YSU Student Investors Achieve Top Ranking in National Competition

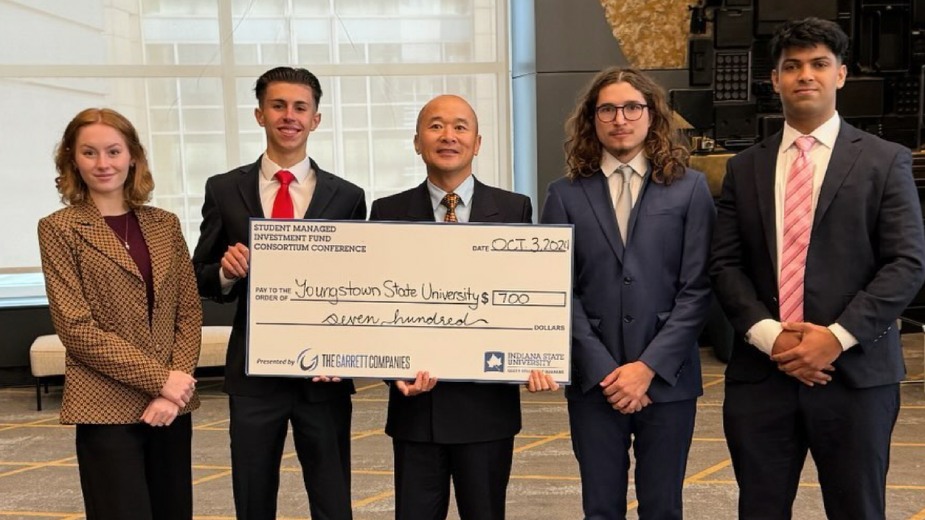

YOUNGSTOWN, Ohio — Students from the Williamson College of Business Administration’s Student Investment Fund at Youngstown State University placed third at the Indiana State University Student Managed Investment Fund Consortium.

The YSU team made its debut at the event, which was held Oct. 2-3 in Chicago. The team secured a $700 prize after competing against more than 140 universities from across the country.

The Student Investment Fund officers, including President James Kover, Vice President Zakria Chandio, Secretary Alison Martin and Treasurer Simon Iwanonkiw, analyzed Nvidia’s business segments, conducted an intrinsic valuation and provided a comprehensive investment recommendation that impressed the judges.

“It was a privilege to represent YSU’s Student Investment Fund at the national level and earn a third-place finish for our Nvidia analysis against 140 other universities,” said Kover, a senior finance manager. “This achievement is a reflection of the incredible faculty at WCBA and the hard work and passion of our student team.”

The students gained valuable insights by networking with industry leaders, including managing directors from the Chartered Financial Analyst and Chartered Market Technician institutes, professionals from Charles Schwab Wealth Management and a former director of the Chicago Board of Options Exchange.

They also visited the Federal Reserve Bank of Chicago and the Chicago Board of Options Exchange, enhancing their understanding of the finance industry.

“We are very proud of our students’ performance in the competition and their commitment to pursuing opportunities to enhance their professional preparation. Our Student Investment Fund demonstrates superior performance, and we are grateful to the WCBA and the Youngstown State University Foundation for their continued support of our activities,” explained Peter Chen, associate professor in the Lariccia School of Accounting & Finance, and the Student Investment Fund’s faculty adviser.

The YSU Student Investment Fund started in 2008 with $250,000 provided by the YSU Foundation’s endowment fund. From 2009-13, the fund received an additional $50,000 each year from the YSU Foundation to invest.

The YSU Student Investment Fund manages an equity portfolio valued at $3.4 million. Over the five-year period ending in 2023, the SIF portfolio generated a cumulative return of 127%, outperforming the S&P 500 by 37% during the same period.

The fund adheres to a disciplined value investing strategy, focusing on acquiring companies with durable competitive advantages that are trading at a discount to their estimated intrinsic value due to temporary market inefficiencies or short-term market sentiment.

The performance of this student-managed fund demonstrates the value of a long-term, fundamentals-driven investment approach. This achievement highlights the strength of the Student Investment Fund at YSU and the commitment of the WCBA to providing students with hands-on learning opportunities in finance and investment management.

Pictured at top: Alison Maring, James Kover, Simon Iwanonkiw, Zakria Chandio, all officers of the Student Investment Fund at Youngstown State University, and Peter Chen, associate professor in the Lariccia School of Accounting & Finance, faculty advisor (center), earned third place among 100 other universities in the Student Managed Investment Fund Consortium (SMIFC) held in Chicago, Illinois receiving $700.

Copyright 2024 The Business Journal, Youngstown, Ohio.