YOUNGSTOWN, Ohio – A venture capital company established by business leaders in 1986 only lasted a few years but two of the operations it helped to establish in the Mahoning Valley remain in business today.

“Venture Capital Company to Invest in Area Entrepreneurship” was the headline in a story published in the May 1986 edition, which reported on the formation of a new entity. Initially called Valley Venture Capital, it became Mid American Resource Corp.

The two surviving companies are what was founded as Sovereign Circuits and Vinyl Profiles.

Among those spearheading the effort was Forest Beckett. The founder of Beckett Aviation was “serving as a liaison between business leaders in Mahoning and Trumbull counties, lobbying for financial support to underwrite operating costs” of the new company, our story reported.

Beckett, at a news conference to announce the initiative, credited state Sen. Harry Meshel with conceiving the idea during a meeting in the governor’s office a year earlier. “I was there to ask for some things for the Mahoning Valley and Harry said, ‘Why don’t you get a venture capital fund going and get investors who have an interest in helping the Valley?’”

Beckett and J. Philip Richley, then a Cafaro Co. vice president and a former mayor of Youngstown, recruited Arnold Clebone from the Ohio Department of Development to oversee the investment fundraising effort and eventually head the venture capital company. Clebone – today a Liberty Township trustee – was the economic development finance program director for ODOD.

Clebone recalls Beckett as persistent.“When the guy wanted to get something, he was very stubborn and obstinate about it and he didn’t take ‘no’ for an answer,” he remembers. “He knew how to get people to contribute.”

Other local business leaders involved with the steering committee included James Baker, president and CEO of Bank One of Eastern Ohio; Thornton Beeghly, president, Standard Slag; Alan G. Brant, president and CEO of Second National Bank of Warren; Jack Gibson, president, Jack Gibson Construction; Don McGowan, chairman and president, Ohio Bancorp; John Payiavlas, Automatic Vendors; and H. Alexander Pendleton, board chairman, Warren Tool Corp.

Contributors to the fund included Bank One, Dollar Bank, Mahoning Bank, Albert Covelli of Covelli Enterprises, Gibson and Beeghly, according to Clebone.

“We raised about $1 million initially,” he says. With those funds, the venture capital company, often referred to by its acronym, MARC, helped four companies, he says. One was a small company that cleaned rail cars. It failed within two years.

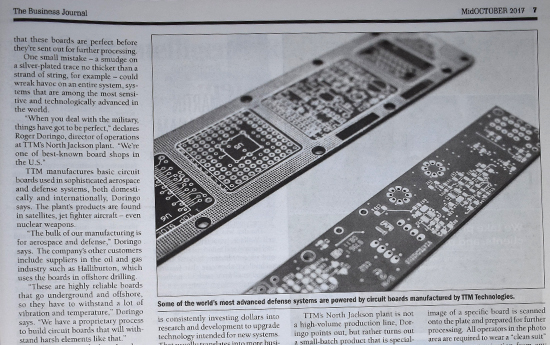

Perhaps the best known of the companies that MARC assisted was Sovereign Circuits, a manufacturer of prototype and advanced circuit boards, which was launched at the Youngstown Commerce Park in North Jackson.

According to the November 1987 Business Journal, Terry Buss, then-director of Youngstown State University’s Center for Urban Studies, asked Peter Mitchell, president of Hamlet Circuits, if he had ever considered starting an electronics firm in Youngstown. That led to Buss connecting Mitchell and his partners with Pam Stanley, director of the Youngstown Area Chamber of Commerce economic development office, known as the Regional Growth Alliance. Discussions followed about what type of incentives could be offered to support such a startup.

The foundation for the North Jackson plant was laid in late November 1987 and the company went into production the following year.

In addition to MARC’s support, financing for the $5 million project included a state loan, money from Mahoning Valley Economic Development Corp. (today known as Valley Partners) and British investors, an Urban Development Action grant sponsored by the city of Youngstown and a community development block grant supported by Jackson Township.

“The company really was teetering back and forth and it needed a lot more money,” Clebone says.

MARC sold its interest in Sovereign Circuits because it was trying to support a Warren-based technology startup, Coptec Inc., which produced laminates and other composites for use in the electronics and aerospace industries.

“I don’t think we even broke even,” Clebone recalls. But other investors stayed in and did “very, very well.”

Sovereign Circuits was purchased by a Nasdaq-listed company in 2006. The North Jackson plant is now owned by TTM Technologies Inc., which purchased it in 2015. The plant continues to manufacture circuit boards used in sophisticated aerospace and defense systems. It is one of 11 plants operated by TTM, a publicly owned California company that reported net sales of $2.2 billion in 2023.

As for Coptec Inc., a story in our October 1988 edition reported that it would be based in a 20,000-square-foot facility at Warren Commerce Park and begin operations the following year.

“Things are looking very good,” David Qualls, Coptec’s president, said in August 1989 as his company prepared to open in the following weeks. “It is very promising.”

The company had made several test runs and sent samples to potential customers, which resulted in orders far ahead of what had been projected for the first month of operations, Qualls said. He also reported that the company had no trouble finding trainable workers.

In addition to MARC’s equity stake in Coptec, which Clebone recalls as being more than $200,000, the Ohio Department of Development provided a $420,000 low-interest loan and the state provided a $100,000 grant for infrastructure improvements at the commerce park.

Coptec ended up failing. Its building eventually was sold, according to Clebone.

“I was out there almost every day,” he recalls. “We had a lot of confidence [in the owners] and they just couldn’t make it.”

Vinyl Profiles proved more fruitful. “We actually did make money on that one and we did well when we sold out,” Clebone says. The company started in Boardman with four extruders, increasing to eight when it moved to North Jackson, he says.

Despite having a track record of two successful companies, MARC wasn’t able to raise additional money to invest in new businesses and ceased operating in the early 1990s.

“Like a lot of companies, we just dissolved. But when we dissolved our investors got their money back,” Clebone says.

Pictured at top: The December 1987 edition included a photo that commemorated the start of construction for Sovereign Circuits.

B2B Marketing in 1986