Two Companies Create More Jobs than Promised

YOUNGSTOWN, Ohio – Two of the three Mahoning County companies receiving tax abatements under the enterprise zone program administered by the county exceeded their investment commitments, the Tax Incentive Review Council learned Friday.

“Compliance has been outstanding this year with the companies,” reported Sarah Lown, public finance manager for the Western Reserve Port Authority and Mahoning County incentives manager. “They’ve all met or exceeded their investment goals and their job creation goals, and every last one of them anticipates growing yet again in the upcoming year.”

Leading the job-creation numbers is Nordson Xaloy, which is in the fourth year of a 10-year, 60% tax abatement that ends in the 2027 tax year. Westlake-based Nordson Corp. announced plans in 2016 to consolidate its existing screw and barrel operations in Youngstown, New Castle, Pa., and Pulaski, Va., into the former Tamarkin Co. warehouse on Victoria Road in Austintown.

Nordson committed to invest $40 million and create 143 jobs during the term of the abatement. So far, it has invested $45.4 million and added 183 jobs, according to the enterprise zone overview presented at the meeting.

The plant, which turns out barrels and screws, now operates as part of Xaloy Holdings LLC, which is owned by Chicago-based Altair Investments. Altair acquired Nordson’s Xaloy assets in 2021.

ARS Recycling in Coitsville also received a 60% abatement for 10 years, beginning in the 2014 tax year. It projected investing $790,000 and creating two jobs during the term of the abatement. In year eight, the company reported investing $1.2 million and creating six jobs.

“They’re doing very well, Lown said. As the federal infrastructure bill is implemented, ARS expects to be going “great guns” and hiring more people.

The third company in the county enterprise zone program, Trumbull Manufacturing in Austintown, hit both its investment target, $533,000, and its job creation target, two jobs, as of year four of its agreement, which began in the 2019 tax year.

In 2021, Nordson paid $184,548 in property taxes and was forgiven $21,226 for the Austintown plant. ARS paid $32,413 in property taxes and was forgiven $8,957 for the same year. Trumbull Manufacturing paid $25,169 and was forgiven $3,787.

The Tax Incentive Review Council, which is made up of county officials and representatives of local governments, school districts, business and labor, also reviewed reports for companies using tax increment financing. This mechanism, available to local governments, permits money that would have been paid in taxes to be directed to a separate fund to pay for public infrastructure improvements within a defined district.

A total of nine companies have TIF districts in Mahoning County, including the Hollywood Gaming at Mahoning Valley Race Course racino in Austintown, which has a 50% TIF that began in the 2015 tax year.

Hollywood Gaming is one of six companies that have 50% tiffs in the county. The others are Ohio Utilities Protection Service, Truck World, Fed Ex Freight and Pur Foods, all in North Jackson, and Inn at Poland Way in Poland. Companies operating under 75% TIFs are Salem Hotel and Early Bird Learning Center, both in Salem, and Aqua Ohio in Struthers.

TIFs don’t have job creation targets but do have a list of infrastructure projects that are approved to be financed through the TIF funds, Lown said.

“We’re definitely using the funding from the racino in the TIF to make sure our infrastructure is being kept up,” said Austintown Trustee Robert Santos, a member of the council.

Such arrangements bring development projects, which increases property taxes in the long run, said Mahoning County Auditor Ralph Meacham, the committee’s chairman.

The committee members also received a report on the community reinvestment area program, which allows local governments to provide real property tax exemptions for property owners who renovate existing buildings or construct new structures.

Jackson Township discontinued its CRA a few years ago but has four active projects remaining: Hilltrux Tank Lines and Liberty Steel, which received 15-year, 40% exemptions that expire in 2022; Republic Metals, which got a 15-year, 60% benefit that expires in 2024; and National Industrial Lumber Co., which has a 10-yesr, 60% exemption that expires in 2023.

There is “very little oversight or accountability” with the CRA program, which does not have investment or job creation targets to meet, Lown said.

“With the enterprise zone program, if you’re not creating the jobs, if you’re not making those investments, you don’t get the abatement anymore. We can stop it,” she said. “The CRA just goes on and on.”

Jackson Township has to cope with bit trucks coming through, straining township roads and budgets, Meacham said. There is discussion in the Ohio General Assembly around amending CRAs to give local governments more control, he said.

The only other CRA in the county is for Southern Park Mall in Boardman, which received a 40% exemption for 15 years that was approved in 2020 to support its recent renovation.

Meacham said he is pleased with the responsiveness of the companies’ in reporting their data. There is a concern when companies “go silent on us” and don’t respond to requests for information.

“We want good actors here because we’re protecting taxpayer funds,” he said.

The auditor also found the lack of new projects “a little surprising.” He attributed that to the COVID-19 pandemic, which paused many company expansion plans.

“These are very valuable programs for economic development in the area,” he said. “As the economy settles down again, there’ll be more projects coming to us.”

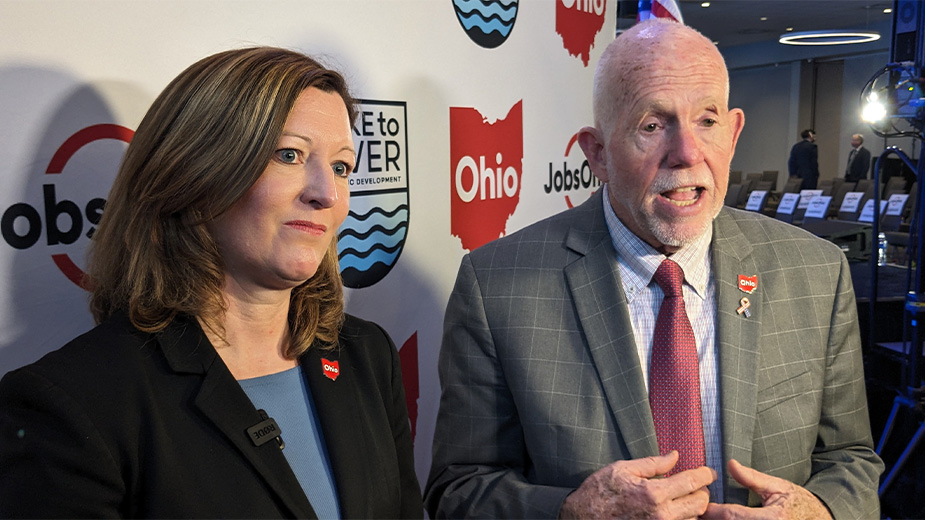

Pictured at top: Xaloy wants to hire more workers at its Austintown plant on Victoria Road.

Copyright 2024 The Business Journal, Youngstown, Ohio.