Tax Incentive Review Council Suggests Chill-Can Town Hall

YOUNGSTOWN, Ohio – The city’s tax incentive review council is proposing a virtual public forum related to The Joseph Co. International’s Chill-Can project on the East Side.

“I received a lot of phone calls regarding the West Coast Chill-Can plant,” said Jonathan Bentley, executive director of the city’s human relations commission. He said residents have questions regarding the progress of the project and would like to interact with those involved in the development.

The council, which hasn’t met since late last year because of the coronavirus pandemic, held a virtual meeting Tuesday that was broadcast live over the city’s YouTube channel. The committee reviews the performance of companies that receive tax abatements and pledge to create a certain number of jobs in return.

In 2017, Joseph Co. received a 75% tax abatement for 10 years to help with the development of what the company says will be a $20 million manufacturing, distribution and technology campus. Chairman Mitchell Joseph said the complex would produce the world’s first self-chilling can and yield the creation of 237 jobs.

The city also provided the project with a $1.5 million water/wastewater grant and spent another $360,000 to acquire and demolish houses that once stood at the site.

Ground was broken on the project in November 2016. A single can has yet to be produced and just a few people have been hired.

Bentley’s office assesses how companies comply with fair employment standards and whether those receiving city tax breaks are making a good-faith effort to hire city residents, women and people of color.

Bentley said he’s had difficulty getting a response from the company regarding progress at the site, and pondered whether it would be beneficial to host a virtual town hall event that would address many of the concerns or questions people have with the project.

“I think it’s an excellent idea,” said First Ward councilman Julius Oliver. The councilman said that he too has received numerous phone calls about the project and wants the public to understand that the city has limited control over the development, but is hopeful it will succeed.

Mahoning County Auditor and tax incentive review council chairman Ralph Meacham added that the forum should include representatives from The Joseph Co. as well.

“I think the only way it would be effective is if we have a spokesperson from that company,” he said.

When a company that receives tax incentives is unresponsive to a city official’s requests, the council should follow-up with a formal letter, Bentley noted.

“There should be an open line of communication to any company receiving incentives,” he said.

The Joseph Co., based in Irvine, Calif., initially wanted to begin production in 2018, but the timetable has consistently been pushed back. Two buildings were built in 2017 and a third building is now under construction at the site.

In May, The Business Journal and ProPublica co-published a lengthy investigative story on the city’s enterprise-zone program and spotlighted the Chill-Can project. The story found that about half of the companies receiving tax incentives over the last 30 years had failed to create the number of jobs promised.

T. Sharon Woodberry, the city’s director of economic development, said she’s reached out to a number of companies who say they’ve experienced difficulty because of the pandemic, which has resulted in fewer jobs in some locations.

But those numbers would not be reflected on the review council’s next annual report, which will assess company employment activity in 2019. That report should be compiled within the next several weeks and members will evaluate the performance of these companies at the annual meeting, tentatively scheduled for September.

Much of the discussion at the tax incentive review council meeting focused on how the city could improve accountability from those companies that do not comply with hiring targets identified in their incentives agreements.

Oliver said one solution is an idea that was raised during a virtual town hall meeting hosted by The Business Journal and ProPublica in June. Other cities, he noted, have had success in providing a portion of tax abatements to companies up front for, say, the first five years of the agreement. Once they reach their hiring goals, the remainder of the incentives would be awarded during the second half of the term.

Should the company fail to hit that target during the first five years, then the city could terminate the incentives agreement, he said.

Traditionally, the city provides a 75% tax abatement over 10 years to companies on the value of new construction.

Oliver added that the city must also find a way to ensure that its residents have an opportunity to apply for jobs from companies receiving tax incentives.

Bentley said that he and others are updating the city’s workforce database that would enable a more aggressive outreach effort to these companies who are hiring.

“I think it will be a vital tool for this year and going forward,” he said.

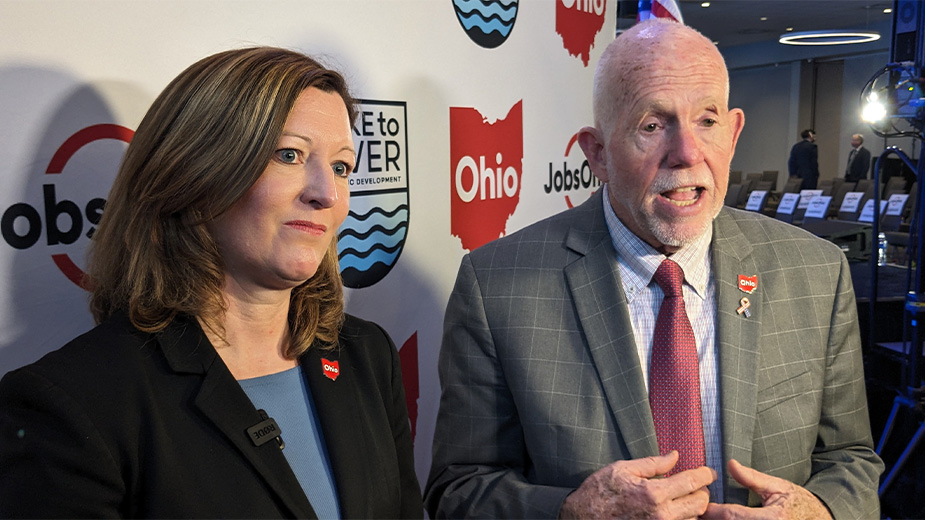

Pictured at top: Two buildings constructed in 2017 have yet to begin production of the patented Chill-Can. Photo: Maddie McGarvey for ProPublica.

Copyright 2024 The Business Journal, Youngstown, Ohio.