Ohio Unemployment Claims Rise Slightly to 29,709

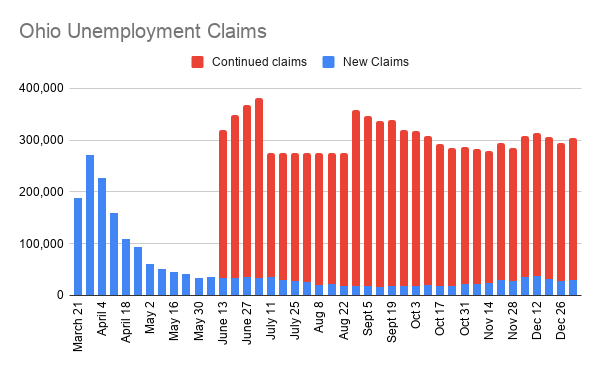

YOUNGSTOWN, Ohio – Ohioans filed 29,709 new unemployment claims last week, according to the Department of Job and Family Services, about a thousand more than the week before.

The agency also reported 274,460 continued jobless claims were filed for the week ended Jan. 2, up about 9,000 from the previous week.

Those numbers, however, may be lower than the true number of people seeking unemployment compensation. Earlier this week, several Business Journal readers contacted us, saying they haven’t been able to file their claims for pandemic unemployment assistance, the extra funding provided by the federal government. One reader said her claim status hadn’t changed, yet payment was denied Dec. 19, approved and paid Dec. 28 and denied again Jan. 2.

In an email response to questions, Bret Crow with the Ohio Department of Job and Family Services stated no new PUA claims can be accepted currently until the department receives more detailed guidance from the U.S. Department of Labor on implementing provisions in the new coronavirus relief bill.

“We are working behind the scenes to set up our systems to pay individuals as quickly as possible once we receive those final details,” Crow said. “Those eligible will receive all benefits they are entitled to, retroactive to Dec. 27.”

In the 42 weeks since the pandemic began, Ohio has paid $7.7 billion in unemployment compensation to 886,000 residents, as well as $7.6 billion in pandemic unemployment assistance to 820,000 claimants.

In Pennsylvania, the state’s Department of Labor reports 38,512 unemployment claims were filed for the week ended Jan. 2, roughly even with the week before. Since the pandemic began, there have been 1,919,879 unique claims in the state.

The state has paid $6.5 billion in unemployment compensation and $7 billion in pandemic unemployment assistance.

Nationwide, 787,000 people filed for unemployment last week, a slight drop from the previous week. In total, 5.1 million people are receiving regular state unemployment compensation.

On Friday, the government will likely issue a gloomy jobs report for December. Economists expect it to show that hiring slowed for a sixth straight month — and possibly that employers shed positions for the first time since the job market collapsed in April just after the pandemic erupted.

Unemployed Americans gained some urgently needed help late last month when a $900 billion rescue aid package was signed into law. That measure provided a $300-a-week federal jobless benefit on top of an average state benefit of about $320. As many as half the states are now distributing the federal benefit, according to an unofficial tally at UnemploymentPUA.com. In states that take longer to pay out the $300 payments, any missed payments can be made retroactively.

The federal extension of benefits was lengthened to 24 weeks by the congressional legislation. That program will remain in place until mid-March. A separate program that provides jobless aid to contractors and gig workers who previously weren’t eligible was also extended for 11 weeks. Both benefits had briefly expired Dec. 26, temporarily cutting off all aid for 10 million jobless Americans.

The Labor Department said this week that despite President Donald Trump’s delay in signing the relief package — he did so six days after Congress’ approval — jobless benefits under the extended programs that lapsed Dec. 26 should be paid out without interruption.

The continued weakening of the U.S. job market coincides with other signs that hiring and economic growth are faltering under the weight of the pandemic. On Wednesday, payroll processor ADP reported that private employers shed 123,000 jobs in December, the first such monthly decline since April. ADP’s figures generally track the government’s jobs data over time, though they can diverge significantly from month to month.

In November, consumer spending — the lifeblood of the economy — declined for the first time in seven months, having steadily weakened since summer. Retailers have been especially hurt. Purchases at retail stores have dropped for two straight months.

During the holiday shopping season, consumers pulled back on spending, according to debit and credit card data tracked by JPMorgan Chase based on 30 million consumer accounts. Such spending was 6% lower in December compared with a year ago. That was worse than in October, when card spending was down just 2% from the previous year.

The Associated Press contributed to this story.

Copyright 2024 The Business Journal, Youngstown, Ohio.