Tax Incentive Review Council Recommends Revoking Chill Can Abatement

YOUNGSTOWN, Ohio – The city’s Tax Incentive Review Council on Tuesday recommended that incentives awarded to the failed Chill Can project be rescinded after years of inactivity at the site.

“It is our goal to recover what was lost during the years he’s received the tax abatement,” said Stephanie Gilchrist, director of economic development.

It’s still unclear how the city will accomplish this, Gilchrist acknowledged, since the matter is still tied up in foreclosure litigation. “That’s what we’re trying to figure out now,” she said.

The TIRC’s recommendation to rescind the abatement would have to go before City Council, which would vote on legislation to terminate the tax breaks.

M.J. Joseph Co., the Irvine, Calif., developer behind the Chill Can project on the city’s East Side, promised to invest $18.8 million to construct a research and manufacturing campus for self-chilling technology, including beverage cans.

In 2017, the company signed an enterprise zone agreement with the city that awarded the project a 75% tax break on new construction over 10 years at the site. M.J. Joseph promised to create 237 jobs and make the investments. The company constructed three buildings, but all of them are empty.

According to the latest TIRC report prepared for the city, the company reported a single employee as of Dec. 31, 2022, who was paid $13,946; it reported zero employees as of Dec. 31, 2023. The report further shows a total investment of $4.7 million.

Moreover, records from the Mahoning County Auditor’s office show that M.J. Joseph owes a total of $42,033.78 in property taxes on the abated portion of the property. Of that number, $22,813.74 is delinquent.

Auditor’s data show that the company last made tax payments to Mahoning County on Aug. 5, 2022, of two installments of $5,821.36 and another of $582.14. It has not made payments since. Dozens of other vacant parcels at the site also show delinquencies ranging from $3 to $15 apiece.

Nevertheless, the company realized property tax savings of $34,735 just in the 2022 tax year alone, according to the most recent TIRC report.

In addition to tax incentives, the city in 2017 awarded the project a $1.5 million development grant provided that the company meet its job and investment targets, plus incurred additional expenses in demolition and relocation costs for residents at the site.

A Mahoning County Common Pleas Court ruled last year that M.J. Joseph owes the city $1.5 million for breach of contract and another $733,480.80 in sanctions.

Yet the issue is still part of a foreclosure action filed by engineering firm MS Consultants nearly two years ago. The city joined the action and recently filed a motion for a summary judgment in Mahoning County Common Pleas Court seeking an order to force the sale of the property and buildings.

First Meeting in Two Years

The TIRC’s meeting Tuesday is the first in nearly two years — a period of little or no oversight of its enterprise zone program. City officials have said the board couldn’t gather a quorum and the city lacked the personnel to compile information as to whether companies were abiding by their hiring and investment targets.

The board recommended continuing seven agreements Tuesday. These include Fireline Inc., VAM USA LLC, Gasser Chair Co., Wells Associated Renaissance Partners LLC Strollo Architects, Youngstown Stambaugh Hotel LLC, Youngstown Campus Associates LLC and Youngstown Tool and Die Co. LLC.

However, board member and 1st Ward Councilman Julius Oliver had questions regarding the Fireline and Youngstown Tool and Die agreements.

“There’s very little hiring of city residents,” Oliver said after reviewing Fireline’s report.

According to data provided to the city, Fireline reports 11% of its employees are city residents. It also reported hiring seven people in 2023, but all were nonresidents.

Brian Clinkscale, the new director of the city’s Human Relations Commission, said he visited the company and noted that one of the issues is that it has been difficult to attract job applicants in general, let alone applicants who live in Youngstown.

“I sent them a lot of names from our workforce database,” he said. “I do know of one person from that database that did get an interview. I’d like to follow up with them and see exactly what they’ve done since.”

Also, board members expressed concern over Youngstown Tool & Die’s commitment to start an apprentice mentorship program associated with the city schools, which was part of its enterprise zone agreement.

That program, however, is not in place, officials said.

“When they seek incentives from us, it just can’t benefit them,” Oliver said. “The reason, I believe, there’s so much unemployment in the city is because of this stuff going back decades.”

Oliver said it was time to “start over,” as there is a new human relations commission director on board. “We need to come up with those programs and say, ‘This is what we require within our tax abatement program,’” he said.

Board Chairman Ralph Meacham, Mahoning County auditor, suggested that the TIRC meet more frequently instead of annually to go over reporting data.

The board agreed to a tentative time frame of early November for a subsequent meeting.

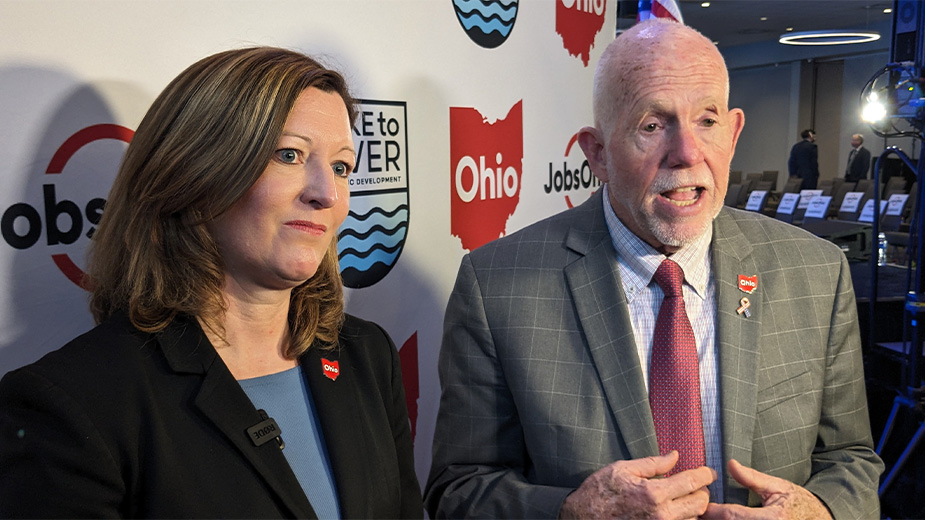

Pictured at top: The vacant Chill Can site in Youngstown.

Copyright 2024 The Business Journal, Youngstown, Ohio.