Ohio Reports 115,174 New Unemployment Claims, 3M in Pandemic’s 1st Year

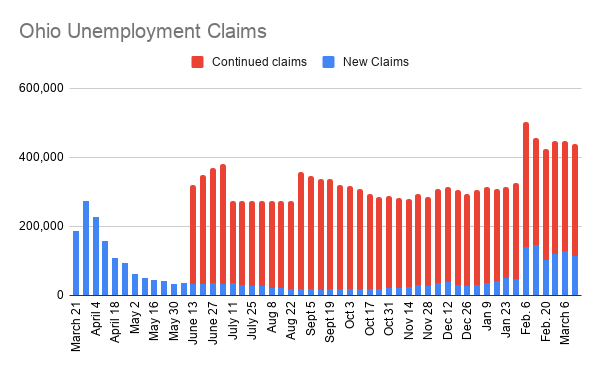

YOUNGSTOWN, Ohio – There were 115,174 new unemployment claims filed in Ohio last week, according to the state’s Department of Job and Family Services, down about 13,000 from the week prior.

Of those claims, about 20,000 were flagged for potential fraud. Those who believe their identity has been used to file fraudulent unemployment claims can call 833 658 0394 or use the “Report Identity Theft” button at Unemployment.Ohio.gov.

There were also 322,063 continued claims filed with the state the week ended March 13, up about 4,000 from the previous week.

In the year since Ohio began reporting weekly unemployment claim figures because of the coronavirus pandemic, there have been 3,129,380 new claims filed. The weekly peak came the week ended March 27, 2020, when 272,117 initial claims were filed, while the low point came the week ended Sept. 12 with 16,294 new claims filed.

The peak for continued claims came the week ended Feb. 6, when 360,638 were filed. Since Ohio began reporting the number of continued claims filed each week, the total has never dropped below 238,793 – a figure reached the week ended July 11.

Over the past 52 weeks, the state has disbursed $9 billion in unemployment compensation to 973,000 Ohioans, along with $9.8 billion in pandemic unemployment assistance to 999,000 people who do not qualify for traditional unemployment payments.

Pennsylvania’s Department of Labor reports 20,837 initial claims filed the week ended March 6, the most recent with data available. Since the start of the pandemic, there have been 2,836,582 initial claims filed.

The state has paid $7.3 billion in unemployment compensation and $8.2 billion in pandemic unemployment assistance. Across all compensation programs, the state has paid $38.4 billion to claimants through the week ended March 13.

Nationwide, 770,000 people filed for unemployment benefits last week, up about 45,000 from the week before.The numbers have dropped sharply since the depths of the recession last spring but still show that employers in some industries continue to lay off workers. Before the pandemic struck, applications for unemployment aid had never topped 700,000 in any one week.

The four-week average of claims, which smooths out weekly variations, dropped to 746,000, the lowest since late November.

A total of 4.1 million people are continuing to collect traditional state unemployment benefits, down 18,000 from the previous week. Including separate federal programs that are intended to help workers displaced by the health crisis, 18.2 million Americans were receiving some form of jobless aid in the week of Feb. 27, down by 1.9 million from the week before.

The continuing layoffs are occurring even as the overall job market has shown solid improvement. Last month, U.S. employers added a robust 379,000 jobs, the most since October and a sign that the economy is strengthening as consumers spend more and states and cities ease business restrictions.

With vaccinations accelerating, hopes are rising that Americans will increasingly travel, shop, eat out and spend freely after a year of virus-induced restraint.

President Joe Biden’s $1.9 trillion relief package is also expected to help accelerate growth, especially with most adults this week receiving $1,400 stimulus checks that should fuel more spending. An extension of $300 weekly unemployment benefits into early September will provide support, too, along with money for vaccines and treatments, school re-openings, state and local governments and ailing industries ranging from airlines to concert halls.

Yet the nation is still 9.5 million short of the number of jobs it had in February 2020. And Federal Reserve Chair Jerome Powell suggested Wednesday after the Fed’s latest policy meeting that the overall economic outlook remained cloudy.

“The state of the economy in two or three years is highly uncertain,” Powell said at a news conference after the Fed signaled that it expects to keep its key interest rate near zero through 2023 despite some solid economic gains and concerns about rising inflation pressures.

By most barometers, business activity in the economy’s vast and hard-hit service sector is still far from normal. The data firm Womply said, for example, that as of early last week 63% of movie theaters, galleries and other entertainment venues were closed. So were 39% of bars, 32% of gyms and other sports and recreation businesses and 30% of restaurants.

The Associated Press contributed to this story.

Copyright 2024 The Business Journal, Youngstown, Ohio.