Tax Incentive Review Council Votes to Keep Abatements, Including Chill-Can

YOUNGSTOWN, Ohio – The city’s Tax Incentive Review Council on Thursday agreed to continue all 13 enterprise zone agreements it holds with various businesses, including the ill-fated Chill-Can development on the East Side.

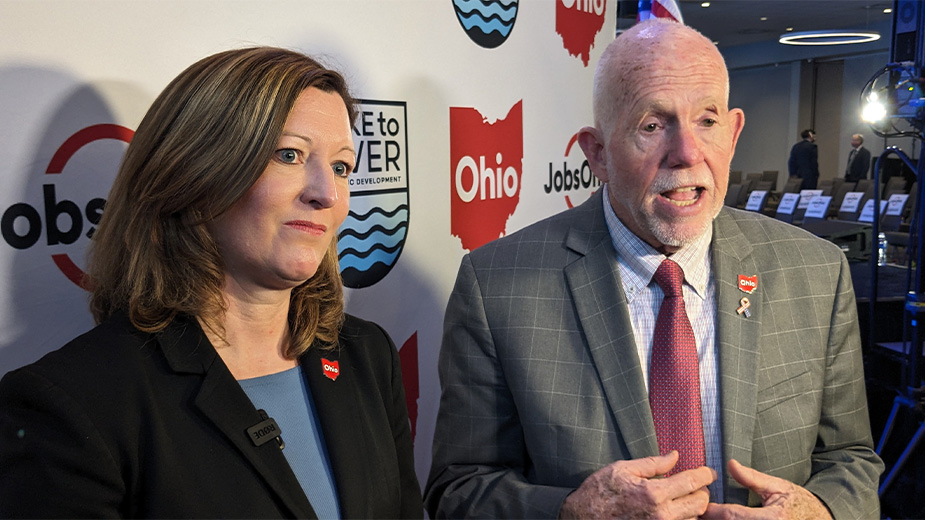

“We’re leaving it to the law department in terms of how to handle that,” said T. Sharon Woodberry, the city’s economic development director said of the Chill Can project.

The city and M. J. Joseph Development Co. are embroiled in a legal dispute over the land and incentives that were awarded the project in 2017. In 2016, the developer announced it would construct a 22-acre “Chill-Can” campus on land bound by Oak Street, Fruit Street, Himrod Avenue and the state Route 7 expressway.

Four years ago, the city entered into an enterprise zone agreement with Joseph Development, awarding the project tax abatements of 75% over 10 years in return for the creation of at least 237 jobs by August 2021. However, the company has hired just two employees – presumably security – and three buildings at the site remain empty.

The site was to be a manufacturing operation for Joseph Co. International to produce the world’s first self-chilling can. It was also to serve as a research hub to develop new self-chilling technology for the military and other industries.

Woodberry said the abatements took effect during the 2019 and 2020 tax years. The incentives are based on the auditor’s value of just two of the buildings – amounting to about $1.3 million – and not the full project investment.

According to the city’s calculations, the abatement reduced Joseph Development’s tax bill by about $55,000 in 2020, Woodberry said. Numbers for 2019 were not available.

“It’s not what they expected it to be,” she said, noting the buildings are not completed and functional.

In March, the city warned Joseph Development that it was in default of the enterprise zone agreement and another development agreement that awarded the project a $1.5 million grant. The city said it would take legal action to secure the land and claw back all of the incentives, including recouping costs the city spent to demolish existing houses in the area to make room for the project.

Instead, Joseph Development filed a lawsuit in Mahoning County Common Pleas Court in May, alleging the city had no right to take the property or incentives. The city countersued, claiming damages of more than $2.8 million.

The case is set for trial Aug. 23, 2022 in Judge Maureen Sweeney’s courtroom.

Woodberry told the committee that business is strong for those companies that currently hold enterprise zone agreements with the city. However, the biggest challenge for them at the moment is finding workers to fill open positions, a trend evident in every economic sector in the country.

“All the employers have expressed the economy is much better,” she said. Yet the biggest frustration facing these companies is that they can’t find qualified employees to hire.

“We’ve always had that imbalance, but I think we’re seeing it amplified now,” Woodberry said.

These challenges are reflected in the review council’s annual report, which tracks the performance of companies that received incentives in terms of investment and job creation. The council reviewed 13 companies that held active agreements in 2020.

Overall, these companies pledged to create a total of 613 jobs as part of their agreements. In 2020, that number stood at 159, mostly because of the ramifications of COVID-19 and a tight labor pool.

Investments, on the other hand, are on track. According to the review council’s annual report, total real and personal property investment from these projects stood at $156.4 million, just under the committed number of $158.6 million.

First Ward Councilman Julius Oliver questioned why some projects are still receiving incentives when they fail to meet metrics such as hiring city residents.

He noted one project in particular, Youngstown Campus Associates LLC, which built the Enclave student apartments along Wick Avenue. In 2019, the complex reported employing 39, six of which were city residents. In 2020, the building employed 32, but reported zero city residents as employees.

“They’ve not hired Youngstown residents,” Oliver said. “We should put them on notice so its doesn’t continue.”

Woodberry responded by saying that it would be best to follow up with the company for an explanation. She speculated that these employees could have been students at Youngstown State University and COVID could have affected their jobs.

On the other hand, Oliver praised projects such as Youngstown Stambaugh Hotel LLC, which developed the DoubleTree by Hilton downtown. “The hotel does well with hiring city residents and minorities,” he said.

The hotel reported all 18 of its employees were city residents, 28% of whom were minorities.

Woodberry also reported on two new projects now underway at the Salt Springs Road Business Park. Youngstown Tool and Die has moved into the former Exterran Energy plant, while work has begun at the city-owned Ameritech call center building to accommodate Kempthorn Collision Center.

Youngstown Tool and Die has retained 46 positions at the site and has pledged to create 40 more over a three-year period.

Kempthorn has started some renovation and expects to occupy the former Ameritech building in January. In July, the city negotiated a lease/purchase agreement with the company. Kempthorn wants to invest $450,000 in improvements and another $500,000 in equipment in the project. The company plans to employ 22 people.

Among the biggest challenges facing companies in the city is attracting a qualified workforce, Woodberry said. That’s instigated conversations with organizations such as Flying High Inc., Mahoning and Columbiana Training Association, the Youngstown Warren Regional Chamber, and other resources to help connect companies that receive incentives with training programs.

“I’m talking to them about the employers we have,” Woodberry said.

Copyright 2024 The Business Journal, Youngstown, Ohio.