry executives who shared their perspectives on aspects of the global and regional economy during this morning’s 2015 Economic Forecast Breakfast presented by the Youngstown Warren Regional Chamber.

“Energy has been the big story this year,” Laychur says. Prices have dropped nearly 60% since last summer, driven lower by weak global demand and good production, particularly in North America. “It’s a big surprise in the economy and has a lot of wide-ranging implications, some good, some bad,” she said.

The lower energy prices “clearly” benefit consumers, putting more money in their pockets, but people aren’t spending those savings. “If we look at retail sales and other measures of spending, it really hasn’t increased that much. It seems people are saving this money,” she said. The main change in behavior is that consumers are again buying sport utility vehicles and trucks.

At the same time, the low energy prices “could be a negative” for economies closely tied to energy production. “As prices go down and demand dries up, it’s not economically feasible to get the oil and gas out of the ground any longer,” Laychur continued. Just this week, TMK IPSKO in Brookfield and Vallourec Star in Youngstown, which supply products and services to the oil and gas industry, announced layoffs and shutdowns.

Another presenter, David Lucido, senior vice president and chief financial officer at Cortland Banks, who spoke on asset management, noted the challenge presented by the persistent low interest rate environment.

“That has compressed margins for banks,” Lucido said. Because of that, banks have been looking for other opportunities to make money from fee income “so that’s been a big focus of the last couple of years.” In addition, Cortland Banks has tried to take “a more balanced approach to both short-term and long-term investments to help our investment portfolio yield more than it might otherwise do in this low-rate environment.”

The stock market has risen for six consecutive years, fully recovering the losses of the Great Recession, and is in a period of better than average returns, said John Augustine, chief investment officer for Huntington Trust. Since 1920, returns have averaged about 10% each year, with three “very difficult” periods: the Great Depression, the late 1970s and the early 1980, “and we just went through the last one and it was no fun,” he said.

Because the U.S. economy is doing “relatively well” compared to the rest of the world, “We can keep a majority of our customers’ money at home,” Augustine said. Also, low interest rates are driving long-term investors to the stock market not only for growth but also for income, he added. History suggests, although it doesn’t guarantee, that the stock market is “fairly valued” but has the opportunity to move higher in a low interest rate environment, he said.

Other presenters were executives from Talmer Bank & Trust, PNC Bank, KeyBank, Farmers National Bank, Home Savings & Loan and Seven Seventeen Credit Union. Topics addressed included last year’s economic performance, the international economy, foreign exchange rates, mortgages and banking regulations.

The breakfast also featured a presentation by Anthony Noreen, head coach and general manager of the Youngstown Phantoms hockey team, and the showing of the chamber’s economic development video highlighting last year’s activity. The video included various distinctions awarded to the Mahoning Valley over the past year highlighting local job growth, unemployment declines and affordable cost of living.

The video also spotlighted company expansions such as the Matalco Inc., Hynes Industries and Laird Technologies projects. Overall, the chamber economic development team completed 13 projects last year resulting in a total investment of $126.6 million, 484 new jobs and 470 retained jobs.

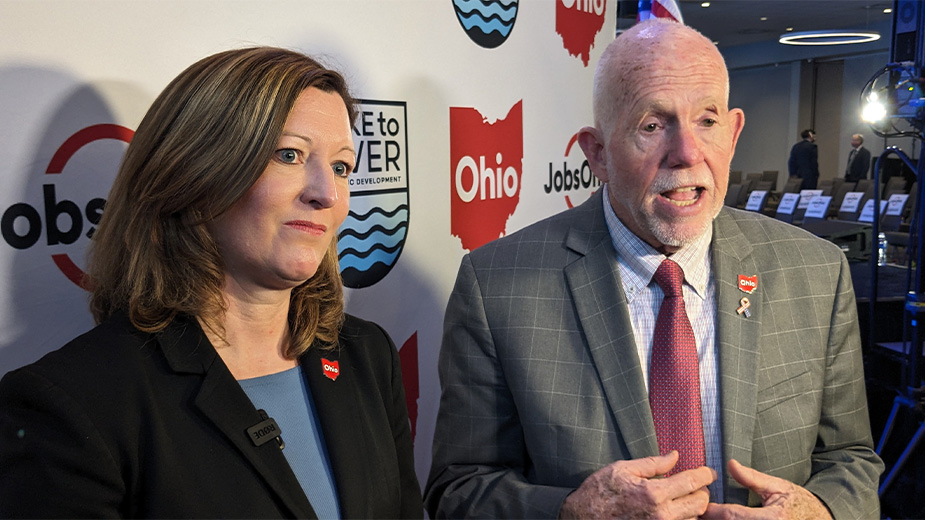

This year, the chamber is working on projects that could result in a potential investment of $1.4 billion, 1,266 new jobs and 2,889 retained jobs, said Sarah Boyarko, the chamber’s vice president, economic development, North America.

“The fact that there are still more companies that manufacture products for the oil and gas industry considering an investment in the Valley says a lot,” she related. “They’re watching what’s happening in this region and they want to be a part of it.”

Copyright 2015 The Business Journal, Youngstown, Ohio.

Copyright 2024 The Business Journal, Youngstown, Ohio.