More Than a Third of Teens Say They Won’t Be Financially Dependent by 30

GIRARD, Ohio — A survey by Junior Achievement and Citizens Bank found that 63% of teens believe they will be financially independent of their parents by age 30. That leaves more than a third who believe otherwise.

Released in conjunction with Financial Literacy Month in April, the survey highlights the top financial goals and concerns among teenagers, according to a release. Of the 1,000 U.S. teens ages 13 to 18 who were surveyed by Wakefield Research, 74% believe they will own a car by the time they are 30, 60% believe they will own a home, 44% say they will begin saving for retirement and 43% expect to have their student loans paid.

“These survey findings show a disconcerting lack of confidence among teens when it comes to achieving financial goals,” said Michele Merkel, president of Junior Achievement of Mahoning Valley. “With a strong economy, you would think teens would be more optimistic. It just demonstrates the importance of working with young people to help them better understand financial concepts and gain confidence in their ability to manage their financial futures.”

At 62%, getting a full-time job was the top financial goal, the survey found. Other goals include graduating from a four-year college (59%), no longer relying on parents or caregivers for money (53%), and saving enough money for a big trip or vacation (41%).

Paying for college was the top financial concern at 47%, followed by not being able to afford living on their own at 45%, paying taxes at 43%, and finding a fulfilling, well paying job, 40%.

“The survey makes clear that more has to be done to help prepare young people for planning and dealing with their finances,” said Ralph M. Della Ratta, president of Citizens Bank, Ohio. “We are committed to helping with that good mission by assisting them with the daunting challenge of paying for college. We also educate them about how to best manage their money by establishing savings and checking accounts, and we provide financial support and skilled volunteers who can assist young people through partnerships with organizations locally such as Junior Achievement of Mahoning Valley.”

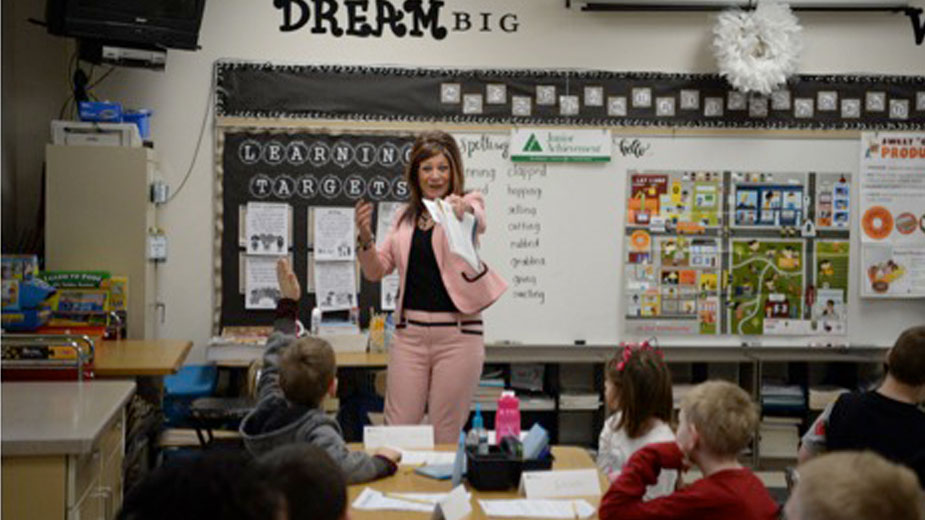

Volunteers from Citizens Bank teach second grade curriculum, JA Our Community and have teams participating in the Junior Achievement of Mahoning Valley bowl-a-thon fundraiser May 7.

Other survey findings include:

- Of those surveyed, 64% turn to parents or caregivers for financial advice, 38% turn to family members, 30% to friends, and 27% turn to online resources, including articles and social media.

- Teens who earn money and have a bank account comprise 61% of respondents, while the rest save their money unbanked, including using a shoebox or piggybank.

- Among those enrolled in school, 40% of females and 34% of males believe they would make less than $35,000 in their first full-time job after high school.

- This year, 22% of teens earn money by working independently, compared to 16% in 2018. For spending money, 64% of teens rely on gifts while 32% earn allowances for doing chores.

Pictured: Rita Fuscoe, branch manager at Citizens Bank, teaches second graders at Prospect Elementary.

Copyright 2024 The Business Journal, Youngstown, Ohio.