Panelists Tout Assistance for Minority Business Owners

YOUNGSTOWN, Ohio – The number of minority- and women-owned businesses combined account for the fastest growing segment of small business, which is why Ohio Secretary of State Frank LaRose is holding virtual roundtable meetings across the state to ensure their success as Ohio reopens amid the pandemic.

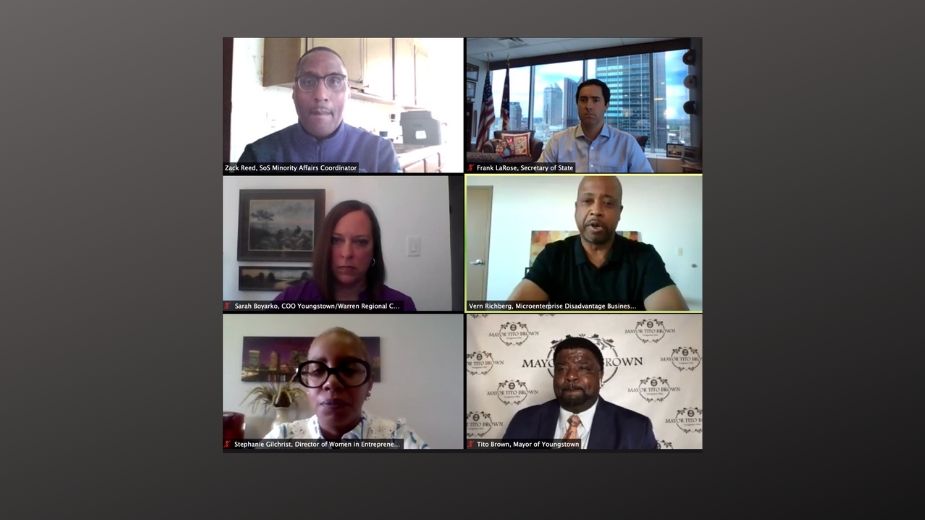

LaRose and local officials held an hour-and-a-half virtual roundtable Wednesday to discuss efforts to further the economic success of minority- and women-owned businesses in the Mahoning Valley.

Vern Richberg, regional director for the Minority Business Assistance Center at Youngstown Business Incubator; Stephanie Gilchrist, director of YBI’s Women in Entrepreneur Program; Youngstown Mayor Jamael Tito Brown, and Sarah Boyarko, chief operating officer and senior vice president of economic development for the Youngstown/Warren Regional Chamber, joined LaRose for the roundtable.

Before the coronavirus pandemic, the number of minority business owners in the U.S. was growing at a rate of 17% annually, six times faster than the growth rate of all firms, according to a joint report from the Milken Institute and the Minority Business Development Agency.

Gilchrist said the Women in Entrepreneur Program has helped hundreds of female business owners in its five-year history.

To ensure future success, LaRose said the state will soon launch a new certification for women entrepreneurs. The program is similar to the Minority Business Enterprise Program certification, which was created in an effort to make all state contracts, opportunities and benefits available to economically disadvantaged businesses without discrimination based on race, color, religion, national origin, disability, age, or ancestry.

“I spoke with administrative services and they told me it is in the final stages of launching the program,” LaRose said.

The economic impact of state-certified Minority Business Enterprises is $16 billion. Last year, these companies directly and indirectly supported the creation of nearly 53,000 jobs in the state, generating $1.25 billion in state tax revenue, according to a 2019 study by Ohio Minority Supplier Development Council.

Gilchrist said most individuals calling the YBI seeking advice on starting new businesses are women. Five years ago, YBI opened the Women in Entrepreneur Program.

She said hundreds of women have been served through three accelerator programs, such as, We Create, We Launch, We Grow. The first phase is planning, setting up a business model and getting businesses and name registered.

“This is the time where someone can decide to walk away or not, and nine times out of 10, she’ll say, ‘I’m in,’ ” Gilchrist said.

The We Launch phase is a 10-week course focusing on accounting, business and legal planning. Oftentimes, a female business owner comes back to teach other women how to succeed.

The final four-week phase focuses on marketing and initiatives for growth, such as developing e-commerce during the coronavirus pandemic.

The first step for any minority or woman who wants to start a business is to get in touch with assistance programs through the incubator at YBI.org, Richberg said.

“The website is your first door to find resources and referrals to get help,” he said. “We have a lot of coaching and mentorship services. We just need to get people connected with those.”

YBI’s Minority Business Center serves seven counties from Ashtabula through Monroe counties. Richberg says MBAC relies on digital learning to deliver tools to would-be business owners.

“Many members or clients work during the day and then pick up children from daycare or run to the grocery store. We try to meet customers where they are when they can access learning,” Richberg said.

Mayor Brown said he is hoping Federal Opportunity Zones and Community Development Block Grant funding can be used to help small business and neighborhoods by possibly creating city makerspaces where someone could sell a product and residents could easily purchase a product without having to worry about transportation.

“I hope to see communities benefiting 10 years from now because we invested CDBG dollars with opportunity zones to give some stability, not just in the downtown area, but I want to see neighborhoods thrive as well,” Brown said.

Panelists were asked how entrepreneurs can easily find properties to fix up or purchase as opposed to leasing business space. Boyarko explained the chamber’s website has a database of available properties that can be viewed online.

While the organization doesn’t have a specific department that deals with minority businesses, Boyarko says the chamber works closely with Richberg, Gilchrist and local officials on projects.

It’s important for entrepreneurs to contact the panelists to learn about available grant and loan opportunities, they said. Access to capital is the most common question they said they all receive.

“Minority business owners have to access the same opportunity to capital because you can’t grow a business without an infusion of capital,” Richberg said, acknowledging the state’s commitment to making more funding available through the Ohio Minority Micro-Enterprise Grant Program. “How are we going to ensure those dollars continue to flow to minority communities or whether those dollars will be sustainable?”

While capital is important, it’s more important for people to allow the center to help them prepare their records and applications for assistance, he noted.

“One thing we have learned from COVID is the importance for minority businesses to be able to quickly access their financial documents, and some didn’t know 2019 growth revenue because many are cash businesses,” Richberg said. “Many companies need help getting their business houses in order, so access to capital may not be the first thing we need.”

Gilchrist says anyone interested in assistance with applying for the state funding opportunities should call the assistance centers. On June 2, Gov. Mike DeWine announced new funding opportunities, including the Ohio Minority Micro-Enterprise Grant Program, which is a $5 million grant program to help businesses owned and operated by minorities and women in response to the COVID-19 pandemic.

Eligible businesses can apply for grants of $10,000 per business on a first-come, first-served basis. This will provide access to much needed capital for up to 500 minority- and women-owned businesses to continue operating now and to prepare for the future.

State-certified Minority Business Enterprises (MBE) and/or women-owned businesses with state certification in the Encouraging Diversity Growth and Equity (EDGE) Program with up to $500,000 in annual revenue and 10 or fewer employees are eligible. Businesses that have received federal assistance through the federal CARES Act are not eligible.

Panelists agreed that for businesses to reopen successfully, adhering to state health official recommendations and taking steps to make customers feel safe is key.

“Having the proper PPE [personal protective equipment] and having a long-term goal to maintain health recommendations are important,” Brown said. “It also will take businesses making their customers feel comfortable so they want to come back.”

The MBDA-Milken Institute report states there are approximately 3.3 million minority business owners in the U.S. Census numbers for local minority business ownership was only available through 2012. It shows 3,277 businesses are minority-owned in Mahoning County, with 2,260 of those in Youngstown, while Trumbull County has 1,214, with 638 located in Warren.

Copyright 2024 The Business Journal, Youngstown, Ohio.