Officials Tout Expansion of Ohio Homebuyer Program

WARREN, Ohio – The new Ohio Homebuyer Plus program launched in early 2024 already has seen success, with more than 10,000 accounts opened across the state by residents hoping to purchase a home in the next five years.

The program, which helps with saving for a down payment to make home ownership possible, is currently open to only Ohio residents.

Now lawmakers are considering expanding program eligibility to military service members from other states who want to make a permanent home in Ohio.

“I can’t say enough about this program,” said David Christner, executive board member of the Eastern Ohio Military Affairs Commission and the Youngstown Air Reserve Base Community Council. “Anything we can do to reduce the stress level on our folks who are serving our country is a great thing. These people sometimes have full-time jobs. They are involved actively in training, and sometimes they are deployed for months at a time.”

Christner said it’s important for their stress level that they know their families have a place to live while they are serving and there is a home waiting for them when they return from deployment.

Christner was one of the participants in a housing roundtable Thursday at the Trumbull County Veterans Service Commission.

There are nearly 30,000 service members and veterans in Trumbull, Mahoning and Columbiana counties combined, according to Herman Breuer, director and service officer with the Trumbull County Veterans Service Commission, who said 14,700 live in Trumbull County alone.

“Northeast Ohio is the largest veteran population by region in the state,” Breuer said, adding that the Veterans Service Commission in Warren hopes to host a homebuying event to give veterans more information about the program.

Legislative efforts were introduced to open the program up to active-duty military members stationed in Ohio. The legislation is sponsored by state Reps. Nick Santucci of Howland Township, R-64th, and Brian Lampton of Beavercreek, R-70th, along with state Sens. Brian Chavez of Marietta, R-30th, and Terry Johnson of McDermott, R-14th.

Santucci, who participated in Thursday’s roundtable, said he believes Gov. Mike DeWine would sign the legislation.

Those serving at the Youngstown Air Reserve Station would be among those to benefit.

“As you all know, in Trumbull County our largest employer is the Youngstown Air Reserve Station,” Santucci said. “If, for whatever reason, we were to lose the Youngstown Air Reserve Station, it would be catastrophic economically for us and for our community. And so this type of program is not only going to help them, but help families that are associated with our active-duty service members.”

There are military bases throughout Ohio, and Santucci said those who are serving in the state deserve the additional perk.

There are 830,000 veterans in Ohio, according to the Ohio Department of Veterans Services.

How the Program Currently Works

Ohio Treasurer Robert Sprague pointed out during the roundtable that post-Covid, the cost of buying a home is 50% more than pre-Covid, which is due to increased costs of building, higher interest rates and lack of inventory.

Additionally, Sprague said a real estate agent told him that the No. 1 reason people can’t buy a home is because they can’t afford the down payment.

So the Ohio Homebuyer Plus program was created to help Ohio residents save for the down payment, with some additional help.

Every Ohio resident qualifies for the program, which allows anyone at least 18 years old to work with a participating bank or credit union to apply for a savings account. The money earns additional interest and may qualify the saver for a tax break. The money must be used toward the purchase of a home within five years.

Sprague said not only do those in the program get whatever interest rate the bank is offering but, additionally, the state is offering 2.57%.

“You cannot find a better investment in the United States of America right now than this risk-free investment here in the state of Ohio if you are a potential homebuyer,” Sprague said.

Premier Bank’s Matthew Connelly, vice president, treasury sales manager, said right now the bank is offering a 7.25% interest rate, plus up to a $250 match after six months. And if the homebuyer uses Premier Bank for their mortgage, they receive $500 off their closing costs.

In the three weeks Premier Bank has participated, it has already seen $1 million placed into the program by 225 people opening the accounts by filling out the one-page application and reading a 12-page participating statement from the treasurer’s office.

Sprague said more than 10,000 accounts have been opened up throughout the state.

“This thing has just exploding,” he said. “People need this product; they want it. … We see a lot of participation across the state.”

“This is a wonderful offer,” said Trish Howe, executive officer of the Home Builders and Remodelers Association of the Valley. “It helps not only those who are current homeowners who are looking to upsize or downsize, empty nesters, but it also helps people who maybe feel like I would never qualify for something to be a homeowner, who would not even have the nerve to go into the bank to ask for a loan.”

Howe said the program is a path out of renting and into home ownership.

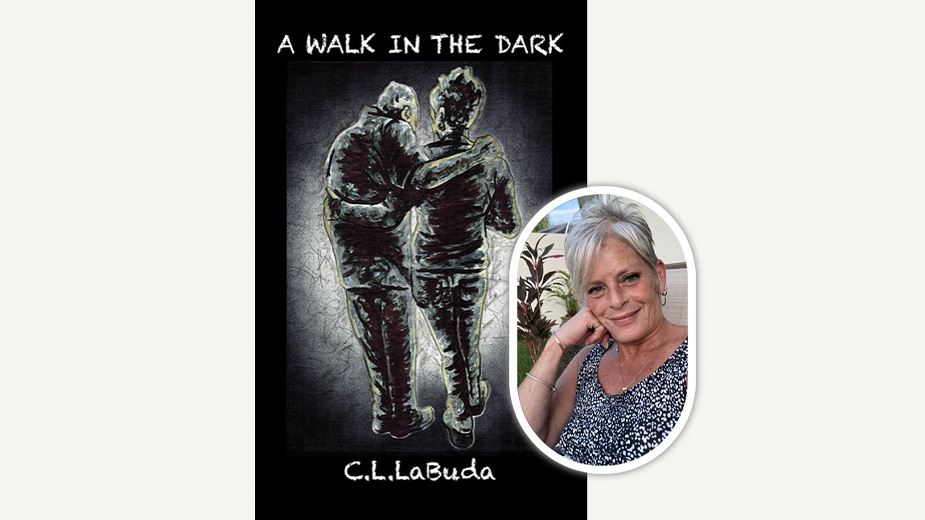

Pictured at top: From left are David Christner, executive board member of the Eastern Ohio Military Affairs Commission and the Youngstown Air Reserve Base Community Council; Herman Breuer, director/service officer for the Trumbull County Veterans Service Commission; Ohio Treasurer Robert Sprague; state Rep. Nick Santucci; Trisha Howe, executive officer of the Home Builders and Remodelers Association of the Valley; Matthew Connelly, vice president, treasury sales manager at Premier Bank; retired Maj. Rick Williams, associate director of the Office of Veterans Affairs at Youngstown State University.

Copyright 2024 The Business Journal, Youngstown, Ohio.