Ohio Targets Fraud as 1099-G Tax Form Distribution Begins

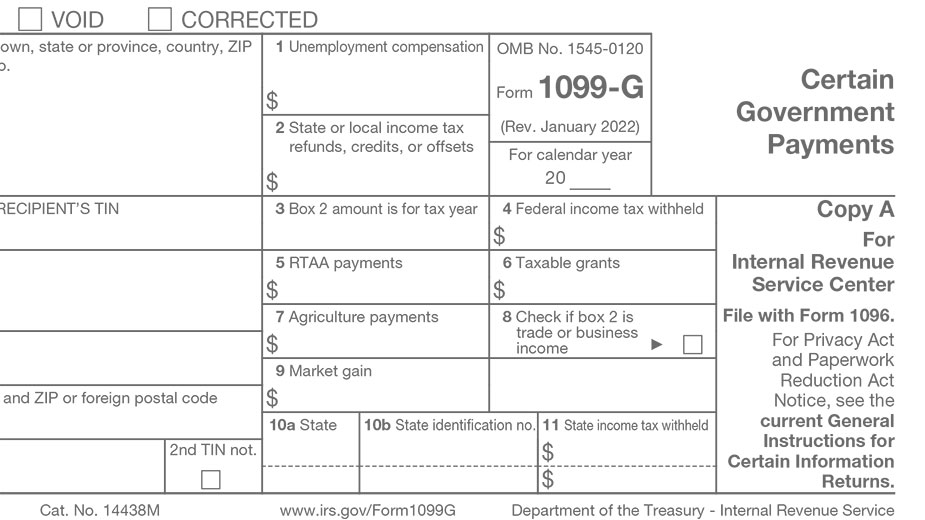

COLUMBUS, Ohio — As the Ohio Department of Job and Family Services begins issuing 1099-G tax forms to individuals who received unemployment benefits the previous year, Director Matt Damschroder says the department is taking additional steps to ensure 1099s go only to legitimate claimants amid widespread identity theft experienced by unemployment programs across the country, according to a release.

“Identity theft has been a widespread national challenge for state unemployment programs since the start of the pandemic,” Damschroder said in the release. “For many individuals in 2020, a 1099 was their first indication that their personal information was used to file a fraudulent unemployment claim. To help ensure we do not generate a 1099 for victims of identity theft, we contacted everyone slated to receive a 1099 and asked them to report potential identity theft through our recently enhanced fraud-reporting portal.”

In September, Damschroder announced improvements to the fraud-reporting portal at Unemployment.ohio.gov, which make it easier for those who have received correspondence in other people’s names to report potential fraud. The department is using information from that database to suppress the generation of the 1099-G tax forms.

Last month, ODJFS notified some 955,000 Ohioans last month that applications for unemployment benefits were filed in their name in 2021. Individuals who received a notice and did not apply for benefits were asked to report it as soon as possible, if they have not already done so, by clicking the red Report Identify Theft button on the website or calling 833 658 0394. While the IRS indicates that individuals should not report incorrect 1099-G income on their tax return, ODJFS recommends consulting the IRS or a qualified tax adviser with questions.

For more fraud guidance and frequently asked questions, visit Unemploymenthelp.ohio.gov/IdentityTheft.

Legitimate unemployment claimants who received benefits in 2021 need 1099-G forms so they can report this income when filing their annual taxes. ODJFS issued approximately 1.7 million 1099-G forms in 2021 and 200,000 forms in 2020

Published by The Business Journal, Youngstown, Ohio.