Tax Authority to Look at Incentives for GM Battery Plant, $60M It Owes Ohio

YOUNGSTOWN, Ohio – The Ohio Tax Credit Authority is slated to decide at its meeting Monday whether to force General Motors LLC to repay $60 million in tax incentives that it received a decade ago to retool its Lordstown complex.

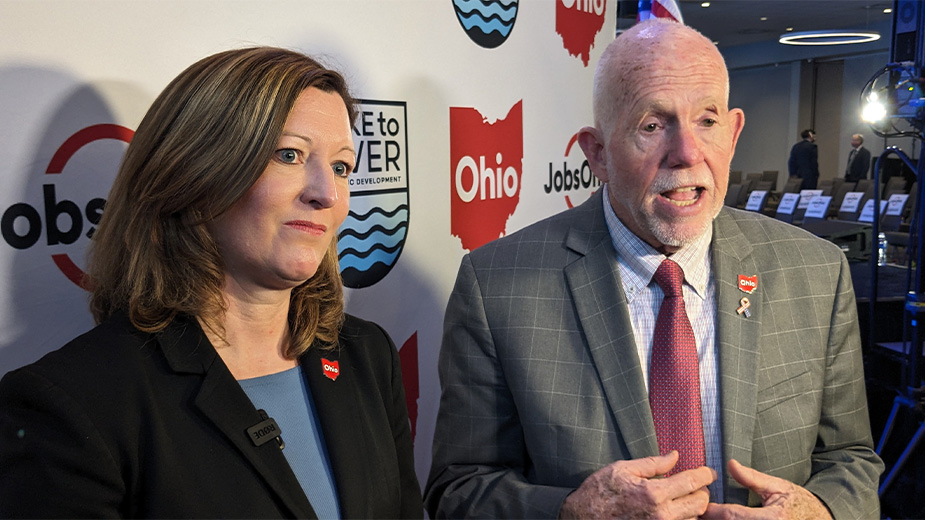

Also on the agenda are potentially new tax credit incentives targeted for GM’s joint venture with LG Chem – Ultium Cells LLC — a $2.3 billion electric-vehicle battery plant under construction in Lordstown (pictured above). The value of Ultium’s tax credit proposal has not been made public.

Ohio Department of Development Services spokesman Todd Walker said that at as of late Thursday, both measures were scheduled for Monday’s meeting.

However, the agenda is subject to change. The two issues were scheduled for the tax authority’s previous meeting on Aug. 31 but were pulled at the last minute.

Gov. Mike DeWine said the following day that the decision to table the GM issues allows time for the automaker and the state to engage in constructive dialogue about possible additional investments in Ohio.

“While they do owe this money because they didn’t carry out the terms that they said they were going to do, we’re looking for an avenue whereby we could encourage more investment in Ohio and whereby reach an agreement with General Motors,” DeWine said.

Should the tax authority order GM to repay the incentives, it would be one of the largest clawbacks in U.S. history, specialists have said.

In June, The Business Journal and ProPublica reported that the state informed the automaker in March that it was in violation of two tax credit agreements the company signed in 2009. The agreements – worth $60.3 million — stipulated that GM would maintain employment at the Lordstown Assembly Plant until 2040.

GM has argued that it shouldn’t repay those incentives, or at least a substantial portion of them, according to documents obtained by The Business Journal and ProPublica.

The automaker cited deteriorating market conditions in the small car segment as a major factor in closing the plant, which at the time produced the Chevrolet Cruze.

GM emphasized that the state should consider its $2.3 billion investment to build and operate the new Ultium plant in Lordstown, as well as its other operations in Ohio, and that it far exceeded its investment in the Lordstown plant while it was operating.

The state awarded two incentives agreements to GM – a job creation tax credit agreement worth $14.2 million and a job retention tax credit deal worth $46.1 million in 2009. In return, GM agreed to keep its Lordstown complex operating until 2040.

GM shut the Lordstown plant in March 2019, eliminating about 1,600 factory jobs there.

In July, Ohio Attorney General David Yost filed an amicus brief before the tax authority, demanding that the regulatory body hold GM accountable for the full tax bill.

“It’s clear cut,” Yost told The Business Journal last month. “They took the tax credits, then they took the jobs.”

Copyright 2024 The Business Journal, Youngstown, Ohio.