Lordstown Council OKs Tax Breaks for TJX Project

LORDSTOWN, Ohio – Lordstown Village Council gave final approval Wednesday night to a tax abatement for TJX Companies Inc.’s 1.2-million-square-foot regional distribution center here.

The ordinance, which passed on a 4-1-1 vote, with Councilman Ronald Radtka abstaining, authorizes the village to provide a 75% tax abatement on the increased value of the Lordstown site should the warehouse – estimated at between $140 million and $170 million – be built there.

The warehouse would service TJX’s HomeGoods division and create 1,000 full-time jobs by Dec. 31, 2024, according to the abatement agreement.

The legislation is one of three items council members approved related to the project. On a pair of 5-0-1 votes – with Radtka again abstaining from the votes because his family owns a portion of the 300-acre site where TJX wants to build the warehouse – council approved a tax-sharing agreement with the Lordstown School District for the 25% not being abated and authorized Mayor Arno Hill to submit an application with the state for a roadwork development agreement.

Under the revenue-sharing agreement, approved by council in its second reading Wednesday, the village and the school district will evenly split income taxes on annual payrolls exceeding $1 million generated by the warehouse.

Councilman Robert Bond voted against the abatement, while he and Councilwoman Karen Jones voted against suspending council rules to permit the legislation to take effect as an emergency measure, which was in its third reading, although Jones ultimately voted for the abatement.

The legislation takes effect in 30 days.

Without the abatement, there was a “good chance [the project] was going to east central Pennsylvania,” and TJX is six months behind where the company had hoped to be, Hill said following the votes. He voiced his appreciation to council for passing the abatement adding that, contrary to the complaints of tax abatement opponents, there is no “net loss” to the schools.

“The money that’s being abated is not money that was in anybody’s budget,” he said. “There’s no loss of revenue except for fictitious loss.”

Tax abatements are “killing” school systems in Ohio and elsewhere, Jones said, but said since school board officials at last night’s meeting appeared to be OK with the abatement, she would vote for it.

She also called for tax abatements to be outlawed at the federal level.

“I think it would be great if there were no abatements. But you know what? That’s not the real world,” Hill said.

“That’s the cost of doing business,” Jones lamented.

Bond also criticized the 75% agreement for TJX, as well as other 100% tax breaks granted in the village. He pointed to growth in nearby Jackson Township, which no longer offers tax abatements.

The township now has a tax increment financing district in which half of the increased tax value from projects is shared among the township, local schools and Mahoning County, with the other half dedicated to infrastructure related to the projects.

Lordstown has “the same infrastructure if not better” than Jackson Township has, Bond said. “If we’re not careful, we’re going to have so many abatements out there that we’ll be wealthy on paper and cash poor.”

The roadwork development agreement would provide the village with $1.4 million from the Ohio Development Services Agency for roadwork needs related to the TJX project. Total roadwork improvement costs are estimated at $2.7 million, according to state documents.

TJX has committed on the public record to covering the balance of those costs, Hill said.

Additional funds might be available from the Ohio Department of Transportation’s Division of Jobs & Commerce, said Sarah Boyarko, chief operating officer of the Youngstown/Warren Regional Chamber.

Boyarko has been working with TJX for more than two years on the project.

“We’re obviously very pleased with tonight’s outcome and we’re looking forward to the next approval before the Trumbull County commissioners in the coming weeks,” she said.

The commissioners must hold a public hearing before granting final approval for the abatement. The earliest date that can take place is Jan. 23, said Nick Coggins, economic development coordinator for the Trumbull County Planning Commission.

Before then, the village planning commission will meet to take up a road vacation needed for the project and potential consolidation of parcels, Hill said. The following day, there will be a pre-application meeting with the village engineer to discuss the site plan, he said.

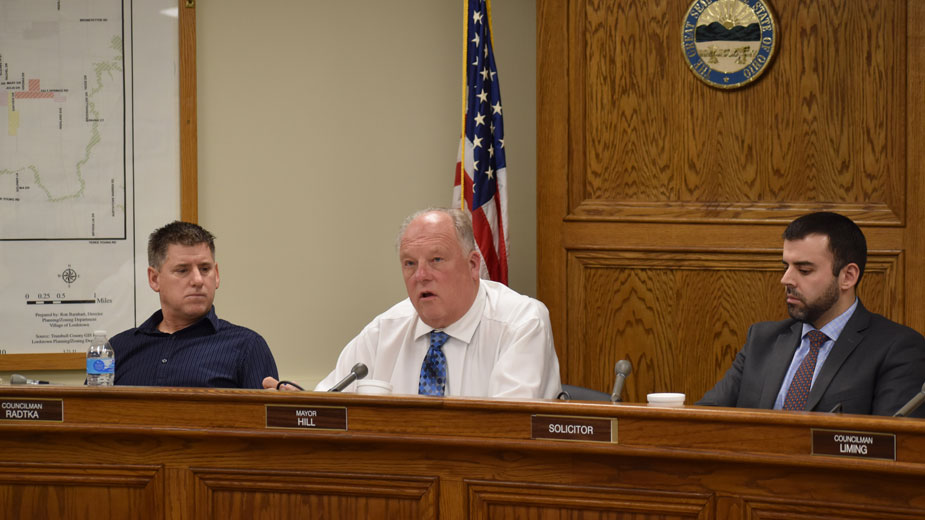

Pictured: Lordstown Councilman Ronald Radtka, Mayor Arno Hill and attorney Vito Abruzzino, who filled in for solicitor Paul Dutton.

Copyright 2024 The Business Journal, Youngstown, Ohio.