Mahoning Valley PPP Impact: $789M in Loans, 91K Jobs Protected

YOUNGSTOWN, Ohio – From iconic Mahoning Valley businesses to one-person endeavors, Paycheck Protection Program loans reached just about every company in the area.

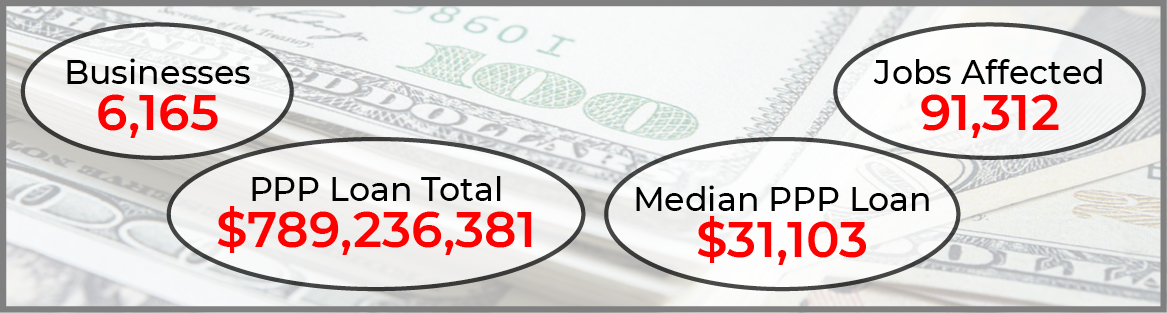

In total, 6,165 businesses in Mahoning, Trumbull and Columbiana counties received loans from the program, according to data from the Small Business Administration released Wednesday.

Loans in the three counties totaled $789,236,381 and affected 91,312 jobs.

The median loan was $31,103, though the value of loans awarded ran the gamut. Two businesses received the maximum amount of $10 million and 22 businesses got loans under $1,000.

The smallest amount awarded was $100 to Richard S. Miller, while AVI Foodsystems and Schwebel Baking Co. each received $10 million loans. In addition, two Schwebel sister companies also received funds: Schwebel Baking Co. of PA got $1,767,000 and Schwebel Baking Co. of NY got $542,200.

In the wide gulf between the companies are nearly every business in the area. Rounding out the top 10 after AVI and Schwebel are:

- Empowering People Management of Warren, $8,467,300.

- Simon Roofing and Sheet Metal Corp. of Boardman, $8,389,600.

- CAD Capital LLC of Warren, $7,05,422.

- Dalcan LLC of Warren, $6,499,730.

- Cadle LLC of Warren, $6,305,660.

- HBK Professional LLC of Canfield, $6,102,700.

- Butech Bliss of Salem, $5,089,800.

- Covelli Family Limited Partnership II of Warren, $5,079,675.

CAD Capital, Dalcan, Cadle and Covelli Family Limited Partnership are all listed with the same address as the headquarters of Covelli Enterprises, as are 14 other entities. On filing documents, 15 of the entities list people who were leaders at Covelli businesses at the time of their filing as agents. The exceptions are FK Sodo LLC and FK Lake Mary LLC, FK Waterford LLC, which the Ohio Secretary of State does not have on file. Combined, the 17 Covelli companies received $43,389,740.

SEE A FULL LIST OF LOCAL PPP LOANS HERE

Under PPP guidelines, restaurant franchisees were allowed to count each restaurant location as an individual entity, ensuring that large franchisees were able to access funds needed to stay open. None of the Covelli-related companies approached the threshold of $10 million, though eight reported the maximum threshold of 500 employees.

The Youngstown Publishing Co., which operates The Business Journal and After Hours Youngstown, received $137,000 and retained all 19 employees.

With the data also including dates PPP loans were approved, it’s easy to see the chaos of the program’s early days. Early on, when uncertainty over the pandemic and its effects were perhaps at their peak, it was a mad scramble by businesses and their advisors to get applications in.

Locally, just six PPP loans were accepted on the first day applications could be submitted – April 3.

That number continued to rise exponentially: 20 on April 4, 41 on April 5, 101 on April 6 and 188 on April 7. The daily total continued rising the remainder of that week, before dipping slightly the weekend of April 11 and 12, only to continue rising on Monday.

The peak came on April 16, when 509 applications were submitted. That was the final day before funding for the first phase of the Paycheck Protection Program ran out, with $349 billion in loans were approved nationwide.

In the tri-county area, first-round lending totaled $577,927,180.89 to 2,541 businesses.

The second phase of the PPP never exhausted its allotment before applications closed Aug. 8. In August, $3,137,101.62 was lent to 96 area companies, including six on the final day.

A full list of every business in the three-county area receiving PPP funds can be read HERE. All information on the list and in this story comes directly from the Small Business Administration.

PPP loans can be fully forgiven if the business maintains its prepandemic employment after an eight- or 24-week period. According to the SBA, there have been roughly 595,000 forgiveness applications submitted nationwide, with more than 367,000 approvals for either full or partial forgiveness. Lenders have 60 days to review applications before sending them on to the SBA, which in turn has 90 days to approve or deny forgiveness.

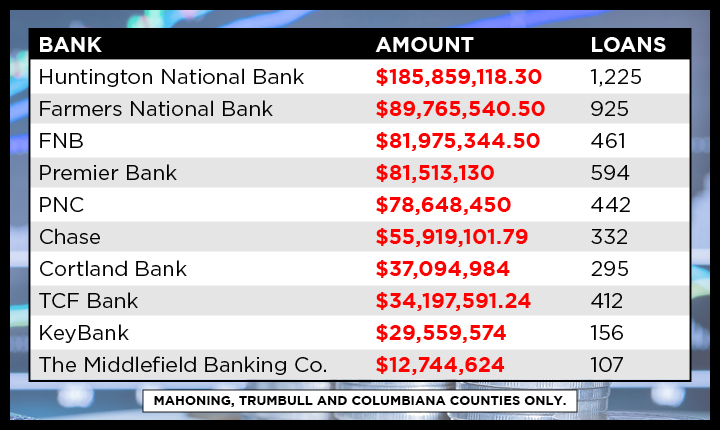

In total, 155 banks processed Paycheck Protection loans for local businesses, from area standards to credit unions in other states to financial apps such as Kabbage. The majority, however, went through the first on that list.

Huntington National Bank led lending across Mahoning, Trumbull and Columbiana counties with $185,859,118.27 lent to 1,225 businesses. Following was Farmers National Bank with $89,765,540.50 lent to 925 businesses.

Result for other banks with a local presence include:

- FNB: $81,975,344.50 to 461 businesses.

- Premier Bank: $81,513,130 to 594 businesses.

- PNC: $78,648,450 to 442 businesses.

- JPMorgan Chase: $55,919,101.79 to 332 businesses.

- Cortland Bank: $37,094,984 to 295 businesses.

- TCF Bank: $34,197,591.24 to 412 businesses.

- KeyBank: $29,559,574.97 to 156 businesses.

- The Middlefield Banking Co.: $12,744,624.62 to 107 businesses.

For smaller businesses, three options stood out with median loan size well below the overall mark: fintech app Kabbage, Utah-based Celtic Bank Corp. and Valley Economic Development Partners.

According to SBA data, Kabbage processed loans for 154 area businesses totaling $5,913,129 – a median size of $9,808 – while Celtic Bank handled 126 businesses for $2,293,086.84, a median of $5,748.77.

And Valley Economic Development Partners – listed on SBA data as Mahoning Valley Economic Development Corp., as its name change took place after the Paycheck Protection Program closed – processed 71 loans totaling $1,431,768, for a median of $8,896.

In September, Terry Louk, the agency’s director of SBA lending, told The Business Journal the coronavirus pandemic and subsequent PPP loans “brought us back to our roots.

“We were born out of an economic crisis and this has brought us right back in,” he said. “We’ve been able to focus on what we were truly created to do.”

Copyright 2024 The Business Journal, Youngstown, Ohio.