Council Committee Recommends Pulling Allied Erecting Abatement

YOUNGSTOWN, Ohio – City Council’s Finance Committee on Monday recommended terminating an enterprise zone agreement for a company that had a history of not living up to its end of the deal.

The company, Allied Consolidated Industries Inc., is now out of business, said Seventh Ward Councilwoman Basia Adamczak, justifying the city removing the tax incentives.

However, company president John Ramun said that the company is still active, although it has significantly scaled back after it filed for bankruptcy in 2016 in the wake of a legal battle with U.S. Steel. Moreover, Ramun said the property was sold in 2019, but Allied is now leasing a part of the building.

“We’re still in business,” he said. “We’re still manufacturing shears.”

Allied has a long history of receiving tax incentives without committing to creating a sufficient number of jobs under the terms of the city’s enterprise zone program.

The company was among several that The Business Journal included as part of its series examining 25 years of enterprise zone deals that the city signed with companies pledging to expand and create new jobs. Under these agreements, companies are generally awarded a 75% tax break in exchange for new investment and a commitment to create jobs.

More than half of those companies failed to create the number of jobs promised and about one-fourth failed to create a single job, The Business Journal found. Still, these companies received millions in tax breaks over the years.

Allied, for example, was first awarded a 10-year, 100% tax abatement in 1994, in which it pledged to invest nearly $4 million into its operations and create 50 jobs. According to city records, the company failed to create a single job after 10 years of receiving tax breaks from the city.

The city negotiated a second enterprise zone agreement with the company in 2006 that would provide tax incentives on new construction ranging from $815,317 to $1,757,288 over the period of 10 years. Construction was delayed and the tax period wasn’t activated until 2011. In return, Allied pledged to create 16 jobs but created none, according to city records. The company filed bankruptcy in 2016.

The finance committee also recommended that City Council expand the community reinvestment area to include every census tract in the city.

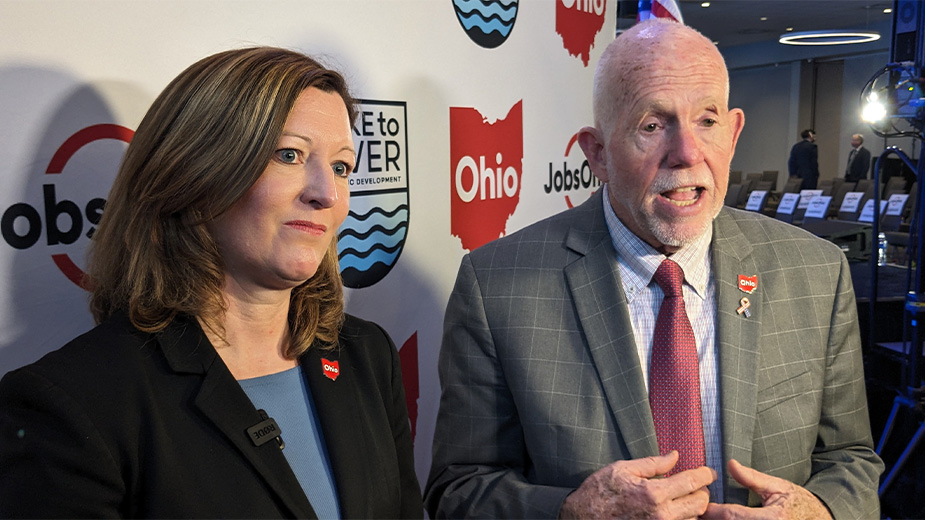

“We’re asking council to make the entire city a CRA,” said Nikki Posterli, director of the city’s department of community planning and economic development. She said there were some pockets on the city’s north and west sides that were not designated as community reinvestment areas.

Expanding the designation to the entire city better aligns neighborhoods with the city’s housing strategy, so everyone in Youngstown could benefit from incentives through the program.

The city’s CRA program awards tax exemptions on remodeling and new construction for homeowners, and provides incentives for new commercial improvements as well.

Copyright 2024 The Business Journal, Youngstown, Ohio.