Clean Energy Future LLC Presents Case for 100% Tax Break to Build $900M Energy Plant

WARREN, Ohio — A public hearing Wednesday morning to discuss the potential for development of a second Clean Energy Future power plant in Trumbull County called into question the proposed 100% property tax abatement for the project.

Through an Enterprise Zone agreement with the county, Clean Energy Future Trumbull LLC is requesting a 100% tax abatement for 15 years for the Trumbull Energy Center project, which would be built at the Lordstown Industrial Park of state Route 45.

This would be Clean Energy Future’s second natural gas fired electricity plant in the county. Its first project, the Lordstown Energy Center also in the industrial park, reached full operations this year. Plans for a third plant were scrapped when the Ohio General Assembly passed House Bill 6 in 2019.

Clean Energy Future is in the process of financing the Trumbull Energy Center, which includes a little more than $900 million in investments, said Steven Remillard, the company’s vice president of development. Clean Energy looks to start construction in September with a 36-month construction period, after which it will hire 22 full-time workers within three years of the project’s completion.

Similar to the Lordstown Energy Center, the Trumbull Energy Center would be outfitted with a 940-megawatt thermal turbine, which is enough to power some 900,000 homes, Remillard said.

Wednesday’s planning commission meeting was a public hearing, so the commissioners didn’t take a vote on the abatement. No members of the public attended the hearing, but residents will have an opportunity to offer commentary at forthcoming Lordstown Village Council and Trumbull County commissioner meetings when final votes will take place.

Both the Trumbull Career and Technical Center and the Lordstown Board of Education have approved the agreement.

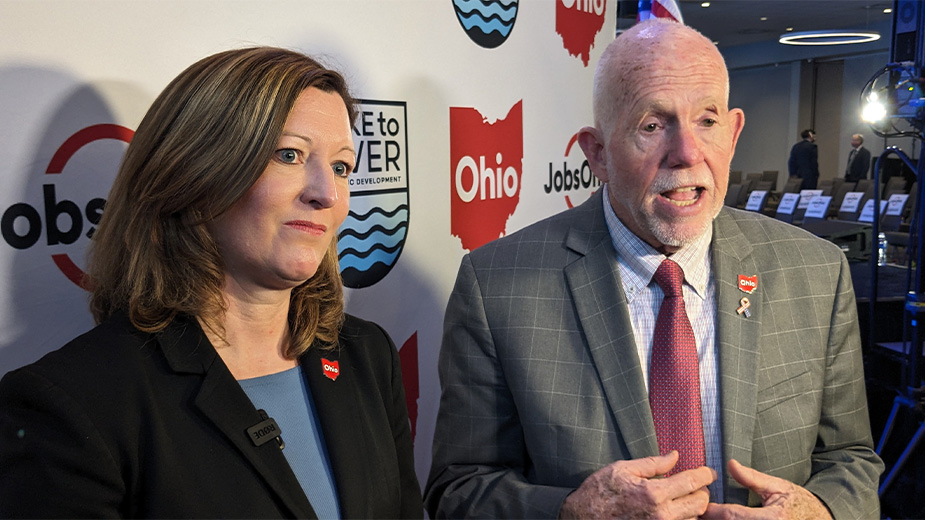

During the meeting, Commissioner Niki Frenchko questioned the need for a 100% tax abatement for the project and wanted to know who was negotiating on behalf of the county to “ascertain at least a portion of the property tax,” she said.

“I come from a background in real estate where no one ever gets 100% of what they ask for,” Frenchko said. “They’re already here. They already have one industry here. It’s more advantageous for them to continue here in Trumbull County as opposed to going somewhere else. So who is negotiating and just giving everyone 100% of what they’re asking for?”

Frenchko noted dissent from TCTC’s vote, which approved the abatement with an 11-7 vote, as reported by the Tribune Chronicle. Board member Dan Denman voted against the request, saying Clean Energy’s commitment to hire 22 people wasn’t enough to warrant an abatement, the Tribune reported.

“That is not worthy of a tax abatement, in my opinion. I understand it will be 22 jobs, but 22 homes don’t generate enough income for one student to go to school. That is why I have a hard time with this,” Denman said at the time.

When Frenchko asked Remillard if it was true that Clean Energy Future wouldn’t consider Trumbull County for the project without the 100% tax abatement, he said it is “when you apply the tax rate to a project of this scale.

“When you get to $900 million, it’s a pretty significant tax burden that would basically make the project unfeasible,” Remillard said. The abatement is necessary “in order to make everything work with economics, work to be competitive with other generators,” which includes the Lordstown Energy Center, he continued.

And while the two plants are identical and the company has the same managing partner, explained Nic Coggins, assistant director for the Trumbull County Planning Commission, the investors for the two plants represent two different companies: Clean Energy Trumbull and Clean Energy Lordstown.

“They come with different investors, different owning partners,” Coggins said. But because they have the same managing partner is why they are requesting similar locations and similar tax abatements, he continued.

Coggins allowed that a 100% tax abatement isn’t typical, but a donation-sharing agreement has been reached where payments will be issued to the schools and village in lieu of property taxes. Per Ohio Revised Code, any project that generates more than $1 million in new income tax “needs to be shared with the affected school district at a 50/50 rate,” he said.

Typically, the county doesn’t ask for anything and is paid an annual fee for managing the tax abatement program, he added. The fee – 1% of annual benefits a company receives at a minimum of $500 and a maximum of $2,500 – is put into the general fund, he said.

Investors are doing due diligence on the project based on contracts and cost of construction, water, sewage, fuel and property taxes, so the tax abatement program is “one of the big elements of making the project a success,” Remillard added.

When Frenchko asked about whether Clean Energy has fulfilled its obligations related to the tax abatement for the Lordstown Energy Center, Coggins affirmed the company has fulfilled all obligations required by the county.

“This year, they’ve exceeded their minimum new construction, their minimum total investment and their minimum machinery equipment,” Coggins said. “And they’ve hired three more people than they had promised.”

Clean Energy is finalizing its equity team, which includes Clean Energy Future as project developer and owner, and Siemens Energy, a division of Siemens Financial Services.

“Once we have the equity, we should move pretty quickly through the debt financing process,” Remillard said.

At the peak of construction, Clean Energy expects to have some 900 skilled trades workers on-site, Remillard said. The “long-term construction jobs” will be filled with local labor, he said. The Kansas-based Black & Veatch, which has an office in Akron, is the contractor for the project.

“They’ll source the labor locally,” Remillard said. “They’ve talked to the union halls to make sure that given all the construction that’s going on, whether they’ll have enough craft labor and everyone ready to go to support construction of the project.”

Remillard also commented on the indirect benefit of the construction workers coming into Lordstown and patronizing the local businesses.

“They’re buying lunches, they’re going to the restaurants, they’re buying gas,” he said. “They’re doing that transient shopping to and from the job site.”

Clean Energy has obtained all the necessary permits for the project, including an Ohio Environmental Protection Agency permit to discharge wastewater in the nearby Mud Creek, according to documents from the Ohio Power Siting Board. Included in the OPSB documents are reports on projects environmental and economic impacts.

According to the environmental impact study, the project will be built on a 23-acre parcel of land adjacent to the Lordstown Energy Center, and the report determines there would be no adverse impacts to land near the project site.

OPSB reports there are 10 parks, recreation areas or golf courses within a five-mile radius, including the Lordstown Village Park, which is about 1.6 miles north of the site; the Warren Wildlife Area, which is about 3.6 miles northeast of the site; the Mill Creek Metroparks Bikeway and Waddell Park in Niles about 3.8 miles east of the site; and the Meander Golf Course, which is about four miles south of the site.

“As part of our review, we’ve looked to make sure this facility is not proposed to go in a flood plain, not proposed to go in a known wetland and is in accordance with some of the zoning,” Coggins said. Clean Energy is working with the Village of Lordstown zoning department to update the zoning to the portions of the property that are still zoned residential “and adding a buffer to ensure that it does not affect any residents nearby,” he continued.

The city of Warren and the company have a verbal agreement to a water proposal, but there is currently no contract in place, he noted. The wastewater plant in Warren said they do have capacity issues, “but that should not affect this project, as much of their waste is going to be for cooling purposes,” he added.

According to the economic impact report by Calypso Communications LLC, a New Hampshire-based independent economic consulting firm, some of the direct and indirect impacts associated with the project include $312 million in construction expenditures “directly spent in regions of Trumbull and Mahoning counties,” as well as the generation of $530.4 million in total economic activity in the state.

Calypso reported the project will support 915 jobs in Trumbull and Mahoning counties in each year of the construction phase, with the potential for another 234 jobs supported in Ohio regions. In addition to the full-time jobs filled at the plant, the project would support another 35 jobs in Trumbull and Mahoning counties, according to the report.

During construction, the Calypso report estimates “construction and ancillary economic activity would produce $14.9 million in additional state and local tax revenues.”

“The first plant was great for the area. And this is going to be just as great,” commented Commissioner Frank Fuda.

As far as why the company selected Trumbull County for the project, Remillard cited its access to water supply in the village and nearby cities of Warren and Niles, “which makes power generation competitive,” gas supply, truck and vehicle access, as well as rail and highway access, which makes it good from a construction standpoint, he said.

“And the fact that it was in an industrial location,” he says.

Before the commissioners can vote on the abatement, the proposal goes back to Lordstown Village Council, which is awaiting a master funding agreement prior to the vote, Coggins said. Village Council had its first reading of the proposal on March 15.

Upon receiving the agreement, the village council “does seem to be in favor of” the abatement, he said.

Copyright 2024 The Business Journal, Youngstown, Ohio.