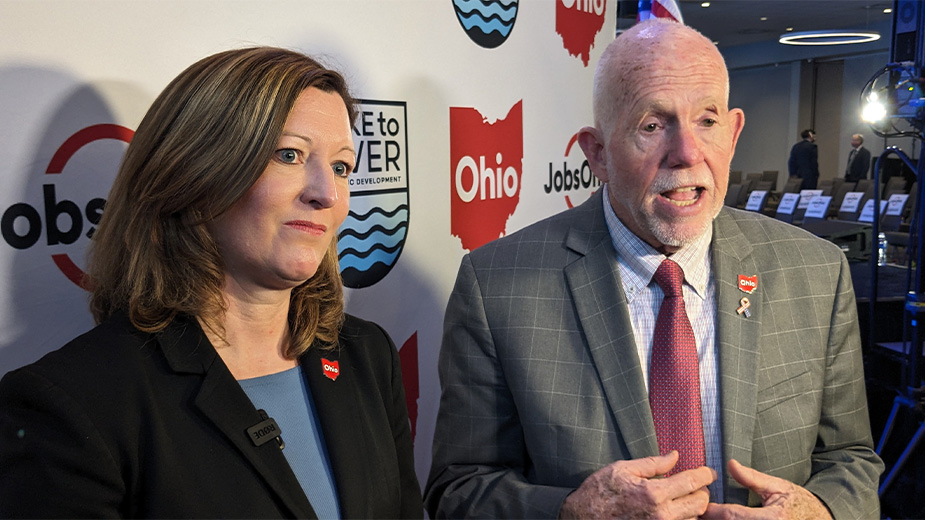

Ohio Commerce Department Director Highlights Agency’s Broad Impact

YOUNGSTOWN, Ohio – The director of the Ohio Department of Commerce says securities fraud runs rampant across Ohio, and the state is taking measures to help bring some restitution to victims.

“This has become such a pervasive problem,” Sheryl Maxfield told a group of business professionals during the Youngstown/Warren Regional Chamber’s “Lunch With Legislators” event at Legends Food & Drink in Boardman.

The department’s Division of Securities regulates securities brokers, securities salespersons, investment advisors, investment officers and advisor representatives. In the case of fraud, the division pursues administrative actions, civil injunctions and criminal referrals.

Securities fraud has become so ubiquitous that the Department of Commerce plans to launch next month a new program called The Ohio Investor Recovery Fund, Maxfield said.

“It’s a crime victim’s compensation fund for those people who have been hurt by a securities professional,” she said.

While it’s likely investors who were bilked for large amounts of money — compensation, she added, would most likely be capped at $25,000 – the state at least has created a program to help, she said.

“Currently, there is no victim compensation program available for people who have been ripped off,” Maxfield said. “If there are people out there with money, someone is going to try and take advantage of you. We certainly are seeing a lot of it.”

Maxfield, who was born and reared in Struthers, noted the state has proven very effective in prosecuting these types of cases. “I don’t know either through prosecution or plea deals that we have lost one.”

The director emphasized that the Department of Commerce’s primary function is a regulatory agency that oversees or administers approximately 800 programs.

Aside from securities, the department serves as licensing or regulatory arm of a broad portfolio of business sectors, including real estate, financial institutions, liquor control, industrial compliance, unclaimed funds, medical marijuana and the state fire marshal.

“We are first and foremost a regulatory agency,” Maxfield said. “We are about protecting Ohio citizens and businesses, and that’s through cooperative compliance.

Maxfield said the department probably plays a role in the lives of each Ohioan at least once a week, if not on a daily basis.

Sprinkler systems, sanitation and compliance in nursing homes or hotels, underground storage tanks at gas stations, fireworks sales, state credit unions, real estate, prevailing wage issues, even elevator inspection – all come under the purview of the Department of Commerce, she said.

Maxfield noted the department’s objective is to leverage technology to provide support for Ohioans and businesses, support the efforts of the state’s first responders, and increase outreach and education for the agency’s stakeholders.

The agency’s division of financial institutions, for example, has initiated financial literacy grant programs to educate children at an early age on the importance of making wise financial decisions, she said.

“This starts when they’re very young,” Maxfield said, relating a recent event that introduced some basic, simple financial scenarios to pre-school children. “If you start as simple as that, by the time they get to high school or college-age they’re much more informed.”

Over the past six years, the Department of Commerce has overseen the licensure of medical marijuana growers, processors and testing labs in Ohio, Maxfield noted. Dispensaries, she added, operate under the State of Ohio Board of Pharmacy.

Since January of 2019, Ohio’s medical marijuana industry has recorded a total of $1 billion in sales, she said.

One division that is not well known is the agency’s unclaimed funds department, Maxfield said.

“The department is sitting on $3.6 billion that does not belong to the state of Ohio,” she said. Rather, this money belongs to citizens, businesses or nonprofits that at one time either lived in or did business in the state. “Our job is to get that money back into the hands of the rightful owners.”

These funds could be decades-old insurance payments, reimbursements, security deposits, or rebates that were never collected, she said.

“As good as we are at trying to get money back to people, it’s coming in way faster,” Maxfield said. “We really do want to help businesses succeed and make Ohio a better place to live.”

Copyright 2024 The Business Journal, Youngstown, Ohio.