Waivers Now Available for Pandemic Unemployment Overpayments

By Emily Crebs

This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism. Please join our free mailing list as this helps us provide more public service reporting.

Maggie Rose applied for pandemic unemployment assistance in April 2020 after the restaurant she was working in shut down due to the COVID-19 pandemic. She was quickly approved.

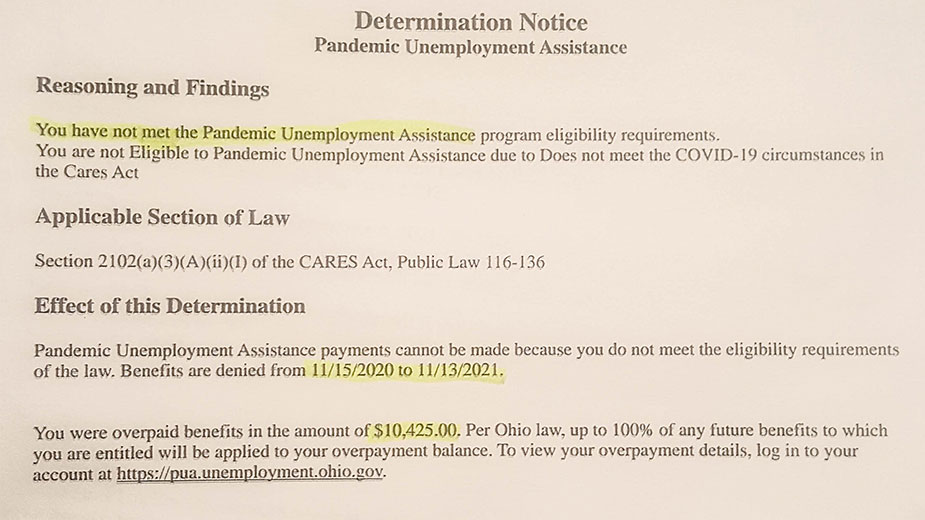

Then a couple weeks ago, she received an email from the Ohio Department of Job and Family Services telling her to pay the balance owed on her account.

Rose was overpaid $12,000 – something she said was extremely scary “for someone who’s just gone through a move, hasn’t gotten a job yet, I’m using the little bit of money I have left to bring my car here.”

Rose recently moved to Atlanta, Ga., and because she can’t afford to pay back the balance, she appealed.

In April, nearly one in five PUA recipients got an anxiety-inducing letter in the mail: the state requesting money back. For many who needed pandemic unemployment assistance to tide them over in the first place, finding the time or money to appeal has been a struggle.

Ohioans were accidentally given over $1.2 billion in accidental PUA payments between May 2020 to February 2021, ODJFS interim director Matt Damschroder said at a press conference May 17. Damschroder explained that non-fraudulent accidental payments could happen due to an accidental error by either the applicant or an ODJFS employee.

For traditional unemployment insurance, individuals who are overpaid and cannot afford to pay back the money are eligible to apply for a waiver. Congress added the ability to forgive PUA overpayments in the CARES act extension in December 2020. But ODJFS didn’t mention anything about waivers in their letters asking for back payment.

In mid-July, ODJFS announced that individuals would soon be able to log in to the PUA website and add a waiver to their claim. ODJFS started rolling the system out July 14. Officials said this week that 700,000 individuals who were overpaid to no fault of their own have received notifications that they may begin the waiver process. They declined to name a resolution date, saying it would be “later this summer.”

In February 2018, state Reps. Lisa Sobecki, D-45 Toledo, and Jeff Crossman, D-15 Parma, introduced a bill that would force the ODJFS to approve PUA overpayment waivers if the applicant did not commit fraud.

Crossman said the bill has stalled in committee, and he and Sobecki have made attempts to make it heard on the house floor.

“The urgency was there; it hasn’t gone away,” Crossman said. “I feel like there’s been a lot of time wasted.”

Sobecki and Crossman said they’ve seen both their constituents and people across the state of Ohio suffer from the pandemic overpayments and subsequent debts.

“I really hope ODJFS can act on these cases expeditiously and get the dollars back into Ohioans pockets who are continuing to suffer through this pandemic,” Sobecki said. “It breaks my heart, the stories I’ve heard. Not just my constituents but across the state.”

Laura Wilson, a lawyer with Freking, Myers & Reul, said in the absence of a waiver system set up to handle PUA overpayments, she’s seen appeals take up to six months to be processed.

Rose has yet to hear back about her appeal.

Other individuals have struggled to fix mistakes in the ODJFS system, like Katie Airy.

In April 2021, she was notified that someone had made an unemployment claim with her identity. Airy told ODJFS and they marked it as fraudulent.

Then on May 14, 2021, Airy became unemployed. She first called ODJFS on May 10 to file a claim.

Airy called ODJFS for a total of 22 times in ten weeks, according to her notes. She would be on the phone for hours being transferred to different individuals in ODJFS, explaining her situation every time she spoke to someone new.

On the 21st call, Airy thought her information was finally updated and her claim filed, but she discovered that errors made on ODJFS’s end were still unresolved. Airy was scheduled for a call with the processing center of ODJFS on Aug. 2, and once again, never received a call back.

“The pressure is insurmountable. You have people because your car payments are due, you’re trying to find a job, and you’re waiting on the phone for hours – how do you find a job? You can’t get in the right frame of mind or find the time,” Airy said.

Airy scheduled another call for Aug. 9. This time an automated system did call her. She waited on hold for 17 minutes. The system disconnected her before a person answered the phone.

“If any non-government employee or company worked this way, the employee would be fired and/or the company would go out of business,” Airy said. “This is mind boggling.”

Copyright 2024 The Business Journal, Youngstown, Ohio.