Mobile Software Clicks at Turning Technologies

YOUNGSTOWN, Ohio – Turning Technologies is a much different company than when it was established in 2002, when it rapidly validated the market for its audience response products as well as the B2B software development model its landlord, the Youngstown Business Incubator, established that year.

Today, more than half of Turning’s business is in the mobile software segment and the remaining in the traditional hardware space that defined it for so long.

“The market has changed quite a bit, especially from a technology perspective,” says Ethan Cohen, president and CEO.

But the company has also seen plenty of other changes since Inc. magazine named it, in 2007, as the fastest growing privately held software company in the United States and the 18th fastest growing privately heldcompany overall.

About the same time, the company experienced its first ownership change. More followed as venture capital partners moved in and out.

But perhaps the most significant change is how Turning delivers its core TurningPoint polling software. Adapting to the marketplace, the company has shifted to an application that capitalizes on now-ubiquitous mobile technology, without completely abandoning its traditional hardware.

“Now that we’ve built this base infrastructure, there are a lot of growth opportunities for us,” Cohen says.

And as the company evolves, it remains anchored downtown in building constructed when the central business district’s turnaround was beginning to take hold.

In 2008, Turning graduated from the incubator’s main building, where it was founded, to YBI’s newly built Taft Technology Center, which Turning occupies today as its sole tenant.

Cohen – whose father grew up in Youngstown, and who remembers visiting Wick Park with his grand-father – says he has no plans of taking the company elsewhere.

In October 2016, he succeeded Mike Broderick – Turning’s sole remaining founder with a day-to-day active role at the company, and who remains on the board today – as president and CEO. Cohen had joined Turning in April as its chief operating officer and chief technology officer. He previously operated an internet merchandising company.

“You wouldn’t expect to find a web- and mobile-based technology company here in Youngstown, but we’re been very happy with the talent we’ve found,” Cohen says. Employees, by and large are loyal, he asserts. “I like to think in part because we’re an attractive company to work for.”

Although Cohen declines to give specific employment figures, he says Turning employs more than 100 workers in the Youngstown area. At its peak, when Turning acquired eInstruction in August 2013, the company was said to employ more than 200.

“When Turning did that [acquisition], it acquired a number of declining businesses” that offered products such as interactive white boards, which are being replaced with flat-panel television sets, Cohen says. Thus it decreased employment accordingly.

In an October 2017 memo to employees that was obtained by local news organizations, Cohen announced “a restructuring initiative” that resulted in the “reduction of about 20 employees and some changes in roles and responsibilities.” As he explained, “Net billings for the first eight months of this year [2017] were about $4 million below last year, and this deficit will increase when we release September results.”

The company does not disclose annual sales or its earnings.

Turning was purchased in 2010 by private equity fund Brockway Moran & Partners Inc. of Boca Raton, Fla. – the company’s third venture partner, which purchased the majority stake in the company from Talisman Capital Partners. Talisman had acquired control four years earlier.

Turning was “a big success story pretty quickly,” says Jim Cossler, YBI’s current entrepreneur in residence and its CEO when Turning was founded.

Cossler, who spearheaded YBI’s shift to fostering business-to-business software startups, says Turning’s success was “critical to our ability to win community confidence to help catalyze downtown and attract high-quality deal flow and investors.”

But in recent years, Turning was “a little slow” moving its technology into smart phones and making the device hardware-agnostic, Cossler says.

“They’ve done that now,” he continues. “There’s still a big market for this in terms of real-time online testing, polling and surveying. I don’t think that market has gone away. They’re positioned now to do a better job of capturing it.”

On Aug. 14, the company announced it was awarded a contract with the state of New York that streamlines the purchasing process for state agencies, local governments, public authorities, public school and fire districts, and public and nonprofit libraries. The contract signals that Turning Technologies is in full compliance with state regulations and its prices have been negotiated and approved at the state level. As a result, purchases can be made directly from the company, rather than initiating a formal bidding process.

“This is great news for our clients,” Cohen said in a press release, “as it is now easier for them to purchase our products and easier for us to provide them with the tools they need.”

About 40% of Turning’s business is in higher education, according to the CEO, with the remainder divided among a customer base that includes a “large” corporate market, international clients, government and military.

“The one area of education that we don’t do as much in as we did historically is the K-12 market,” Cohen says. “There’s not as much money in that market as there used to be, and not as much growth opportunity as there is in the higher-end space.”

This time of year, as its clients begin fall classes, most support-related questions address functionality or workflow, usually some minor issues, says Kevin Herrholtz, vice president of client success and a 10-year employee.

“Clients are definitely more aware of the products,” he notes. “When we talk to clients now, some of that base-level knowledge is in place that may not have been there five years ago.”

Instructors have become “more savvy” in terms of their understanding the technology and what it can do, Cohen continues. Their requests are more sophisticated in terms of functionality, analytics and reporting, as well as where they would like to see Turning go with the technology over time.

Conor McLennan, psychology professor at Cleveland State University and director of its language research laboratory, has used Turning’s audience response system as an educational tool since 2006.

Among the adjustments the educator has made over the years is including “I have no idea” as an option in multiple choice questions. This provides a more “honest look” at how many students might be unclear on subject matter than if they guess at the correct answer, he says.

In large lecture halls, the response technology can help ensure students are following along with the lecture and staying engaged, McLennan says. In smaller settings, it can help stimulate discussion and debate when addressing controversial topics or ones that students might be too shy to mention.

“People are learning more about what the technology can do. And as the technology has grown more sophisticated and ubiquitous, there’s more that you can do,” Cohen affirms.

In the corporate segment, “Everybody has a smartphone, everybody has an iPad,” says Chuck Reigrut, vice president of sales for corporate, government/military and K-12. “It enables people to take technology they have and use it for multiple purposes. It’s a lot easier to get our technology out in front of some folks.”

Still, the need for Turning’s clicker hardware hasn’t gone away, Reigrut and Cohen acknowledge.

“We sell a lot of hardware because there are various applications in higher ed, corporate and military sectors, where people want the hardware,” Cohen says.

Web-enabled devices can offer distractions to the user such as news alerts, for example, or can be used to look up an answer to a question on the internet, he points out. And Turning’s hardware isn’t dependent on Wi-Fi access.

“If you have 400 students in a classroom all trying to respond at the same time, it often overloads the circuitry,” Cohen explains. “You don’t have that problem with the clicker.”

Military customers have settings where Wi-Fi isn’t permitted and corporate clients often have environments without Wi-Fi access, he adds.

In international markets, particularly in developing countries, there is greater demand for the hardware, although that is changing as well. Demand in Europe tends to mirror the United States, the executives say.

International sales represent about 15% of Turning’s business, with Europe – and the United Kingdom in particular – being a good growth area, the CEO reports.

“That being said, we do have various other countries, some of which might not be ones you’d expect, where opportunities pop up for us, and it varies by year to year,” Cohen says. “We have a lot of business in South Africa. That’s a very large growth area.”

Down the road, the company plans to integrate interactive multimedia with its software. Someone viewing a video in a corporate training or higher education environment could respond to questions regarding the material, and integrate those responses into what is happening in the classroom.

“At the other end,” Cohen says, “we’re building out our analytics and reporting capabilities so you can dive more deeply into the data we’re collecting to better understand the dynamics of learning.”

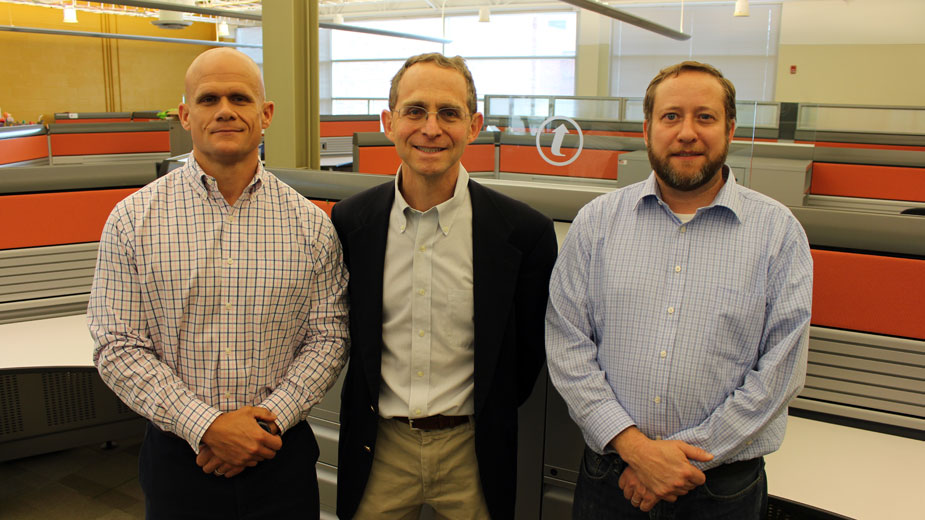

Pictured: Vice president of client success Kevin Herrholtz, President and CEO Ethan Cohen and vice president of sales for corporate, government/military and K-12 Chuck Reigrut are leading the transformation of Turning Technologies.

Copyright 2024 The Business Journal, Youngstown, Ohio.