DeWine Proposes $5B BWC Dividend to Employers

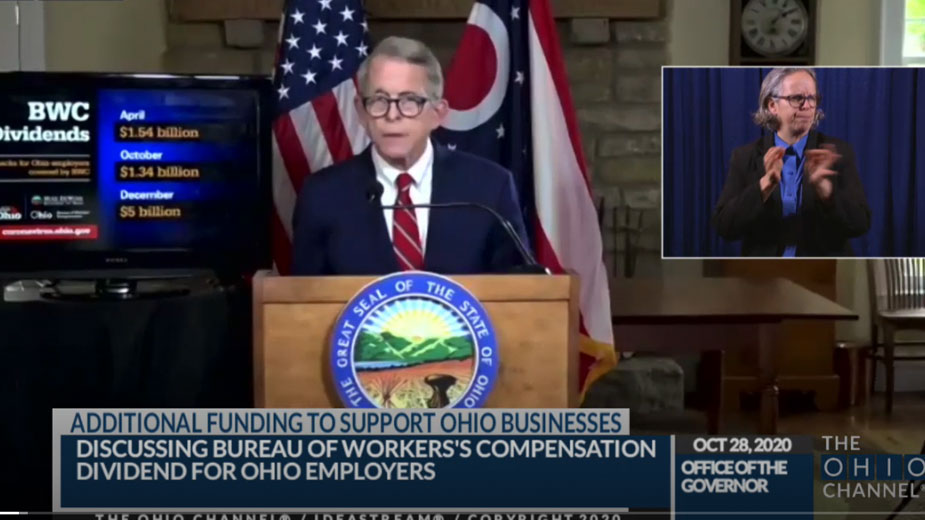

COLUMBUS, Ohio — Gov. Mike DeWine is asking the board of the Ohio Bureau of Workers’ Compensation to approve a $5 billion dividend to Ohio employers covered by the bureau. He made the announcement during a press conference Wednesday.

Since March, BWC has issued two dividends to Ohio employers covered by BWC, including a $1.54 billion dividend in April and a $1.34 billion dividend earlier this month. The $5 billion dividend is nearly four times the total premiums BWC collected from its employer members in policy year 2019.

If approved, would be the third dividend issued this year, bringing the total distribution to nearly $8 billion.

“This is the largest BWC dividend that has ever, ever been issued,” DeWine said. “Our economy is coming back. But many of our businesses, businessmen and women continue to struggle.”

The BWC board is expected to vote virtually on the proposal Nov. 2.

If approved, DeWine said the checks would be distributed in December, ranging from hundreds of dollars “to even millions of dollars for employers covered by the BWC system,” he said. The intent is to help keep businesses open and keep workers employed, he said.

On average, a restaurant could see a check for about $13,000, he noted. The average Ohio farm could see a check for “roughly $9,500,” he added.

Public employers are also eligible to receive funding. For example, the city of Columbus “stands to collect the single largest check at nearly $64 million from this dividend,” he said.

Checks from past dividends are still going out this week. DeWine said those businesses that have received dividend dollars have referred to them as “lifelines.”

The $5 billion dividend would be “a game-changing event, particularly in combination with those other levels of support for many businesses in Ohio,” added Lt. Gov. Jon Husted.

“This is going to be, for some of them, the difference between staying open and closing,” Husted said.

Husted reminded viewers that the dividend isn’t “deficit spending,” rather money that Ohio business owners paid in and was managed by the BWC, he said. And with PPP dollars no longer available and no additional federal stimulus on the horizon, the dividend is being returned to business owners at “a crucial time of need,” he said.

This week, the state approved $419.5 million in virus relief funds, including $162.5 million for businesses.

Despite the pandemic, the bureau remains in a “strong fiscal position,” DeWine said, “thanks largely to healthy investment returns, on employer premiums, a declining number of claims each year and prudent fiscal management.”

In 2019, BWC saw its largest rate decrease in at least 60 years for private employers at 20%, said Stephanie McCloud, administrator/CEO. The rate was again lowered this year by 13%, she said.

“Even with continued falling premium rates and multiple dividends since 2013, our net position and financial stability continued to exceed our expectations,” McCloud said.

BWC was concerned about how the pandemic might impact its investments over the summer, she continued. Since July, the BWC has earned just under a billion dollars in investment income, she said.

“What this tells us is that our modeling and our investment policies are solid,” she said. “So, using this information, we are ready to support businesses to stay open, to reduce layoffs and to Ohioans employed.”

The BWC’s goal is to start getting checks to employers by the second week of December, McCloud said. By getting the dividend to Ohio employers by the end of the year, they can then consult with their tax preparers in January about potential tax consequences, she said. It will also give them time to apply any losses they may have incurred because of COVID-19 against that income.

As far as how much businesses owners can expect to receive, McCloud advised they look back at their most recent true-up amount and multiply it by about 3.72. A true-up is an annual report of actual payroll for the previous policy year, which is used to help calculate a company’s premium.

Adam Sharp, executive vice president of the Ohio Farm Bureau, said the dividend will help Ohio farms remain competitive in an industry that’s seen impact from the pandemic on a global scale.

Sheila Trautner, president and CEO of TASTE Hospitality Gorup, agreed, adding that Ohio’s restaurants and food services businesses “greatly appreciate these BWC dividends,” as well as other efforts, including grants through the federal Cares Act, funding for liquor permit fees and the drinks-to-go program.

Restaurants can use the checks to offset PPP expenses, purchase additional hand sanitizer and cleaning equipment, and keep people employed. The industry employs some 585,000 in the state, she said.

“Restaurants in general, they run on tight margins so every dollar counts,” Trautner said. “Restaurant people are tough. We are tenacious. And we will preserve and do everything in our power to survive 2020 and drive Ohio’s economy.”

When asked about the size of the request, DeWine said the BWC assured him they could do it and that it was fiscally prudent. “We always want to take a conservative approach; always want to take a cautious approach to something like this,” the governor said.

Even with the proposed $5 billion dividend, the BWC is still in a “conservative posture” in regard to management of its funds, added Chan Cochran, chairman of the BWC board of directors. After approval and payment of the dividend, the agency will still hold $6.3 billion in net assets, 1.43 times its actuarial liabilities, “meaning we have money in reserve for even major changes in financial markets,” he said.

Cochran predicted the proposal would be “well received” by the board next week.

“The BWC exists to help Ohio employees who are hurting,” Cochran said. “Because the COVID virus presents unprecedented challenges in Ohio, helping our businesses and their workers is a proper and needed use of these funds.”

Copyright 2024 The Business Journal, Youngstown, Ohio.