New Ohio Unemployment Claims at 101,825 as Suspected Fraud Drops

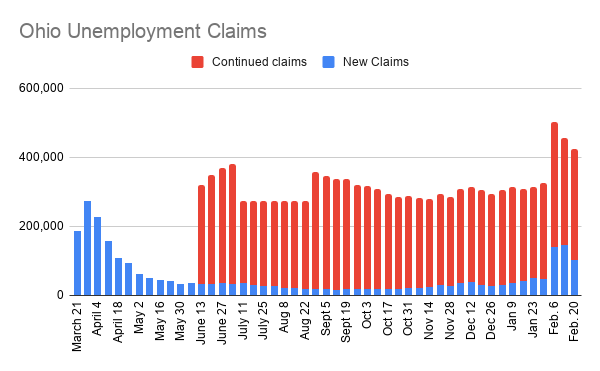

COLUMBUS, Ohio – The Ohio Department of Job and Family Services received 101,825 new unemployment claims the week ended Feb. 20, down about 45,000 from the week before.

The agency flagged at least 29,000 claims submitted last week as potentially fraudulent. If such claims aren’t counted, there were about 73,000 initial claims filed – a level not reached since late April.

Those who believe their identity has been used to file fraudulent unemployment claims can call 833 658 0394 or use the “Report Identity Theft” button at Unemployment.Ohio.gov.

In addition, there were 322,542 continued claims filed with the state, up about 15,000 from the week before.

Over the past 49 weeks, since the Department of Job and Family Services began reporting weekly unemployment because of the pandemic, the state has distributed $8.6 billion in unemployment compensation to 941,000 Ohioans. In addition, there has been $9.1 billion paid in pandemic unemployment assistance to 905,000 people who don’t qualify for traditional unemployment benefits.

In Pennsylvania, the state’s Department of Labor reports 28,417 initial claims were filed the week ended Feb. 13, bringing the total since mid-March 2020 to 2,763,588.

The state has paid $7 billion in unemployment compensation and $7.9 billion in pandemic unemployment assistance through the week ended Feb. 20.

Nationwide, unemployment filings fell to 730,000, according to the Labor Department’s weekly report, down about 111,000 from the previous week and the lowest figure since late November.

The latest figures come as the job market has made scant progress in the past three months. Hiring averaged just 29,000 a month from November through January. Though the unemployment rate was 6.3% in January, a broader measure that includes people who have given up on their job searches is closer to 10%.

All told, 19 million people were receiving unemployment aid as of Feb. 6, up from 18.3 million the previous week. About three-quarters of those recipients are receiving checks from federal benefit programs, including programs that provide jobless aid beyond the 26 weeks given by most states.

Key sectors of the economy, though, are showing signs of picking up as vaccinations increase and government rescue aid works its way through the economy. The Federal Reserve’s ultra-low-rate policy is providing key support, too.

Retail sales soared last month as many Americans spent the $600 checks that were included in a relief package enacted in December. Factory output also rose and has nearly regained its pre-pandemic levels. And sales of newly-built homes soared last month.

Michelle Meyer, an economist at Bank of America, this week upgraded her forecast for growth this year to 6.5%, which would be the fastest since 1984. Daily coronavirus infections are down more than 70% from their peak, Meyer noted, which should lead to more states and cities relaxing business restrictions.

Further economic relief is also likely, she noted, as Congress considers President Joe Biden’s proposal for a new aid package amounting to $1.9 trillion.

The Fed has pegged its short-term interest rate near zero to encourage more borrowing and spending. Chair Jerome Powell stressed in testimony to Congress this week that the Fed plans to keep its rate ultra-low until the job market has recovered – even if inflation has begun to surpass the Fed’s 2% target level by then. That soothed the stock market, which had fallen in the past week on fears that rising interest rates and the threat of inflation might lead the Fed to raise rates too quickly and potentially derail the economy.

The yield on the 10-year Treasury note has risen sharply in anticipation of more robust economic growth and is now near 1.5%. At the start of the year, the 10-year yield was below 1%.

In his testimony this week, Powell downplayed the inflation risk and instead underscored the economy’s struggles, including the 10 million jobs that remain lost since the pandemic erupted nearly a year ago. That’s a deeper job loss than was inflicted by the Great Recession of 2008-2009.

But on Wednesday, Richard Clarida, a Fed vice chair, sounded a more optimistic note in remarks to the U.S. Chamber of Commerce. Clarida pointed to the distribution of vaccines and the economic relief package that the government enacted late last year as reasons for a sunnier outlook.

“The prospects for the economy in 2021 and beyond,” Clarida said, “have brightened, and the downside risk to the outlook has diminished.”

Even the ice storms and widespread power outages in Texas, damaging as they were to residents and businesses there, are unlikely to inflict a major blow on the overall U.S. economy, according to Oxford Economics.

Oren Klachkin, lead U.S. economist at Oxford, estimates that the harsh winter weather will slightly lower growth in the January-March quarter to a still-blistering 6.8% annual rate, down from a previous estimate of 7.1%.

The Associated Press contributed to this story.

Copyright 2024 The Business Journal, Youngstown, Ohio.