SBA Seminar Tells How to Get a Small-Business Loan

YOUNGSTOWN, Ohio – The U.S. Small Business Administration is not a lender, but its programs offer commercial lenders added assurance that borrowers will repay their loans.

SBA’s loan programs were the topic of a seminar Tuesday hosted by the Ohio Small Business Development Center at Youngstown State University.

The SBA doesn’t extend credit. Rather it guarantees up to 75% or 85% of the financing that commercial banks and other private-sector lenders extend to small enterprises, said Thomas Sangrik, economic development/lender relations specialist in the SBA’s Cleveland district office.

Programs the SBA offers are its 7A loans, which guarantee up to 85% of loans of less than $150,000 and up to 75% on loans greater than $150,000 but less than two million. For loans up to $150,000, there is no SBA guaranty fee – a savings of 2% — through September, unless the program is extended.

Other programs are the SBAExpress, for loans under $350,000, the Veterans Advantage program and the 504 program for long-term financing of major fixed assets such as commercial real estate.

“We’re basically a cash-flow lender,” Sangrik said. Collateral coverage is usually viewed as secondary criteria when considering an application. SBA loans can offer extended repayment terms, lower down payments and more flexible repayment terms.

“People are not sent to SBA because they have bad credit. That’s a myth. If you have bad credit, you’re not going to qualify for an SBA loan either,” said Daniel Segool, assistant vice president and business banking community lender at Chemical Bank. “SBA is there to help in situations where maybe conventionally a bank is not able to lend, but with some assistance from the SBA we can.”

Permitted uses of loan funds include expansion and renovations; construction of new buildings; purchase of land or buildings, machinery and equipment, furniture and fixtures, or leasehold improvements; working capital; and inventory.

“Interest rates are basically market rate. They’ve gone up a little bit but are still historically low,” Sangrik said.

Over the years, SBA has helps several names that have become familiar: Outback Steakhouse, Intel, FedEx, Costco, Compaq and Staples.

As an SBA certified lender, Chemical Bank can originate an SBA loan in house. “SBA has come into the bank, has reviewed our procedures and given us guidelines, and they will allow us to issue an approval on an SBA loan in house,” Segool said. “It saves a lot of time.”

In some cases, a loan can be turned around in a couple of weeks, he said. In fact, in deals involving real estate, factors that extend the time needed for approval are usually out of the bank’s control, such as title work, appraisals and environmental assessments. “The credit process at the bank and the approval process through SBA typically is the shorter of those two things,” Segool said.

Cash flow, or capacity as some call it, is among the five C’s that banks consider when evaluating an application for credit. The “most important thing in lending,” Segool said, is determining whether the business can generate sufficient cash flow to repay the funding sought.

“We want to make sure that is in a comfortable range,” the banker said. “We’re not just talking about the bank being comfortable. We’re talking about you being comfortable, too. The bank doesn’t do you any favors if we put you in a loan that you’re going to struggle to repay.” For every dollar of debt expense, a bank would like the business to have $1.25 in after-expense cash flow, he said.

Another C is character, determined by how promptly a borrower has repaid his other debts. Whether an individual pays business or personal debts in full and on time typically is “a pretty good predictor that in the future you’re going to do that as well.”

Banks also look at conditions of the industry the borrower is in, whether the business has enough capital to successfully operate and is properly collateralized, he said.

Another factor a bank looks at is its own portfolios, Segool added. Should a bank portfolio be weighted too heavily in one sector, it could balk at adding another customer in that industry, where another lender with less exposure might be more willing to consider that customer.

Patricia Veisz, director of the Ohio SBDC at YSU, pointed those who attended the seminar to the resources both within the university and at its partners, one of which is the recently formed Mahoning Valley Is for Entrepreneurs collaborative.

Other resources include the Youngstown chapter of Score, the Mahoning Valley Procurement Technical Assistance Center (which helps local companies find business opportunities with the U.S. government), and the Business and Investment Center (BIC) at the Public Library of Youngstown & Mahoning County.

SBDC also has a computer-modeling program that can help new and existing businesses assess potential financial conditions by changing different variables before they approach a bank for a loan.

“You don’t have to go through this alone,” Veisz said.

Existing business owners and entrepreneurs said they were satisfied with what they heard.

Joe Cusack, owner of Bella Maria’s Boutique in Boardman, was among the 15 business owners and entrepreneurs who attended. The shop, which specializes in women’s accessories, has been open four years. He was interested in learning about SBA loan opportunities.

“We have the holiday season coming up. We need more working capital,” he said.

Brian Emerson of Warren is starting Fantasy Sports Draft Services. “I really liked the resources that they informed me about, especially the BIC,” he said. He also appreciated learning about the SBA program intended to help veterans because he served in the military.

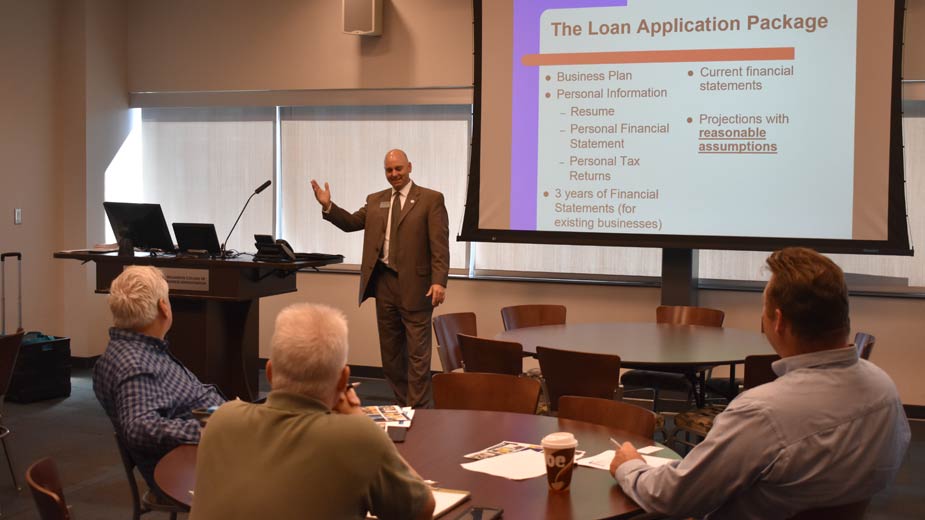

Pictured at top: Daniel Segool from Chemical Bank explains the loan application process at Tuesday’s SBA seminar.

Copyright 2024 The Business Journal, Youngstown, Ohio.