Brown Pushes for Tax Exemption for East Palestine Residents

EAST PALESTINE, Ohio – As Tax Day approaches, residents in the East Palestine area continue to question whether they must pay taxes on the money they received as reimbursement and disaster relief from Norfolk Southern after the Feb. 3, 2023, train derailment.

State Rep. Monica Robb-Blasdel of Columbiana, R-79th, and the East Palestine Village Council pushed through legislation to exempt residents from paying state and local taxes on the money. But at the federal level, similar legislation stalled.

In a letter, U.S. Sen. Sherrod Brown, D-Ohio, called on the secretary of the Treasury and the IRS commissioner to declare the train derailment a catastrophic event, which would exempt those receiving reimbursements from paying taxes on those payments. Many residents in the village received $1,000 inconvenience checks, as well as reimbursement for damages such as lost wages, hotel stays and meal costs while displaced.

“I request that you make an immediate determination that this event was of a catastrophic nature and take steps to inform impacted taxpayers that Norfolk Southern’s payments are not taxable,” Brown wrote in the letter.

“It is unacceptable for these residents to have to pay tax for any reimbursements that simply helped make them whole after the derailment,” Brown wrote.

The full letter can be viewed below.

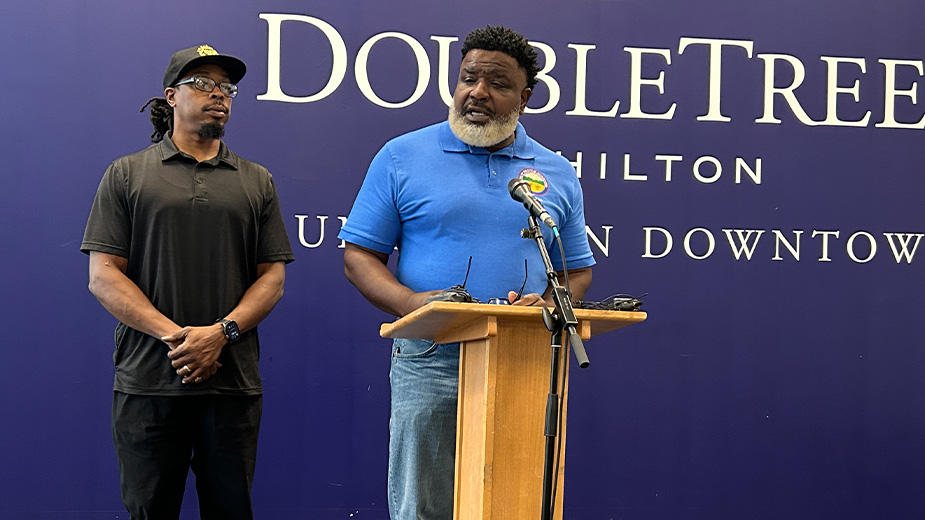

Pictured at top: U.S. Sen. Sherrod Brown speaks at the 1820 House Candles shop in downtown East Palestine on March 11.

Published by The Business Journal, Youngstown, Ohio.