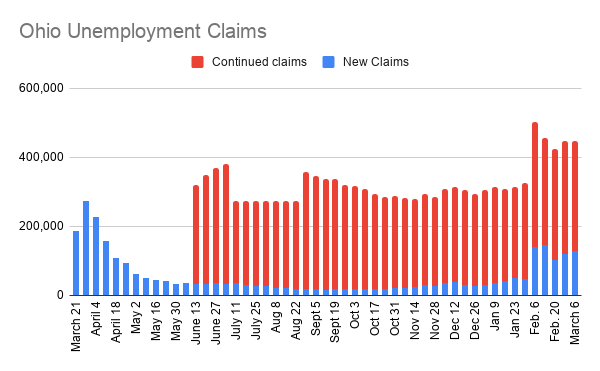

Ohio Unemployment Claims Rise to 128,161

YOUNGSTOWN, Ohio – Ohioans submitted 128,161 initial unemployment claims the week ended March 6, according to the Department of Job and Family Services, and roughly 19,000 have been flagged for potential fraud.

The number of claims submitted rose about 8,000 from the week before. If potentially fraudulent claims are excluded, the number of new claims is at the highest level since the week ended April 18 last year.

Those who believe their identity has been used to file fraudulent unemployment claims can call 833 658 0394 or use the “Report Identity Theft” button at Unemployment.Ohio.gov.

There were also 318,317 continued claims filed with the state last week, down about 9,000 from the week before.

Over the past 51 weeks, since Ohio began releasing weekly unemployment figures because of the pandemic, the state has disbursed $8.8 billion in unemployment compensation and $9.7 billion in pandemic unemployment assistance to those who don’t qualify for traditional unemployment.

In Pennsylvania, there were 20,837 new claims filed the week ended March 6, down roughly 4,000 from the week prior. Since the start of the pandemic in mid-March, there have been 2,833,582 claims filed with the state’s Department of Labor.

The state has provided $7.2 billion in unemployment compensation and $8.1 billion in pandemic unemployment assistance.

Nationally, there 712,000 unemployment claims filed last week, the lowest level since early November.

The Labor Department said Thursday that applications for unemployment aid dropped by 42,000 from 754,000 the week before. Though the job market has been slowly strengthening, many businesses remain under pressure, and 9.6 million jobs remain lost to the pandemic that flattened the economy 12 months ago.

In February, U.S. employers added a robust 379,000 jobs, the most since October, reflecting an economy in which consumers are spending more and states and cities are easing business restrictions. Thursday’s figure, though the lowest weekly figure in four months, showed that weekly applications for jobless benefits still remain high by historical standards: Before the viral outbreak, they had never topped 700,000, even during the Great Recession.

All told, 4.1 million Americans are receiving traditional state unemployment benefits. Counting supplemental federal unemployment programs that were established to soften the economic damage from the virus, an estimated 20.1 million people are collecting some form of jobless aid.

The continuing job cuts reflect the extent to which the pandemic disrupted normal economic activity and kept consumers hunkered down at home rather than out traveling, shopping, dining out and attending entertainment venues. Cities and states restricted the hours and capacity of restaurants, bars and other businesses. Even where restrictions didn’t exist, many Americans for months chose to stay home to avoid the risk of infection.

Now, though, as vaccinations are increasingly administered around the country, business limitations are gradually eased and consumers grow more comfortable engaging face to face with others, optimism about the economy is rising. Last month, consumers bounced back from months of retrenchment to step up their spending by 2.4% — the sharpest increase in seven months and a sign that the economy may be poised to sustain a recovery.

In the meantime, the number of confirmed new COVID-19 cases has dropped to an average of around 50,000 a day from nearly 250,000 in early January.

The Associated Press contributed to this story.

Copyright 2024 The Business Journal, Youngstown, Ohio.