City Tax Incentive Council Ups Monitoring Schedule

YOUNGSTOWN, Ohio – The city’s Tax Incentive Review Council this morning agreed to hold quarterly meetings in order to better monitor how well companies that receive tax abatements are complying with hiring and investment targets.

Under the new structure, the council will meet in January, April, July and October instead of once annually, said Jonathan Bentley, executive director of the city’s Human Relations Commission.

“The initial quarterly meeting in January would be informational in nature,” Bentley said. Those companies identified as falling short of meeting their hiring goals would be invited to a discussion on what barriers they face, the resources they need and how the city could help them.

Bentley said it’s important that these companies are aware of resources that could help boost the hiring numbers of city residents and within the minority community – including partnerships with area trade schools, Youngstown City Schools, community groups and churches.

The council would follow up during the second quarter with those companies and assess whether they’ve used those resources, Bentley said. A third quarter meeting would review preliminary hiring numbers and patterns in preparation for the final scheduled meeting of the year.

“Going into the fourth quarter, when we have our annual meeting, we can make a sound decision at that meeting whether or not to continue or rescind any abatements,” Bentley said.

First Ward Councilman Julius Oliver said that enterprise zone agreements should be rescinded for those companies that aren’t making effort to hire city residents.

“The focus is the city,” he remarked. “Companies need to understand that you can also get great talent from in the city and that needs to be driven into the conversation when these negotiations are happening.”

Those companies that show no effort in hiring city residents should lose their tax abatements, Oliver said.

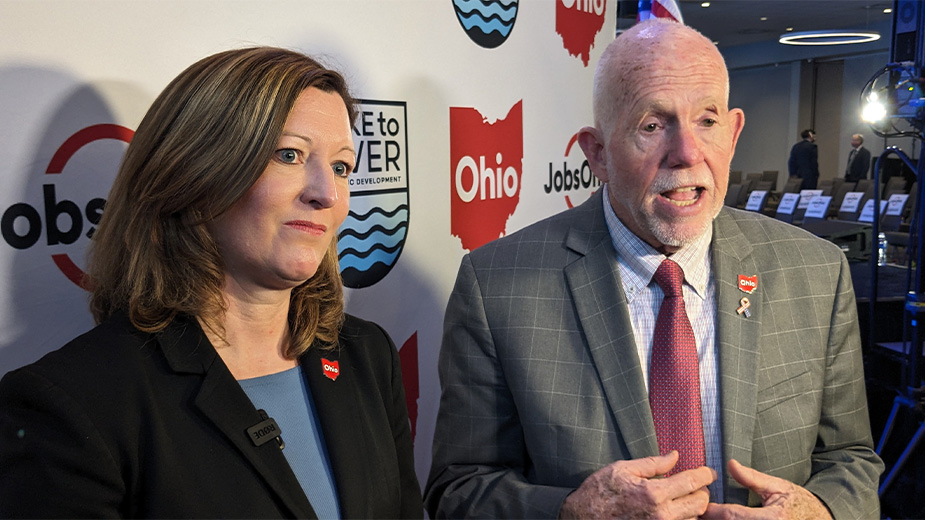

However, T. Sharon Woodberry, the city’s director of economic and community development, said that under state law the city cannot rescind an abatement based on whether a company has hired or not hired minorities or city residents. The city can justify removing a tax abatement only if that company has failed to hire at a certain level for a consistent number of years, she said.

As it stands, the council meets annually to review whether enterprise zone agreements awarded to companies – which usually come with a 10-year, 75% tax abatement on new construction – should be continued. As part of these development agreements, companies pledge to create a certain number of jobs and invest a certain amount of money in return for tax incentives.

Finance Director David Bozanich pointed out that the program is fundamentally important to attracting jobs and new investment to the city.

“In order to create jobs, we need to create investment,” Bozanich said. Since the program started in the 1980s, companies have invested more than $3 billion in the city. “We need to create an environment to invest money.”

Last week, the council adjourned without taking action on whether to extend or rescind enterprise zone agreements. At Tuesday’s meeting, the council voted to continue all active tax incentives for companies in the program.

Copyright 2024 The Business Journal, Youngstown, Ohio.