Legal Strategies: Will Drilling Come Back?

By Molly Johnson

Johnson & Johnson Law Firm

YOUNGSTOWN, Ohio – I am constantly asked, “Will the oil and gas shale boom ever come back to Mahoning County?” Alas, it depends on a number of tricky factors.

As with any business, oil and gas drillers look for maximum profit. Just as a farmer wants to plant the most profitable crop, oil and gas companies evaluate drilling opportunities in terms of the bottom line. So, the first thing a driller considers is the price of hydrocarbons. When the value of oil is high, operators will drill in “oily” areas. When natural gas trades up, they will move into dry gas territory.

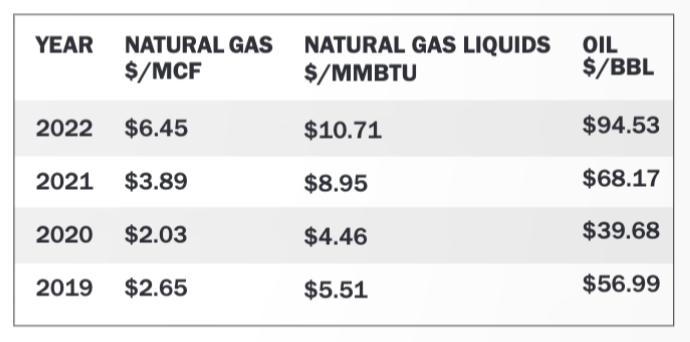

The chart below illustrates the last four years of commodities pricing pursuant to New York Mercantile Exchange and WTI [Western Texas Intermediate] historical records. The natural gas liquid composite price is derived from Bloomberg’s daily spot price.

Wells that came online with lots of oil in 2022 were a driller’s dream. However, hydrocarbon prices are notoriously volatile. No one, not even top executives in the oil and gas industry, can perfectly predict future commodities prices.

Last summer because of the war in Ukraine, natural gas prices were in the $9 range. Because of the warm winter in the United States and Europe, natural gas prices have recently sunk to $2.60.

Second, drillers also look for areas with built-in infrastructure in the form of pipelines and roads sturdy enough to support heavy drilling rigs. Back in 2010, there were few large pipes in eastern Ohio.

Over the last 12 years, however, thousands of miles of pipelines have been installed in our state. Now big collection lines crisscross Harrison, Jefferson, Carroll, Belmont, Noble and Monroe counties, moving gas from wells to treatment plants and then on into larger interstate pipes.

These huge lines have been laid in both directions across the state: from central eastern Ohio up through Toledo and on to Canada, and down through Cincinnati and into the Gulf of Mexico.

A number of treatment plants have been built in eastern Ohio to remove natural gas liquids, such as ethane, from the gas stream. An enormous Shell ethane cracker plant has been built along the Ohio River near Monaca, Pa. Having the plant handy greatly improves the economics of Ohio shale drilling.

Back in 2012, most Utica Shale drillers considered Mahoning County and most of Columbiana County to be in the “wet gas window,” believing that Utica Shale wells drilled here would produce a lot of natural gas liquids. Early wells include Halcon’s Davidson (North Jackson) and Grenamyer (North Jackson) wells; and CNX’s Cadle (North Jackson) and Hendricks (Ellsworth) wells, among others. At the time of publication, all wells were still producing, but not in the massive quantities that wells further south have produced.

The Grenamyer Well, for example, has produced 26,302 barrels of oil and 824,357 MCFs of natural gas since it was drilled nine years ago. Compare that to Encino’s 2020 Williams Well in Carroll County. In only three years it has produced 138,386 barrels of oil and 1,794,993 MCFs of gas.

Perhaps the comparison isn’t fair, though, because drilling technology has progressed substantially in the years between 2014 and 2020. This has caused companies to take a fresh look at areas that did not look promising in the early years of the shale play. In Columbiana County, Hilcorp continues to drill in Fairfield, Unity and Elk Run townships, while Encino has started to lease in the western townships.

Importantly, one of Ohio’s biggest Utica Shale drillers, EOG Resources, through its subsidiary, R&S Operating LLC, has quietly acquired over 395,000 acres of leases on the western, oily side of the play, including rights in Mahoning County. The acquisition involved deep rights under old Clinton sandstone leases.

So, back to the question posed. Will drilling come back to Mahoning County?

The good news is the region now has decent infrastructure in terms of pipeline systems, treatment plants and an ethane cracker plant. Also, the price of oil has rebounded since its crash in 2020 and a cold winter will boost that of natural gas. Most significantly, drilling technology has hugely improved.

EOG’s recent acquisition of Mahoning County deep lease rights is also promising. (Of course, EOG won’t be in any hurry to drill these leases because the leases are not in danger of expiring due to the shallow well production which keeps them in effect.)

The bottom line is that the oil and gas beneath our feet is still there. The question, therefore, isn’t “if,” it’s “when.”

Pictured at top: The Shell Polymers Monaca plant sits on 800 acres along the Ohio River.

Copyright 2024 The Business Journal, Youngstown, Ohio.