New Ohio Unemployment Claims Rise for 3rd Straight Week to 25K

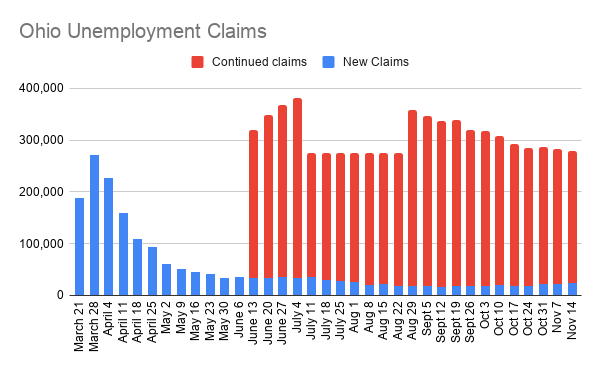

YOUNGSTOWN, Ohio – The Ohio Department of Job and Family Services reports 24,964 new unemployment claims were filed last week, marking the third straight week of increases.

In addition, there were 254,613 continuing claims filed with the department the week ended Nov. 14, down about 6,000 from the week prior.

In the 35 weeks since the pandemic began taking its toll on Ohio, the state has disbursed $7.3 billion in unemployment compensation to 841,000 residents, as well as $7 billion in pandemic unemployment assistance.

The Department of Job and Family Services also warned Wednesday of an email scam targeting current and previous applicants for pandemic unemployment assistance. The email scam claims to offer a “pandemic stimulus benefit.” While the email contains the agency’s logo, clicking links in the email take users to a fraudulent website.

“ODJFS does not send these types of communications. It also warns all Ohioans to beware of scams using texting or emails to obtain your personal information,” the agency said in a statement. “Anyone who receives an email that they suspect may be a phishing attempt should not click on any links.Individuals who have received this notification are encouraged to report it to the Ohio Attorney General’s office at 1 800 282 0515 or OhioProtects.org.”

In Pennsylvania, the state’s Department of Labor reports 23,051 claims filed the week ended Nov. 7, the mots recent available. Since the pandemic began in mid-March, the state has received 2,294,288 unemployment claims.

The state has paid $5.9 billion in unemployment compensation and $6.2 billion in pandemic unemployment assistance.

Nationwide, the number of unemployment claims rose to 742,000, the first week-to-week increase in five weeks.

The Labor Department’s report Thursday showed that applications for benefits rose from 711,000 in the previous week. Claims had soared to 6.9 million in March when the pandemic first intensified. Before the pandemic, applications typically hovered about 225,000 a week.

The economy’s modest recovery is increasingly at risk, with newly confirmed daily infections in the United States having exploded 80% over the past two weeks to the highest levels on record. More states and cities are issuing mask mandates, limiting the size of gatherings, restricting restaurant dining, closing gyms or reducing the hours and capacity of bars, stores and other businesses. At least 15 states have tightened curbs on businesses to try to slow infections.

Evidence is emerging that consumers are losing confidence in the economic outlook and pulling back on shopping, eating out and other activities. Spending on 30 million credit and debit cards tracked by JPMorgan Chase fell 7.4% earlier this month compared with a year ago. That marked a sharp drop from two weeks earlier. Consumer sentiment also declined in early November and is down nearly 21% from a year ago, according to a University of Michigan survey.

The number of people who are continuing to receive traditional unemployment benefits fell to 6.4 million, the government said, from 6.8 million. That shows that more Americans are finding jobs and no longer receiving unemployment aid. But it also indicates that many jobless people have used up their state unemployment aid — which typically expires after six months — and have transitioned to a federal extended benefits program that lasts 13 more weeks.

The worsening viral outbreak coincides with the impending expiration of two federal unemployment programs at year’s end that could eliminate benefits for 9.1 million people, according to a report from The Century Foundation. Congress has so far failed to agree on any new stimulus package for jobless individuals and struggling businesses. The cutoff of aid will sharply reduce income for the unemployed, force a further reduction in their spending and perhaps weaken the economy.

One of those programs is Pandemic Unemployment Assistance, which made self-employed and contract workers eligible for unemployment aid for the first time. PUA was established by a multi-trillion-dollar aid package that Congress enacted in the spring.

The second measure in the stimulus package provided the additional 13 weeks of benefits for unemployed people who have used up their state benefits.

When those two programs expire on Dec. 26, the Century Foundation estimates that 12 million people will lose their benefits. About 2.9 million might be able to transition to a state extended benefit program that can last from six to 20 weeks, the report said. But the rest will lose benefits that average about $320 a week nationally.

The expiration of benefits will make it harder for the unemployed to make rent payments, afford food or keep up with utility bills. Most economists agree that because unemployed people tend to quickly spend their benefits, such aid is effective in boosting the economy.

Cutting off benefits with several million people still unemployed would be unusually early compared with previous recessions. In the Great Recession of 2008-2009, the government extended unemployment benefits to 99 weeks, and the additional aid lasted through 2013. When that program ended, about 1.3 million people lost benefits — a fraction of the number who would lose their aid at the end of this year.

“We’re still down 10 million jobs since the pandemic began,” said Elizabeth Pancotti, co-author of the Century Foundation report and a policy advisor at Employ America, a left-leaning think tank. “We’re heading into the winter, we’re seeing additional business closures, consumer demand is already falling….Cutting off benefits seems inhumane to me.”

In March and April, when the pandemic erupted in the United States, tens of millions of people applied for jobless aid. Though many of them have been rehired or have landed new jobs, those who haven’t found work began exhausting their six months of state aid as early as September.

Most of them would then shift to the Pandemic Emergency Unemployment Compensation program, which provides 13 additional weeks. Yet the Century Foundation estimates that 3.5 million people will have used up all of those 13 weeks before the year ends. An additional 950,000 people will have run out of the 39 weeks provided by the PUA program by then, too.

The Associated Press contributed to this story.

Copyright 2024 The Business Journal, Youngstown, Ohio.