Huntington Advises Investors to Be Patient

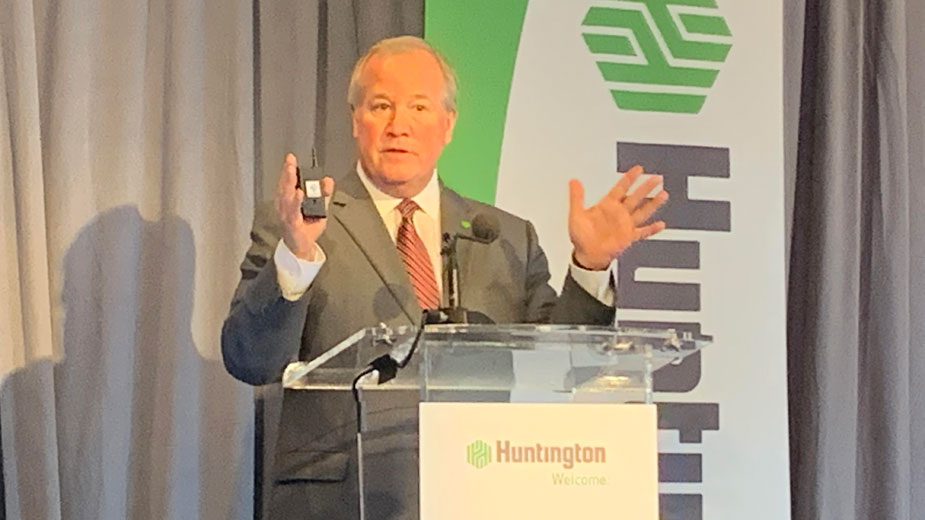

YOUNGSTOWN, Ohio – In a market he describes as a bucking bronco, Huntington Bank’s chief investment officer, John Augustine, told an audience Wednesday that despite a global medical emergency, investors should pause and be patient.

The best comparative is Severe Acute Respiratory Syndrome (SARS), which hit in 2002-2003, when the markets fell two months and then went back up.

“During this period,” Augustine said, “Stocks fell into the 12% to 15% range. As we stand today, the S&P 500 is down about 9% from its recent highs. So, we still could see volatility.”

The investment adviser, who has 30 years’ experience, said his team’s view is that markets will stabilize. “Our suggestion is when the number of U.S. cases [of the coronavirus] peak and start to drop, but everyone is trying to handicap what is that number of U.S. cases going to be. We don’t know,” he said. “The good news is they keep coming in in handfuls.”

Augustine spoke to business and community leaders at the Lake Club during a Huntington Bank Forecast Lunch. From the coronavirus disease (Covid-19) to federal government policies and regional trends, the nationally recognized investment expert outlined the issues and impact on markets.

He explained that markets are recovering in reverse, and will have a positive effect when U.S. cases peak and then drop, according to what was learned from the history of SARS.

“But markets bottomed well before officially, according to the CDC [Centers for Disease Control and Prevention], the SARS threat ended. Because the markets saw that the number of new cases was starting to move lower. We suspect that’s the same here.”

Offering a snapshot of where markets stood Wednesday, Augustine said asset groups such as gold, oil, copper and bonds are converging.

“Markets are going to stabilize in our view, but they’re going to be susceptible every night to the news flow around coronavirus,” he cautioned.

“This is not a bull or bear market, but rather a bucking bronco market. And what do you do when the bronco is bucking? You wait until it stops before you get in the ring.”

Augustine began his overview with current events and what might lie ahead.

“What we’re trying to do is connect economy, business and markets. And now we have health care in the middle of it,” he said. “We’re not health-care experts, but we’re going to give you our best judgments.”

Augustine said his investment team is predicting a V-shaped recovery sometime in the second quarter.

Coming into the 2020, the Huntington Bank investment team was predicting a slow kickoff in a rebuilding economy that would slowly pick up in the second half of the year mainly because of Boeing and getting supply chains moving as trade wars end.

But first, Augustine said, investors are going through a pause that likely will affect the second quarter more than the first quarter.

He sees decent economic numbers coming out from February. The rapidly evolving situation with the respiratory disease caused by a coronavirus — first detected in China and now in almost 70 counties — can deliver shifts in volatile global markets in the span of hours.

The global gross domestic product is $86 trillion. The U.S. GDP is nearly 24% of that and China’s is 15.2%.

“What markets are trying to balance is what happens when 15% of the global economy gets shut down for a month. That’s basically what happened in China in February,” Augustine said, pointing out car sales were down 80% in China for February, but are rebounding.

China provides many of the components of the supply chain that comes into this country.

“What happens when you have 55% of the global economy offline for anywhere from two weeks to a month, and it’s a rolling time period?” he asked rhetorically. “ That’s why we’re seeing this volatility in markets. It’s trying to balance with these asset changes and values, stocks, bonds and commodities. It’s trying to balance that with how fast we’re going to see recovery out of the coronavirus.”

Observations playing out in the markets is that the dynamics are changing in China and South Korea with new cases being reported, triggering an uptick in markets, which quickly turned with Italy’s announcement that it was shutting down for two weeks to contain the virus. California also announced it is taking emergency health measures, and both the European and U.S. markets fell by 2% overnight.

The market slides began Jan. 24, Augustine said, with the steep fall of commodities because China is the biggest buyer, and emerging market stocks. But those two markets are now actually higher.

Augustine pointed out that China’s stock market was higher overnight and actually for the past week. “Why?” Augustine asked. “Because they’re on the other side of this.”

More people are coming out of the hospital than entering, Augustine said, qualifying that statement, according to official numbers.

The general view for markets in the United States is that they will start to calm down once the. number of cases in the country comes down. “And we don’t even know the peak of U.S. cases yet because they’re just getting the test kits out,” he said.

Augustine cautioned that if the economy were going to take a bigger hit than what’s projected, it would be indicated through unemployment claims.

“We know people are unfortunately going to laid off in the airline/tourism industry,” he said, pointing out that as of Wednesday 216,000 people had been laid off.

He said the Huntington economic team will be watching to see if this is just spiking, or if it is rising week to week.

Federal policy changes have had favorable outcomes after the coronavirus. The first was fiscal policy when the Fed cut. The markets jump when the Fed rate is cut, which he said was the right thing to do.

When the Fed Open Markets Committee meets again in March, prime interest rate cuts will be back on the table, because the Fed has to keep the cost of money below the two-year yield. The rate probably will go down another 50 points, he said.

Regionally, Augustine said Huntington’s experts watch the Great Lakes region where many parts are produced for manufacturing. Exports, which are substantial, also are on the radar as well as trucks and farming.

“Since the trade war, what we’ve noticed is that all four are going sideways,” he said.

Locally, economic output is up, employment is down “and we need to tackle that.“

Housing prices are above where they were in 2017.

“Our employment rate is down and we know we have to get that in conjunction with employment up,” he said.

Wages need to rise as well as well as the number of people joining the workforce. “Hopefully we see a turn in that with programs being put into place this year,” he said.

This area has a high quality of life and low cost of living, which should spur job growth in the region. Business valuations were up by 30%, mainly because the Fed doesn’t want a recession and supports expansion. That number probably won’t rise this year, he said.

Pictured at top: John Augustine, Huntington Bank chief investment officer.

Copyright 2024 The Business Journal, Youngstown, Ohio.