Banks Built Towers, Consolidated, Adopted Technology

YOUNGSTOWN, Ohio – The skyline of downtown Youngstown would look very different were it not for the many banks once headquartered here.

Most of the tall buildings with marble lobbies and stately façades reflect the power of the banks that once flourished inside them. But the names of the banks and financial institutions once prominently displayed on the buildings have changed or been erased.

“It’s kind of amazing all of those big towers survived,” says Bill Lawson, executive director of the Mahoning Valley Historical Society. “If you drive downtown or on I-680 skirting around downtown, you see all these 12-, 15-, 17-story buildings.”

Lawson adds those tall buildings are emblematic of a far larger city than the 60,000 currently living in Youngstown.

“But it does speak to where we were in the 1920s up to the 1930s when the population was 170,000 and the future looked bold and brilliant,” he says.

Over the past 40 years, most bank names changed. Central Square transformed from a hub of financial activity to a quieter place.

“On that story of evolution, I don’t think there’s a bank that hasn’t been touched, some many times,” says Gary Small, president and CEO of Premier Bank, formerly Home Savings.

The Mahoning Valley is no different than other places in that regard. Mergers and acquisitions have changed the landscape of banking.

According to the FDIC, there were 14,496 commercial banks in 1984. By 2023, only 4,036 banks remained, according to Ted Schmidt, PNC regional president. He believes the cost of implementing ever-changing technology and compliance regulations will result in even more consolidations.

Downtown Youngstown

Dollar Bank, formally known as Dollar Savings and Trust, was on Federal Street, in a building designed by Charles F. Owsley that was built between 1900 and 1902. Ohio Banc Corp. was the holding company for Dollar Bank in 1985. That year, the company’s annual report had a long list of acquisitions, including The Minerva Banking Co. in Minerva, Potters Bank and Trust Co. in East Liverpool and The Miners and Mechanics Savings and Trust Co. of Steubenville.

Ohio Banc Corp.’s net income was $12.5 million in 1986, and $14 million in 1987. As 1989 came to an end, Dollar Savings announced its intent to acquire the McKinley Bank of Niles. Then, in 1993, amid the Phar-Mor scandal, Ohio Banc Corp. was acquired by National City Bank of Cleveland. PNC Financial Services of Pittsburgh acquired National City in 2008.

“That was one of the largest acquisitions in PNC’s history,” Schmidt says. “It made PNC one of the five largest banks [in the United States], actually doubling the size [as ranked by assets] to $291 billion and PNC expanded their market reach from the Midwest to the mid-Atlantic.”

PNC moved its Youngstown headquarters to its present location on East Federal Street in 2012.

Schmidt joined Ohio Banc Corp. in 1988 and remained through the evolution of National City and now PNC.

“Now, 35 years later, interestingly, I still have the same phone number as the day I was hired in 1988,” Schmidt says. “You don’t see that very often, having one phone number and one institution.”

PNC is only 41 years old itself this year, created in 1983 after Pennsylvania changed its laws in 1982 to allow statewide banking, according to Schmidt. PNC Financial Corp. was the result of the merger of Pittsburgh National and Provident National in Philadelphia, the first two banks to take advantage of the regulatory change. At the time, Schmidt says it was the largest bank merger.

After PNC acquired BBVA in October 2021, it had a presence in 29 of the 30 largest markets in the country, Schmidt says, adding PNC is now in all 30 and is one of the largest institutions in the country with $562 billion in assets, 56,000 employees and about 2,300 branches.

Home Savings Tower

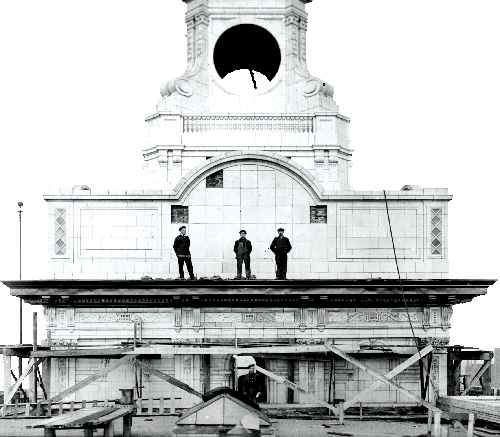

Downtown Youngstown would not look the same without the iconic Premier Bank tower on West Federal Street.

The tower, the symbol of Home Savings and Loan Company for generations, was also designed by architect Charles F. Owsley, with construction starting in 1918. The lights that bath the top of the tower in color were added in 1949.

Home Savings, Small notes, dates to 1889 and “plodded along very nicely as a mutual” for more than 100 years. It became a thrift bank in the 1990s, which meant a transition from depositors owning the bank to becoming shareholders.

When he ate downtown, Small says, an employee at a local sandwich shop always asked him about the latest dividends. The employee was a long-time customer who still had his shares 30 years after the conversion.

“That’s kind of a special story for this market, with that kind of life in the community for so long,” Small says of the bank’s connection to Youngstown. “It’s a big deal.”

The bigger change for Home Savings came in 2017 when it merged with First Federal Bank of Defiance, Ohio. That merger of equals came with a name change for both banks: Premier Bank and Premier Financial Corp. were born.

“We pushed our organizations together because they felt that at double the size, we could have the capacity to do much more,” Small says. “We could invest more and bring cooler things to our clients. We have all the good things that come with that, but still run a community model.”

Youngstown remains home base for many of the executives and headquarters for Premier Bank, while Defiance is headquarters of the holding company, Premier Financial Corp.

Other Banks

Huntington Bank came to the Valley through the purchase of Sky Bank in 2007, which had acquired Mahoning National Bank in 1999.

The 1984 annual report for Mahoning National Bank included new loan products for consumers and an accelerated effort to keep up with the introduction of ATMs. Mahoning National Bank reported $476 million in total assets in 1984, an increase from $441 million the previous year.

In 1985, First National Bank acquired Metropolitan Savings and Loan Co. and moved into what was then called Central Tower, once home of the Central Savings and Trust Company, a bank that failed during the Great Depression. Metropolitan Savings and Loan was in the 18-story art deco building designed by Morris W. Schiebel and built in 1929. Metropolitan Savings and Loan was purchased in 1985. A clue to its history remains visible on the building, 6 W. Federal St., which still bears the name above an intricately carved doorway.

According to Lawson, some downtown banks disappeared entirely. Although not a public bank, Realty Guarantee and Trust Co. operated as an investment bank in the Realty Tower, which was severely damaged in a natural gas explosion May 28.

First Federal Saving and Loan Co. had a building on West Federal Street at one time, where Imbibe Martini Bar and Ryes Craft Beer and Whiskey are today. First Federal eventually moved its headquarters to Boardman and no longer exists, Lawson says.

Wick National Bank was in the Wick Building, which today houses apartments and a restaurant on the first floor.

In addition, Lawson says, Peoples Bank had a presence downtown in the Stambaugh Building, as did its successor, Society Bank, which became KeyBank. KeyBank, however, is no longer downtown.

And, Lawson says, there were several small “ethnic” financial institutions in downtown at one point. All are gone.

Farmers National Bank

Although it was not downtown, the bank with the longest continual presence in the Mahoning Valley is Farmers National Bank. Farmers is currently expanding its corporate offices in Canfield, where it was founded in 1887.

“When I think about Farmers’ history, I think about stability and longevity and legacy,” says Amber Wallace-Soukenik, Farmers executive vice president and chief retail and marketing officer.

Its headquarters expansion will include a large history wall that will tell the story of the bank and all the changes it has undergone since the late 1800s.

The bank has grown immensely in the last 40 years, Wallace-Soukenik says. In the mid-1980s, there were just six Farmers branches, plus the headquarters in Canfield. The total assets were $150 million, an amount that is more common for a single branch of the bank today, she says.

“Today, we’re almost $5.2 billion [in assets] and we have 62 branches and about 750 employees,” she says.

While other banks across the Mahoning Valley have merged or been acquired, Farmers was acquiring other banks.

In 2000, Farmers made its first acquisition: Security Dollar Bank of Trumbull County, which helped Farmers grow to about 14 branches. Since then, Farmers has made seven acquisitions, including 1st National Community Bank in East Liverpool in 2015 and Cortland Savings and Banking Co. in Cortland in 2021.

The bank holding company, Farmers National Banc Corp., bought Butler Wick Trust Co. in 2009, which gave Farmers the ability to offer customers the resources of a “really robust, independently run trust company,” Wallace-Soukenik says. It currently manages $3.5 billion in assets.

Farmers’ most recent acquisition, Farmers National Bank of Emlenton, Pa., gave it a 19-branch foothold in Pennsylvania.

Looking Ahead

Some of the biggest changes in banking over the past 40 years have been due to advances in technology. “I don’t care if you are 8 years old or 80 years old, everybody is using technology,” PNC’s Schmidt says.

ATMs were introduced in 1969, he notes.

On a timeline, online bill pay was introduced in the 1990s, and mobile banking in 1999, he says.

Remote deposit allowed employees to deposit from their desks in 2003, while mobile deposit began in 2011.

By 2017, people were able to transfer money to their friends through their phones on apps like Zelle.

On the corporate side, treasury management platforms also continue to evolve.

“Our clients now can integrate all of their payables and receivables into one platform, send a file to the bank and we will pay all the vendors, whether it is through a check, a card, a wire or ACH [automated clearing house],” Schmidt says.

Given its medium size, Premier is not inventing the newest bank tech, but Small says expanding capabilities and investing in technology is just as important as it is for large national banks.

While it may not be first in line as well for the newest gadget or change, Farmers has implemented a lab branch in Canfield, which serves as a tech incubator. Wallace-Soukenik says this allows the bank to see how customers react to new technology before it launches a full rollout.

Still, the bankers agree, there will always be those who want the human connection in their banking.

“Meeting face-to-face can’t be replaced with any type of technology and it is a key to having really long-lasting trust relationships with your clients or prospects,” Schmidt says.

Banks try to find the balance between how many branches make sense and how many customers can be served mostly through mobile apps.

From 2000 through 2012, the number of branches grew to nearly 83,000, according to the FDIC, before dropping off to 69,900 in 2022. In 2023, the number increased for the first time in a decade to 69,996.

All local banks continue to evaluate whether each branch is necessary.

For instance, Huntington closed a branch in Cornersburg in January and Premier closed a branch in East Liverpool in June.

The need for the Mahoning Valley to have a strong banking presence is apparent.

Small says community banks like Premier have many “Youngstown-centric” people in the top positions and give back to the community through board leadership, donations and volunteer hours.

Additionally, banks support community projects by providing seed commitment when local projects seek bigger amounts of money from Columbus or federal dollars, he says.

Small says he likes the partnerships that have been formed in the Mahoning Valley, including the growth goals of the Youngstown/Warren Regional Chamber, the Western Reserve Port Authority and others.

“There are a lot of right-minded folks who are thinking strategically and are bringing private, quasi-public and governmental entities together to think about long-term strategic horizons for the Mahoning Valley and what it needs,” Small says.

Pictured at top: Downtown Youngstown would not look the same without the iconic Premier Bank tower on West Federal Street.

Copyright 2024 The Business Journal, Youngstown, Ohio.