FNB Adds Consumer Deposits to eStore Offerings

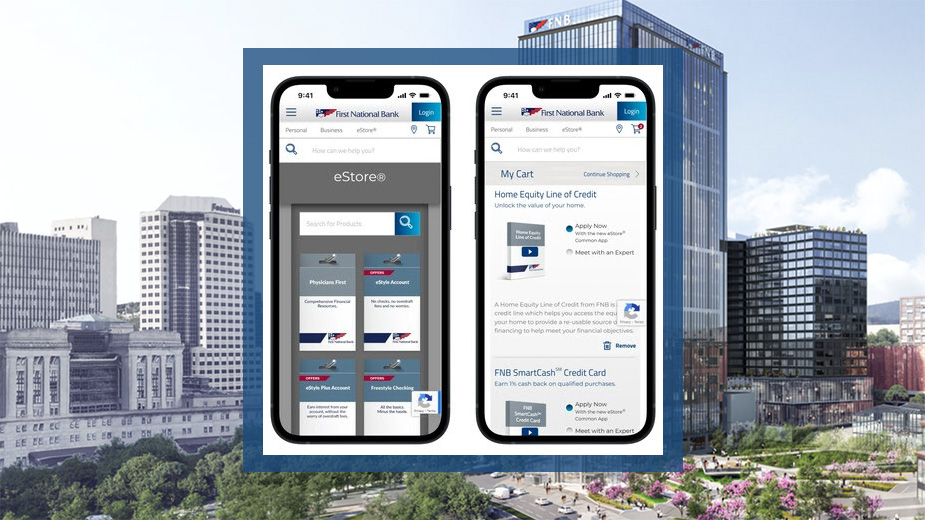

PITTSBURGH, Pa. – F.N.B. Corp. and its banking subsidiary, First National Bank, have launched the latest phase of the F.N.B. eStore Common account application, giving customers a chance to apply for both consumer loan and deposit products with a single application.

The latest development of the company’s Clicks-to-Bricks strategy, the initial phase allowed exclusive application for consumer loans in May 2023. Additional phases will include small business loans and deposit products in 2024.

The common account application can be completed in under seven minutes, according to F.N.B., and saves additional time by allowing consumers to apply for multiple products at once.

“FNB’s ability to scale our online and mobile platforms to quickly introduce new capabilities is a result of our ongoing investments in technology, data science and artificial intelligence,” said Vincent J. Delie Jr., chairman, president and CEO of F.N.B. Corp. and First National Bank. “Our goal is to act as our customer’s primary bank by providing the tools necessary to efficiently and conveniently grow a banking relationship with our company.”

Since launching the common account application in May, F.N.B. reports the number of online consumer loan applications submitted and the total number of consumer loan products applied for online doubled compared with June through December 2022.

Customers can use eStore to select and add products to their shopping cart, and then check out to begin the application. The eStore Common application’s enhanced functionality includes the ability to upload supporting documents as well as automated account funding.

Published by The Business Journal, Youngstown, Ohio.