They Succeed in Companies Typically Owned by Men

YOUNGSTOWN, Ohio – Being a woman who owns and runs a business is not harder, just different, the five female business owners profiled below agree.

Like successful men, these successful women get up early, stay late at work, strive to meet their customers’ needs, work with their accountants, bankers and lawyers, and know what it takes to meet payroll. Unlike men, they put more effort into balancing work and family life, that is, being the primary caretaker of their children.

One, Diane Sauer, didn’t start her family until she was 35. Another, Aafke Loney, dropped out of the workforce to rear her four children. Dawn Ochman’s children are grown. Amy McDevitt Cannon and Erica Royster are single moms who make time to be involved in their children’s interests.

But they all know that no one is going to cut them any slack because they’re female business owners.

This MidMarch edition of The Business Journal, published this week, looks at female entrepreneurship by profiling these five women.

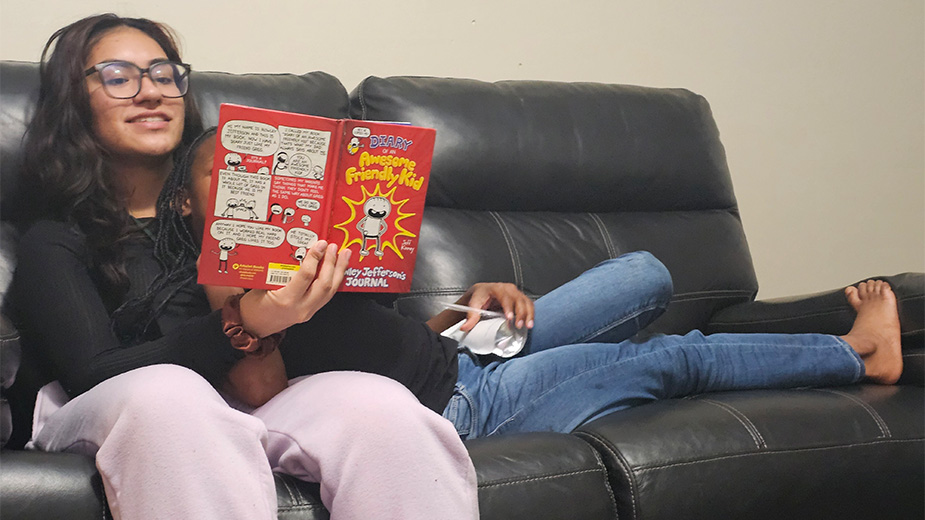

Erica Royster Never Tires of Work

Erica Royster (pictured above) learned to change tires as a teenager at her grandparents’ auto service center in downtown Warren and has never looked back.

She wants people to know, “I’m not a quitter.” When the Great Recession hit and business slowed – “It hurt us,” the manager of South Central Tire & Auto Service Co. says – but it never occurred to her to hang it up.

“For me, it wasn’t an option to close,” Royster says. “I talked it through with my grandfather [Cleo Royster]. We had to hang in there. We’d seen hard times before.”

Today she still changes and balances the occasional tire, still performs a front-end alignment when her four employees are swamped. Most of the 60 hours she spends each week at South Central Tire, though, are devoted to serving customers, controlling inventory and managing her staff.

“I have an amazing team,” Royster says.

The woman who today is manager and part-owner was a girl in 1994 as she watched the shell of the building at 260 South St. SE go up and as the equipment was installed.

Royster learned to change tires “by watching the guys,” she says.

Don’t be deceived by her well-manicured hands. This is a woman who gives added meaning to “I’m not afraid to get my hands dirty.” Because she has.

“Being black and being a woman has pushed me hard to succeed in the industry I’m in,” Royster says.

She learned the other aspects of running the auto service business from grandfather Cleo and studying business administration at Youngstown State University. She stays up-to-date by attending the annual meetings for managers held by the companies whose tires she sells, Goodyear, Kelly and Dunlop.

South Central Tire, which serves both consumers and commercial fleets, has annual revenues of $330,000, Royster says.

After graduating from Warren G. Harding High School in 2001, she enrolled at YSU. After three years there, “My grandmother got sick and I had to be here full-time.” It took doctors nine weeks to determine her grandmother suffers from sciatica.

“[Leaving school in 2004] was one of the hardest decisions of my entire life,” Royster relates, so she could help her grandfather full-time. Tipping her decision to work full-time was being “a single mom” with two young sons.

As the Great Recession worsened, Royster and her grandparents took stock of their situation. “We took a [financial] snapshot of the entire business,” she says, “from insurance coverage to inventory.” Helping them was Jerry Sutton, their CPA since 1999. Sutton says he was impressed by Royster’s determination and ability to see the situation clearly. “I was just the coach,” he says.

Also staying with South Central Tire was Cortland Banks. “They’re a good place to bank,” Royster says.

The reassessment led to reducing the inventory on hand to 200 tires. If South Central is out of a particular tire, “We can get it the same day,”

It’s the high quality of service customers receive that keeps old ones returning and draws new ones, Royster says. “I don’t want a customer just one time,” she elaborates. “Last week, a new customer came in and told me, “Someone referred me to you. I was told you’d give us a fair price and do a good job.’ That’s the best advertising.”

She’s proud that “in five years, we’ve had maybe five ‘comebacks.’ ” A comeback is a customer returning because the work on a tire wasn’t quite right.

She credits service manager Kenneth Cogswell and the education that schools such as the Trumbull County Career Center provide. Automotive apprentice Adrian Freeman, not yet 20, “did work-study while attending TCTC,” she notes, and earned a certificate [as a tire expert] as well as his diploma.

Besides rearing three children – her daughter will be 7 this year – she is president of the Southwest Neighborhood Association, which has 25 members, and active in the Willard School Parent Teacher Association. She also serves on two boards.

She is in discussions with her grandparents to acquire their share of the ownership and it looks as if the business will remain in the family. Her younger son, 13, has asked about washing and detailing cars this summer at South Central Tire.

“We’ve sat down to develop a business plan,” she says.

Aafke Loney’s Business Is Sports

Aafke Loney doesn’t play goalie on the ice at Covelli Centre but the co-owner of Youngstown Phantoms Hockey takes to heart, “The puck stops here.”

“As owner, the buck stops at your door,” she says, resisting the pun. “You’re responsible for everything. It’s easier to be a fan or a player.”

Loney grew up on a farm in southern Alberta, Canada, played basketball, volleyball, ran track, and yes, played ice hockey when she could. Being a girl, it was hard to field a team and the boys’ teams didn’t accept girls.

In 1985, she graduated from Dordt College, a small Christian institution in Sioux Center, Iowa, with a B.S.W., only to discover social work wasn’t the career she wanted. She was an after-school counselor a year before leaving to enter retail. Loney earned her MBA at Chatham University in 2011.

In between, she married her husband, Troy, who played 12 years in the National Hockey League, including for the Pittsburgh Penguins, and stayed home to rear three sons – Reed, Ty and Clint – and a daughter, Aafke. Son Ty, 23, plays for the Wilkes-Barre Penguins.

Being out of the workforce 20 years made it a challenge to return, one reason she pursued her MBA, she says. “There are so many educated women who stay home,” she adds. “You have to keep a foot in the door” to get back in.

Loney has returned full-force. Besides joining her husband, also a co-owner, she is a part-time instructor at Youngstown State University where she teaches sports marketing. And with Christine Ricci, who’s on the adjunct faculties of Chatham and Carlow universities in Pittsburgh, Loney co-founded Business and Educated Connected, a “college and career development company. We help students determine their strengths,” she explains.

As a co-owner of Phantoms Hockey, Loney brings a different perspective to the business of sports. When “men look at it as a game, I look at it from an entertainment perspective,” she says. “I look at hockey for health. I look at it as community outreach.” In her goal of drawing and keeping fans, “I look at it from a strategic standpoint,” Loney says. “It takes a long time.”

One aspect of her strategy is Power Play, where the Phantoms donate used ice hockey equipment to high school students in the Mahoning Valley interested in playing the game. If an ice rink isn’t available, Loney wants them to play street hockey, similar to ice hockey but the players wear roller skates instead. And she wants girls to play.

While Loney wouldn’t describe herself as a second mother to the teenagers on the Youngstown Phantoms, her efforts in their behalf as co-owner very much suggest that role. She recruits and vets families who will provide a home while they play for the hockey team. Moreover, she sees to it that they stay current with their studies.

She and Troy Loney “spend most of our working hours” tending to Phantoms business.

Owning a small business such as Phantoms Hockey is like playing the game, Loney says. “It’s a fast game with many pieces, which means you have to be able to adapt quickly. Adaptability is a good word. A small company allows you to adapt more quickly.”

Amy McDevitt Cannon Follows Her Father’s Footsteps

Amy McDevitt Cannon, owner and president of Phoenix Corrugated Container LLC, is her father’s daughter.

When she grew up in Salem, she spent her summer vacations during high school at his Sebring Container Corp. on Benton Road. There she watched Bill McDevitt run his business, taking his example to heart and doing “everything from data entry to working on the floor. …

“He enjoyed his passion for helping [customers],” Cannon says. “I went with him on sales calls and watched how he treated them. He wanted to help them find solutions, not just be an order taker.”

McDevitt graduated from the University of Mount Union where he majored in biology. Cannon graduated from Mount Union where she majored in biology.

Upon graduation, McDevitt returned to Salem to run the business his father had founded. Her goal upon graduation was to continue to engage in anti-biotic resistant research. The hours she spent by herself in the biology labs at Mount Union made her feel isolated. “I missed the interaction with people,” she says, and reconsidered her career.

She knew the cardboard container business from the ground up and returned to Sebring Container full-time upon graduation, rising to become general manager in 2006. Cannon, the oldest of three daughters, says she was the only one to have an interest in following her father. One sister is a banker, the other a lawyer.

When fire destroyed Sebring Container in 2012, Cannon determined to rebuild. Her father’s health kept him from fully participating.

The challenge before her was intimidating. She had to find a site, buy equipment, recruit qualified employees, identify customers and secure financing. And as a single mom she had a son, Noah (now in seventh grade) to rear.

Cannon, who had become a sales representative for another cardboard company, went to the Salem Area Sustainable Opportunity Center where she met its founding executive, Larry Kosiba, in April 2014.

Kosiba introduced her to the people she needed to become an entrepreneur and write a business plan. One was Greg Yaskulka, a vice president and commercial lender at Huntington Bank, the largest Small Business Administration lender in the Midwest. “Huntington was on board from the beginning,” Cannon says.

“Greg helped on the SBA side. It was a very fluid process. Everything went smoothly. We applied in April [2014] and the loan was funded in November.”

Phoenix Corrugated held its ribbon cutting the following spring in Salem Industrial Park with Lt. Gov. Mary Taylor and Columbiana County Commissioner Tim Weigle joining members of the Salem Area Chamber of Commerce at the open house. Also on hand were her parents, Bill and Cheryl McDevitt, and Noah.

It was the culmination of Cannon finding and leasing a suitable building, then overseeing the installation of three machines that shape paper and cardboard into boxes, glue their sides together, then print those sides and band the boxes to skids.

The Phoenix workforce of four, all former employees of Sebring Container, was happy to return to Salem, Cannon says. All had found comparable jobs but had to drive an hour or longer each way.

Keeping and checking off items on her lists is essential to balancing her personal life and work life. “I even plan out our dinners a week in advance,” she says.

Cannon arrives early and stays late. “I’ve worked Saturdays. I put in 10-hour days,” she says. When there’s a crunch, she doesn’t hesitate to join her four male employees on the shop floor.

While the container industry remains “male-dominated in this area,” Cannon says she has no trouble scheduling sales meetings because “so many purchasing agents are women. That’s not an issue.”

Key, she says, is “a satisfied customer.” And keeping a customer satisfied is “providing solutions.”

Internal administration is “time-consuming” and takes away from the time she would rather spend “developing relationships.”

“The work-life balance is the hardest,” Cannon says. She drives Noah to and from school and relies on her parents to look after him on days when he’s not involved in after-school activities. (They live a mile apart.)

Cannon keeps fit by running. “I’ve run half-marathons the last four years,” she says. At Salem High, she ran cross country. She hurled the discus on its track team and at Mount Union.

Throwing the discus is “a balance of strength and technique,” Cannon says, which also be said of running a small business.

Diane Sauer’s Example Leads the Way

Diane Sauer has the highest profile in the Mahoning Valley as a female entrepreneur and business owner.

The owner of Diana Sauer Chevrolet Inc. in Warren appears in her own television advertisements, but that’s only part of why people stop her to chat in the supermarket and other public venues.

“You’re that car dealer lady,” many tell her as they fumble for her name. Sauer smiles, taking it in stride.

“One of the biggest challenges is getting noticed,” she continues, a major reason why she appears in her TV ads.

“I was told I should do my own ads. I was told I need to brand myself.”

Besides running a successful business, she gives back to the Warren community as a charter member of the Trumbull 100 – she’s a former chairwoman – as secretary of the Community Foundation of the Mahoning Valley board, chairwoman of Mahoning Valley Economic Development Corp., and sits on the boards of the Diocese of Youngstown Foundation, the Rotary Club of Warren Foundation and the Children’s Rehabilitation Center of Warren Foundation.

Not surprisingly, she’s asked to speak about her career and achievements in an industry still male-dominated (although not nearly as much so, she points out).

“The glass ceiling is still there,” she says, “but it’s been broken or punched through, however you want to say it.”

Young women attending Youngstown State University career days were eager to learn more about her experiences, surrounding her and slowing her exit after she spoke in Kilcawley Center.

Most recently, Sauer was the keynote speaker at induction ceremonies for YSU’s chapter of Beta Gamma Sigma, the business honorary society.

“What you see is what I am,” she says in her office on the second floor of her dealership in downtown Warren. “It’s not harder for a woman. It’s just different.”

Making it easier for her and other women in the industry, Sauer says, is that “General Motors has a big initiative, a women’s network.”

Sauer didn’t set out to sell cars or own a dealership. After finding she enjoyed bookkeeping classes at Coldwater High School in western Ohio, she went to The Ohio State University to study accounting. There she found that she preferred cost accounting to financial accounting.

At Ohio State, Sauer met her husband, Kurt, a civil engineering major preparing to enter his family business in Cortland after graduation.

The Sauers came here in fall 1975, confident the mills owned by Youngstown Sheet & Tube Co., Republic Steel Corp. and U.S. Steep Corp. would continue to turn out steel as they always had.

“I thought the jobs would be here,” she says, and that she would work in the accounting office of one of the steelmakers.

It didn’t work out that way. Black Monday in September 1977 changed everything and Diane Sauer went to work for Martin Chevrolet in Warren, starting out as an office manager trainee in is accounting department.

Her performance led to promotions and increasing responsibility and as general manager she realized she could run a dealership.

So when Paul E. Martin, who founded the dealership in 1958, prepared to retire, she sought to acquire it. The dealership became Diane Sauer’s Martin Chevrolet before the reference to the founder was dropped.

Selling cars has undergone a sea change since Sauer joined Martin but the basics remain the same, she says. The Internet has made selling cars “in some ways easier because the customers have educated themselves,” she says. They know what they want and how much they should pay.

But “people skills” underpin car sales, Sauer says. “You have to communicate well with your employees. You have to be fair and educate your employees.”

GM offers online training courses to supplement what Sauer Chevrolet teaches.

“It takes a new salesperson two months to be fully trained,” she says.

“I, as a dealer, am required to conduct training. And the technology advances offer more challenges for our staff to learn and keep up.”

She credits her senior staff for her success and that of the dealership and is proud of the low turnover.

“Our parts manager has been here four years longer than me,” she relates, “and I have an excellent general manager in John Maze. He’s been here 26 years.”

Dawn Ochman Builds Construction Business

Dawn Ochman goes against type. Then again, maybe not.

She’s an entrepreneur who owns her own business, Dawn Inc., which she founded 23 years ago when she was 25. And her company is on track to achieve $10 million in revenues this year.

“We’ll hit $10 million this year for sure,” she says emphatically. “The orders are booked.”

She has “seven open projects” at present but has completed projects “all over the country [including New Mexico and Kansas] although the majority are in Ohio and Pennsylvania.”

In 2013, Gil Goldberg, director of the Cleveland district of the U.S. Small Business Administration, recognized her achievements when he presented her with the SBA Great Lakes Region’s runner-up Woman in Business Champion award.

Dawn Inc., with offices in Chase Tower in downtown Warren, has 26 employees. Ochman arrives early and stays late.

“I’m here at 9 o’clock a lot of nights,” she says in her office on an afternoon in early March. “You won’t find me in front of a TV very much.”

Ochman majored in accounting at Youngstown State University, where she returns once a year to teach an SBA-sponsored class.

Dawn Inc. has low employee turnover, she says. “Employees come and they stay,” the owner says.

Ochman gets up at 6:30 a.m., works hard, puts in long hours. Her employees like working for her and she’s quick to reciprocate: “I feel very grateful for such an excellent staff.” And her company is profitable.

Sounds like Ochman has all the attributes of a successful entrepreneur or business owner, right?

So how does she go against type? Because she owns a general contracting and construction company that does the majority of its business with the federal government. Most employees of Dawn Inc. are carpenters and laborers.

“Women” and “construction” are rarely used in the same sentence. So when Goldberg handed her the Great Lakes Region’s runner-up award, he noted, “She’s set an example for women in business across northern Ohio.”

After graduating from YSU in 1989 – Ochman completed the coursework in three years – she learned the construction business by working for another company. “I thought I could do it better,” she says, and so set out on her own.

In her 23 years, she has learned the complexities of bidding on federal contracts and won bids to build projects at the 910th and 911th airbases at Youngstown and Pittsburgh, for the Army Corps of Engineers, departments of Labor and Energy and for the General Services Administration. She also benefited from a Small Disadvantaged Business certification in 2009 toward the end of the Great Recession and a Woman-Owned Small Business Certification.

One key to her success was mastering the minutiae of construction, not just the many arcane details to submit a bid for a federal contract. “I have to know the questions to ask,” Ochman says. She also has a good relationship with her banker, Kevin Dougherty, a commercial lender at Huntington Bank who works with the SBA. “He’s a good banker,” she says.

Another key is “to believe in myself.” She pauses. “You have to know your weaknesses, embrace them and learn from them,” she adds as she laughs.

Copyright 2024 The Business Journal, Youngstown, Ohio.