Chill Can Developer Misses Payment Deadline

YOUNGSTOWN, Ohio – The land and buildings for the proposed Chill Can manufacturing and research campus will now go to sheriff’s sale.

M.J. Joseph Development Corp., which broke ground in November 2016 on a proposed research and manufacturing campus for its self-chilling beverage can technology, missed a Monday deadline to make good on previous court judgments requiring it to pay more than $1.8 million plus interest to the city of Youngstown and MS Consultants Inc. and pay delinquent taxes to Mahoning County.

Mahoning County Common Pleas Court Judge John Durkin ruled Thursday on behalf of the city and MS Consultants on a joint motion requesting foreclosure on property at the site of the stalled project and to place the assets up for sale. The judgment entry granting summary judgment to the city, county and MS was filed the same day.

“I didn’t get the money. There’s no money,” said Lou D’Apolito, Youngstown deputy law director. “The [Mahoning County] Sheriff’s Department will take it from there.” With the judgment entry signed and filed, the city end of it is done, he added.

Judge Maureen Sweeney last year ordered Irvine, Calif.-based Joseph Development to pay the city $1.5 million for breach of contract. The court subsequently ruled that the company also owes the city another $733,480.80 in sanctions.

The same court last year awarded MS Consultants $322,907.54 plus 18% interest in damages against M.J. Joseph Development for work that MS was never paid for – but completed – at the project site.

The city’s claim relative to the foreclosure complaint includes the $1.5 million lien, plus another $394.35. It does not include the additional money awarded through sanctions.

According to court papers, the city and MS Consultants claim they have valid liens on the property, which consists of approximately 22 acres and three empty buildings at the site.

The judgment entry calls for the following payments:

- $2,150 for the preliminary judicial report to MS Consultants and $500 to the city for the final judicial report.

- Payments to the Mahoning County Treasurer for delinquent taxes, assessments, interest and penalties payable on the property.

- $1.5 million to the city plus 3% interest from Nov. 21, 2022, plus $394.35 in court costs.

- $322,907.54 plus 18% annual interest to MS from Oct. 5, 2018, and $278.47 in court costs.

The balance of sale proceeds, if any, would be held by the county sheriff pending further order of the court to be disbursed according to further order to any other lien holder or interested parties.

D’Apolito said he expected the foreclosure process to begin Tuesday or Wednesday and the sheriff’s department to start an appraisal soon of the site, part of which still belongs to the city. He did not know how long the process would take because of the size of the project and public scrutiny.

“I’m sure they want to do it right,” he said.

He was not surprised that the company did not reach out to the city, he acknowledged.

“I would assume that if they had some interest in being genuine about resolving this, even after the judgment had been granted, they would have contacted me. I’ve been contacted by no one,” he said. “They have no counsel that I’m aware of, and [company CEO Mitchell] Joseph, nor anyone from his entity has contacted the city, so I was surprised that nothing was done.”

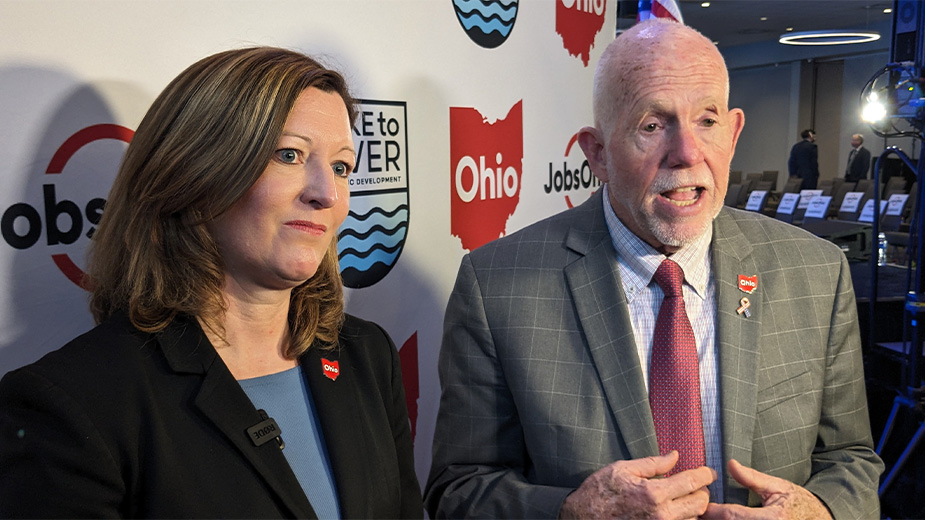

Pictured at top: The vacant Chill Can site in Youngstown.

Copyright 2024 The Business Journal, Youngstown, Ohio.