First National Bank Updates Apps for Smartphones

PITTSBURGH — Promises to revolutionize a business or activity often come across as marketing hype.

The excitement that First National Bank of Pennsylvania is working to convey about an array of innovative technology services it just introduced, and will roll out this year, support its claims of a sea change coming in how its customers manage their accounts.

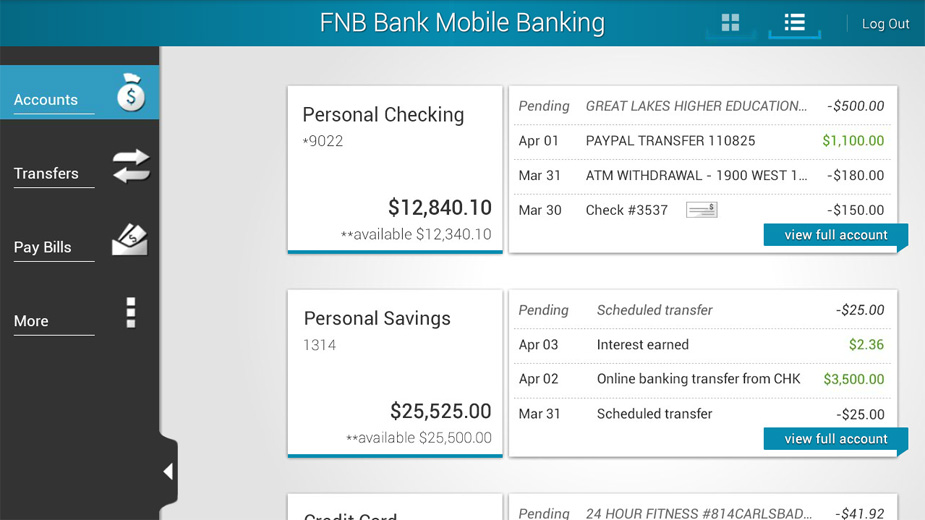

Last month, First National Bank updated its Mobile Banking FNB Direct App that allow its customers with smartphones and tablets, whether consumers or small-business owners, to more easily track and manage their accounts in real time.

“The updated mobile app is more fully integrated with FNB Online Banking and fnb-online.com,” says Sam Kirsch, director of digital channels and payments. “It incorporates the bank’s Help Me Decide tool.”

Use of the updated app allows the customer, without logging in and entering his password, to use his smartphone or tablet to learn his current account balances in real time and then make deposits or payments or transfer funds among his accounts. “It’s a time-saver. It’s an opt-in feature,” Kirsch says.” It also allows customers to set their phones to receive alerts when transactions are performed, say a deposit or payment is made.

The mobile app can be downloaded in both Apple and Android smartphones at no charge.

“The customer determines the level [of information] they want and when they want it,” he elaborates.

This spring, First National Bank will offer a new mobile app for its commercial customers, Kirsch says. The app allow them, when they’re outside their offices, to use their smartphones and tablets to review and approve automated clearinghouse (ACH) transactions.

And late his year, the bank will “roll out additional mobile enhancements related to controls and security,” Kirsch says. Among them: allowing customers to turn their debit cards on and off, set spending limits and restrict the use of credit and debit cards the bank issues based on where the cardholder is traveling.

Once the acquisition of Metro Bancorp Inc., based in Harrisburg, is complete this spring, First National Bank will add 16 ITMs – intelligent teller machines – to its network of 400 ATMs. The ITMs, unlike traditional ATMs, will offer “video chat,” access to a live teller who will appear on a video screen.

Video chat will be available 4 to 9 p.m. weekdays and 9 a.m. to 5 p.m. weekends, Kirsch says.

The ITMs will also offer remote capture, just as smartphone can, and the customer can cash a check down to the penny.

Copyright 2024 The Business Journal, Youngstown, Ohio.