First National Bank Launches Mobile eStore

PITTSBURGH, Pa. — FNB Corp. the parent company of First National Bank, integrated its eStore shopping tool into the FNB Direct mobile app to upgrade the mobile banking experience for customers, including new features.

The company also expanded its suite of online loan applications, it announces in a press release Tuesday.

“Adding the eStore to our mobile app creates a fully digital bank, where customers can conduct routine transactions, purchase products and services, and schedule time with our bankers virtually,” said Vincent J. Delie Jr., chairman, president and CEO of FNB Corp. and First National Bank. “We combine the latest industry technology with personalized service so that customers can access the tools, information and consultation they need, whether they are in an FNB branch or are using an online or mobile device.”

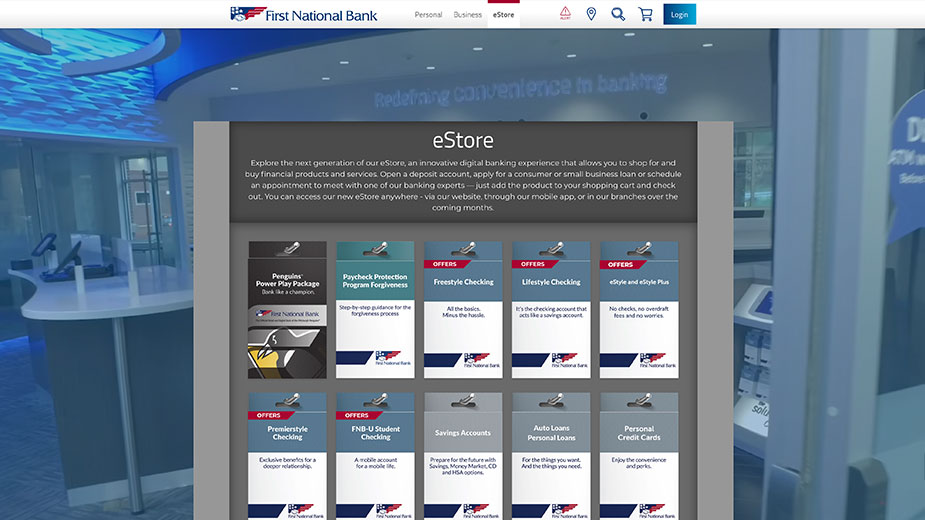

The eStore is accessible on the app and on FNB-Online.com. In 2022, it will also be available at interactive kiosks in First National Bank branches. The eStore allows customers to use digital technology to complete a number of banking activities, including:

- Shopping for financial products and services with product filtering and comparison resources, including the Help Me Decide guided selection tool.

- Opening deposit accounts and applying for consumer and small business loans online or on a mobile device. Customers can use the in-branch kiosk to send product selections to their email and continue their purchase at home or when it is most convenient.

- Scheduling an appointment with an FNB expert. For home mortgage products, customers can even choose an FNB Mortgage representative to work with during the home-buying process.

- Viewing informational videos.

- Accessing FNB’s financial education resources.

In addition to integrating the eStore, the FNB Direct app features a new, modern look, streamlined navigation and direct access to the features customers are most likely to use, such as account balances, Zelle payments, shopping and account opening tools, and FNB contact information.

Other features include the Credit Center, where customers can view their credit score and credit reports, and a customer service chat.

FNB has also expanded its online loan applications to include FNB credit cards, mortgage products, home equity lines of credit, home equity installment loans and asset-based loans for small businesses.

FNB is advancing toward its goal of delivering a simplified, universal application to make it even easier for consumers to access financial solutions, including credit. Since the digital Mortgage experience was launched in May of 2021, 61% of FNB’s mortgage applications have been submitted digitally, with nearly 50% of those submitted outside of normal business hours, demonstrating a significant need for these online services, according to the release.

Published by The Business Journal, Youngstown, Ohio.