Ohio Unemployment Claims Rise for 2nd Straight Week

Updated: 11 a.m. Dec. 18 | Corrected error in headline and copy about 7th straight week of increases

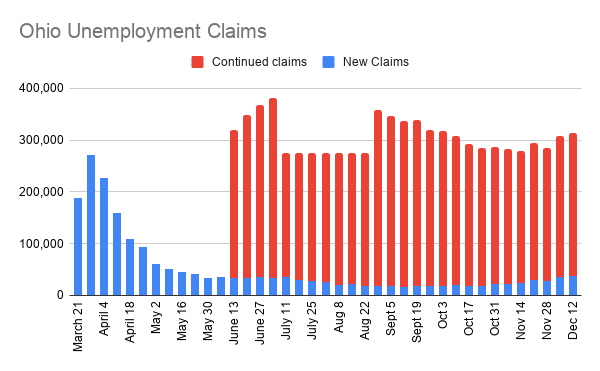

YOUNGSTOWN, Ohio – Ohioans filed 38,327 new unemployment claims between Dec. 6 and 12, according to the state’s Department of Job and Family Services, marking the second week of rising numbers.

The number of continued claims also continued to rise, reaching 274,658. That level is the highest since the week ended Oct. 17, when just over 275,000 claims were filed.

In the 39 weeks since the pandemic began, Ohio has disbursed $7.5 billion in unemployment compensation to 868,000 residents, as well as $7.4 billion in pandemic unemployment assistance to 756,000 Ohioans.

In Pennsylvania, the state’s Department of Labor reports 40,833 residents filed unemployment claims in the week ended Dec. 5, up nearly 17,000 more than the week before. That figure is also the highest since the week of July 5 through 11. Since the pandemic started, 2,408,738 claims have been filed.

The state has paid $6.2 billion in unemployment compensation, as well as $6.7 billion in pandemic unemployment assistance.

Nationwide, 885,000 people applied for unemployment benefits as a resurgence of coronavirus cases threatens the economy’s recovery from its springtime collapse.

The Labor Department said Thursday that the number of applications increased from 862,000 the previous week. It showed that nine months after the viral pandemic paralyzed the economy, many employers are still slashing jobs as the pandemic forces more business restrictions and leads many consumers to stay home.

Before the coronavirus erupted in March, weekly jobless claims had typically numbered only about 225,000. The far-higher current pace of claims reflects an employment market under stress and diminished job security for many.

The total number of people who are receiving traditional state unemployment benefits fell to 5.5 million from 5.8 million. That figure is down sharply from its peak of nearly 23 million in May. It means that some jobless Americans are finding jobs and no longer receiving aid. But it also indicates that many of the unemployed have used up their state benefits, which typically expire after six months.

With layoffs still elevated and new confirmed viral cases in the United States now exceeding 200,000 a day on average, the economy’s modest recovery is increasingly in danger. States and cities are issuing mask mandates, limiting the size of gatherings, restricting restaurant dining, closing gyms or reducing the hours and capacity of bars, stores and other businesses.

On Wednesday, the Federal Reserve signaled that it expects the economy to rebound at a healthy pace next year as viral vaccines become widely distributed. But Chair Jerome Powell warned that the next three to six months will likely be painful for the unemployed and small businesses as pandemic cases spike. The Fed made clear that it’s prepared to keep interest rates ultra-low for the long run to help the economy withstand those threats.

The Associated Press contributed to this story.

Copyright 2024 The Business Journal, Youngstown, Ohio.