Huntington, Home Savings Settle Suit Over Records

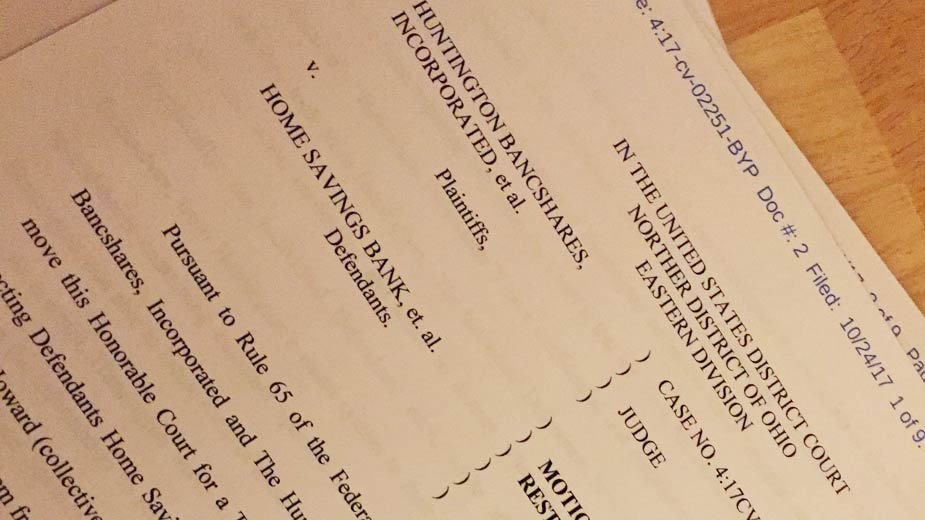

YOUNGSTOWN, Ohio – Huntington National Bank and Home Savings Bank have settled Huntington’s lawsuit that claimed three of its former commercial lenders took “confidential information, proprietary information or trade secrets” with them when they were hired by Home Savings in September.

U.S. Judge Benita Y. Pearson signed the dismissal order Dec. 20. “The parties have informed the court that they have settled the case. Therefore, the docket shall be marked ‘settled and dismissed without prejudice,’ ” she wrote.

Pearson ordered attorneys for the banks to submit by Jan. 19 a proposed and executed stipulation of dismissal for her review.

The lawsuit was filed Nov. 8. The three former Huntington employees are Joshua Toot, now senior vice president of commercial banking for Home Savings Bank; and Kevin Dougherty and David Howard, Home Savings vice presidents and commercial relationship managers.

In a statement released after the lawsuit was filed, a spokeswoman for Home Savings said her bank “is committed to complying with the law and any contractual obligations its employees may have to former employers and disputes that it engaged in any unfair competition against Huntington.”

Huntington’s complaint initially sought a temporary restraining order. Following a conference with attorneys Oct. 25, Pearson ordered the banks to “hire, at their cost, a third-party vendor to review all computers and/or electronic devices” the three bankers used “from April 14 until Oct. 25 to determine what, if any, Huntington information is contained in their computers and that the review will be completed by Nov. 8.”

Should the third party determine that Toot, Dougherty or Howard has such information in their computers, “it will be provided to Huntington and destroyed by the third-party vendor,” the order stated.

Home Savings subsequently asked for more time to complete the review, and was given until Dec. 15, then sought an extension until Jan. 4, which the judge denied. “Instead, the cut-off date to respond is extended to Dec. 22,” Pearson ordered.

The banks agreed that all documents produced in the course of discovery for the lawsuit would remain confidential and not open to public inspection. The terms of the settlement also are expected to be sealed.

Copyright 2024 The Business Journal, Youngstown, Ohio.