Huntington: Lordstown Projects Could Bolster Valley’s Labor Force

YOUNGSTOWN, Ohio – The completion of several big development projects in the near future could address one of the Mahoning Valley’s biggest challenges in a broader economic recovery: the size of the labor force.

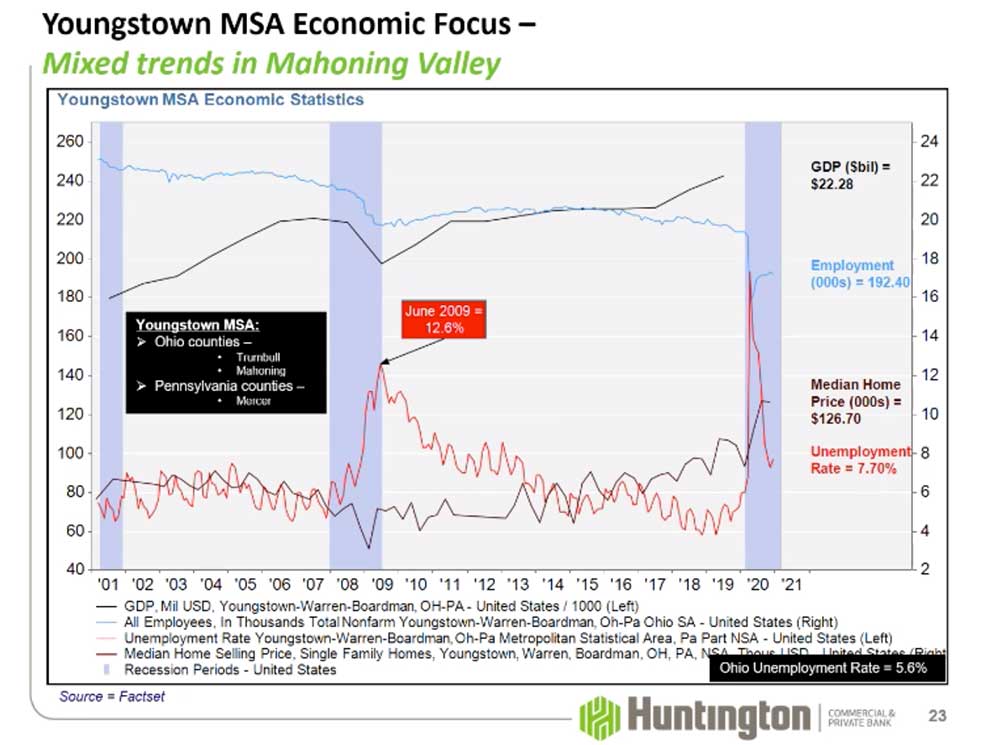

By some measures, the Youngstown-Warren-Boardman metropolitan statistical area – Trumbull and Mahoning counties, along with Mercer County, Pa. – has recovered from the pandemic, says John Augustine, Huntington Bank’s chief investment officer. The area’s GDP rose annually for a decade through 2019, the most recent year with data available, ending that period at $22.28 billion.The median home price is at a record level, $126,700. Unemployment, while still high at 7.7%, had started to drop sharply back toward its prepandemic mark.

But the big concern, Augustine said Wednesday at Huntington’s virtual economic outlook and market overview event, is that employment in the three-county area dropped to 192,000, about 20,000 people fewer than before the pandemic. Zooming out on that trend, the MSA’s employment was above 250,000 in 2000. Among Ohio’s six midsize cities – Akron, Canton, Dayton, Lima, Toledo and Youngstown – only Akron has seen its labor force increase since the start of the millennium.

“It’s the opposite of what’s happening in Pennsylvania. There, most of their midsize cities are growing. In Ohio, we’re not. Hopefully on the other side of this, we all get a lift. With all these projects coming together, is employment going to move higher?” Augustine said. “You can see where we’re getting back to before the pandemic, but we really have to work to get back to where it was in 2000. Hopefully these projects get us there.”

Topping the list of those projects are Lordstown Motors Corp.’s assembly plant slated to start production this fall and the Ultium Cells battery plant, which is expected to start full production by the end of 2022. Lordstown Motors CEO Steve Burns has said his company plans on starting production with about 800 employees, while officials for Ultium have put that plant’s number around 1,100.

Meanwhile, Macy’s is going to expand its North Jackson distribution center and will add 417 jobs there and nearby TJX Companies’ distribution center in Lordstown will have more than 1,000 once it’s operating at full capacity.

“With these projects coming at us, we need people. When that labor force goes down, that means a smaller pond for employees and, for many of us, a smaller pond for customers. We need a catalyst to tell people about our quality of life, low cost of living and the transportation hub,” Augustine said. “We were seeing a good growth in wages, even with trouble around major closures, but we’re building our way back. What we need is people for employment and as customers.”

The success of projects like Lordstown Motors and Ultium are likely to be driven by other changes in a post-pandemic world, he continued, such as policy and regulation discussions dominated by climate change and the shift away from crude oil as the “electron era” gains traction.

“Some of the projects that are affecting this region in a very positive way are coming out of climate change. It’s a theme of this administration and it’s a theme globally. It’s going to be permanent on the other side of [the pandemic],” he said. “And we’re accelerating our case as a country to move from a hydrocarbon-based economy to more of an electron-based economy. This pandemic likely accelerated that and it’ll be permanent.”

Other changes Augustine and his team at Huntington foresee are changes in how people work – more automation in blue-collar jobs and more mobility and remote work for office jobs – and a monetary policy that’s expansive in the mid-term while fiscal policy focuses more on the short-term.

Over the past year, federal spending rose from $5 trillion to $9 trillion as a result of virus-related aid, before ending the year around $6 trillion. The $1.9 trillion American Recovery Act, passed Wednesday shortly after Augustine’s presentation, will tack on more to that, while federal receipts are only around $3.6 trillion. Such spikes, he added, were a global practice as central banks sought to offset the impact of the pandemic.

“This is a debt-financed, stimulus-driven economy this year. The administration is also thinking about another stimulus plan this summer around infrastructure,” Augustine said. “In our view, the debate is going to come over how you get spending back down without impacting lots of people and the economy.”

The Fed has indicated that it plans on keeping interest rates low for the next year or so to ensure the recovery continues. What made the 2020 recession unlike any other is the fact that it was led by the service industry, rather than the goods sector like the housing market in 2008 or the spike in oil prices in 1981.

“It hit a lot of people who weren’t ready for it. Airlines and hotels have never had a recession. …This recession encompassed a whole new group of companies and employees, many of whom were lower wage that didn’t have a month’s worth of savings to get through the lockdown,” he said. “Services is probably about 65% recovered. The question this year is if the vaccine brings enough confidence to return us the rest of the way.”

By contrast, the goods sector was back to prepandemic levels within two months, compared to the three years it took following the Great Recession.

“Why? Because we kept buying houses, cars and we kept delivery trucks coming up and down our streets. It’s already up and it’s probably going to keep going up this spring,” he said.

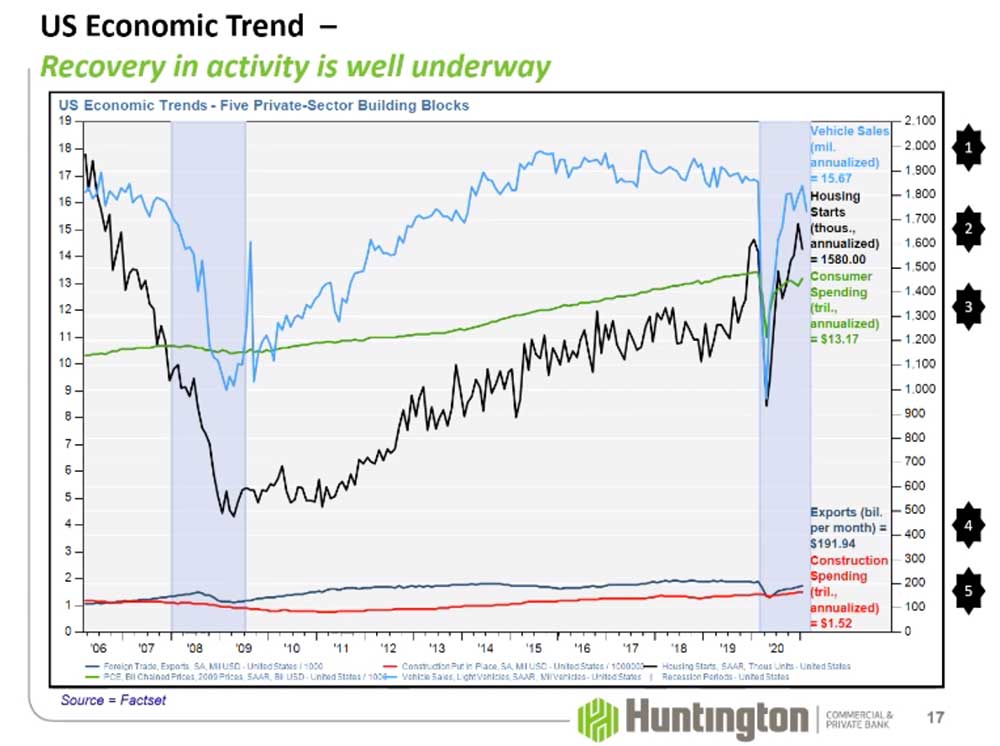

What’s most encouraging, from Augustine’s perspective, is the fact that we’re already out of the recession that started at the onset of the pandemic. Looking at the five “building blocks” the Huntington team uses for its forecasts, three sectors saw “impressive” V-shaped recoveries last year, while two – exports and construction – improved slowly.

In addition to consumer spending in the goods sector, “car sales recovered back to the 16 million annualized pace. They rolled back a bit in February, but that’s likely because of the deep freeze two-thirds of the country went through,” he said. “Housing starts are at a record. Building permits are at a record.”

With all of that combined, Augustine has a clear expectation for 2021: “A year ago, we were just coming into the ‘Great Lockdown.’ Our view now is this is going to be the year of the ‘Great Recovery.’”

Copyright 2024 The Business Journal, Youngstown, Ohio.