A Snapshot of Small Business in the Five Counties

YOUNGSTOWN, Ohio — Companies operating in the private sector across the five-county region on average employ 12.3 people, making this area a reliable barometer for small-business activity. That’s according to business summaries Dunn & Bradstreet compile, which illustrate sector-by-sector snapshots of business activity in Mahoning, Trumbull, and Columbiana counties in Ohio and Lawrence and Mercer counties in western Pennsylvania.

The data reflects the level of employment and the number of establishments in nine sectors of the economy – comprising forestry and fishing, mining, construction, manufacturing, transportation, wholesale trade, retail trade, finance and real estate, and services – through Oct. 31, 2018. These numbers do not take into account major events such as the idling of the General Motors Lordstown Assembly plant in March of this year.

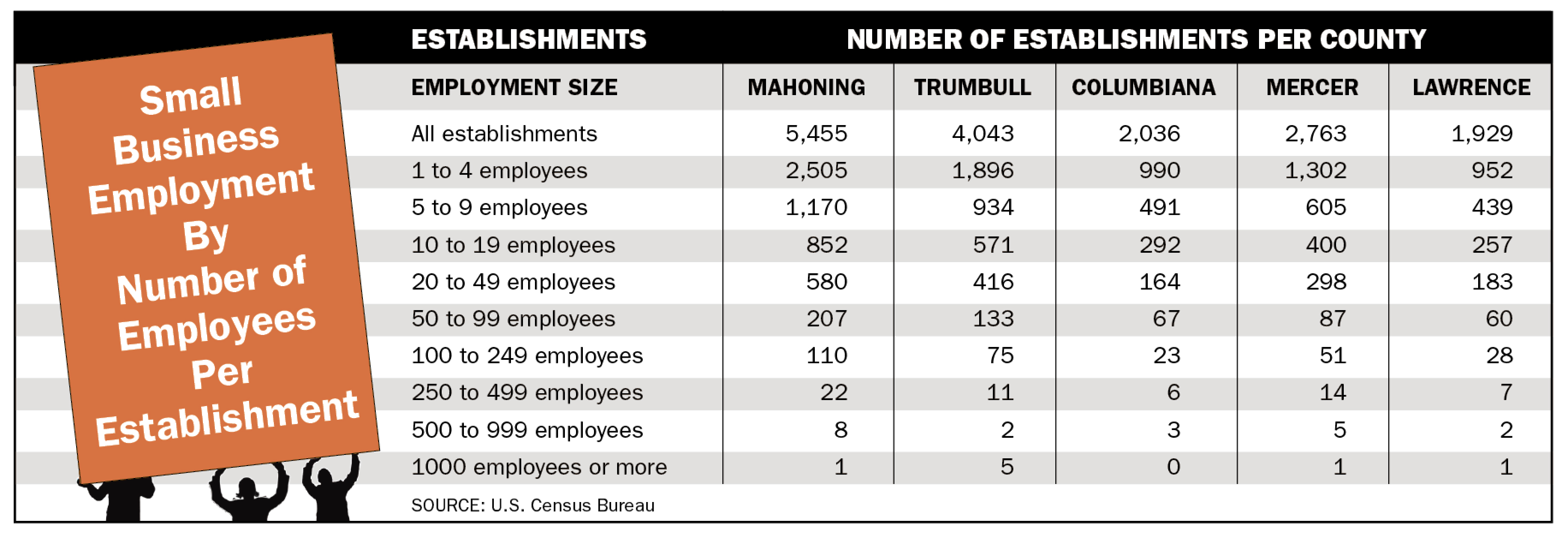

Still, the numbers confirm that the regional economy is driven by small businesses. The U.S. Department of Commerce defines a small business as one that employs fewer than 500 people and possesses less than $50 million in capital. In total, the 18,983 private-sector employers in the five-county region were responsible for 225,445 jobs in 2018.

In each county, the services sector – which includes health care, business, legal and educational services – boasted the largest number of jobs and establishments. During the third quarter of 2018, the service industry included 8,636 companies that accounted for 96,776 jobs throughout the five-county area – an average of 11.2 employees per business, according to data.

Employers in the retail trade provided the second-highest number of jobs with 48,228 positions filled over 4,030 employers, or an average of 11.9 employees for each establishment. While some of these data include big-box retailers, 31% in this sector are identified as eating and drinking places. During the third quarter of 2018, the five-county region reported 1,253 establishments that employ 19,183, or 15.3 employees per business.

Manufacturing proved the third-largest sector in the number of jobs, registering 29,770 total positions at 1,060 businesses in this classification. However, it was the sector with the highest concentration of employees per company – an average of 28 employees for each business.

These numbers are likely to be altered downward in the wake of the layoffs at GM. Trumbull County, for example, reported 11,056 jobs at 306 manufacturers during the quarter at an average of 35.8 employees per business. The layoffs at Lordstown, plus the residual effect on its suppliers, could lower that number by more than 2,000 direct jobs, the bulk of which are in Trumbull County.

The nature and volume of manufactured goods vary from county to county, according to the analysis. In Mercer County, for example, most manufacturing employees – 1,869 – worked at 25 companies that produced industrial and commercial machinery and computer equipment, averaging about 75 employees per business. Columbiana County boasts a heavy concentration of manufacturing activity in this sector too, as 49 establishments employed 1,126, or 23 employees per company.

Trumbull County, on the other hand, reports there are 2,187 employed at 47 businesses in its largest manufacturing subsector, the fabricated-metals products industry (excluding transportation equipment and machinery). An average of 46 were employed at each of these businesses, data show.

Mahoning County also displayed a large concentration of employment at fabricated metals firms, registering 60 companies that employed a total of 1,775, or an average of 29.6 employees in each company. Industrial and commercial machinery and computer equipment proved the second-highest subsector with 1,577 employees across 81 companies, averaging 19.5 employees per business.

The construction industry – the bulk of which are local contractors and builders – employed 10,389 people during the third quarter. According to Dunn & Bradstreet’s analysis, there were 1,221 employers in this sector that on average employed 8.5 people at each business.

Carol Potter, president and CEO of the Better Business Bureau of the Mahoning Valley, agrees that support for small business is a critical component to the economy of the region.

“Small businesses make a big impact in the Mahoning Valley, especially during times of change in the marketplace,” Potter says. “These businesses give people opportunities to achieve financial success while encouraging local innovation and job creation.”

Small businesses have an advantage in that they can respond faster to customer demands and issues, Potter observes. “Small businesses are nimble and can easily adapt to market disruptions through boots-on-the-ground customer service and strategic product improvement.”

Activity in the small-business sector improved in the first quarter, reports Michael Conway, executive director of The Mahoning Valley Economic Development Corp. “Lending is very brisk,” he says.

MVEDC administers the Small Business Administration 504 Loan program for this region. “There’s significant demand and activity,” he says.

During the first three months of 2019, MVEDC administered $3 million in loans to 15 companies. During an average first quarter, the agency would normally have lent out less than $1 million, Conway says.

“There are a smattering of startups in this mix,” he notes.

MVEDC is pursuing additional funding for a second loan fund, which Conway says has the support of local banks. MVEDC is also working with the Youngstown/Warren Regional Chamber, the Western Reserve Port Authority and the Eastgate Regional Council of Governments in developing a strategy to attract new businesses to federally designated opportunity zones in Youngstown and Warren.

Copyright 2024 The Business Journal, Youngstown, Ohio.